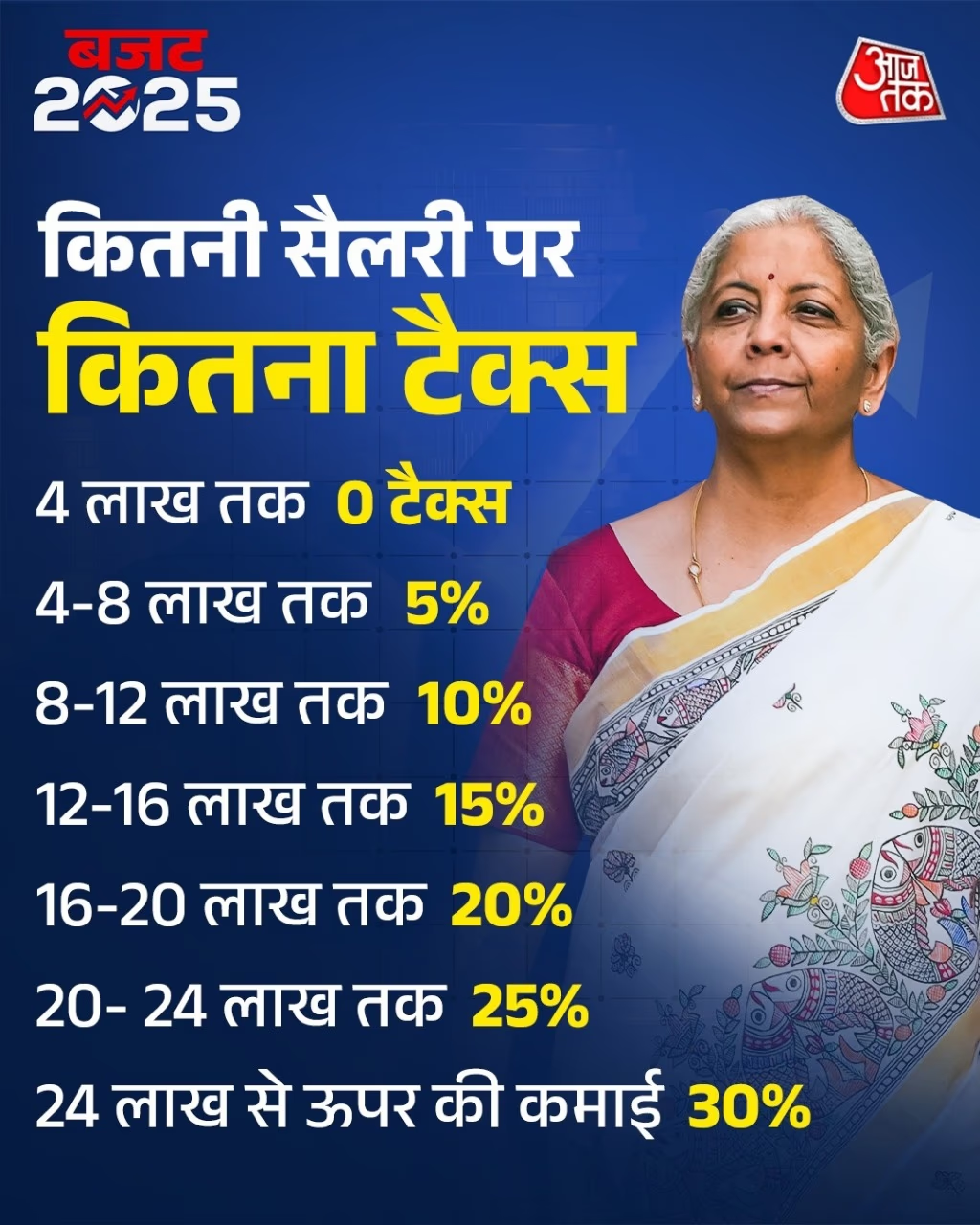

The Finance Minister, Nirmala Sitharaman, presented the budget on Saturday, offering significant relief to the middle class. There's a proposal to make income tax zero for annual income up to 1.2 million, meaning no tax for those earning up to that amount annually. Other income brackets have also been given relief. Before altering the tax slabs, the Finance Minister mentioned in her budget speech that a new income tax bill would be introduced next week, causing some confusion among the public about why there is a need to change tax slabs if a new bill is forthcoming.

New Provisions to Take Effect Next Year

Ved Jain, former president of the Institute of Chartered Accountants and a tax expert, answered this by stating that the upcoming income tax bill is expected to be presented to Parliament next week and could be passed by the monsoon session. He mentioned that the new bill might be implemented starting the fiscal year 2026-27, but implementing it right away is not feasible. However, the changes proposed in the budget's tax slabs will be effective from April 1, 2025. He noted that the proposed tax slabs in the budget would remain unaffected by the new bill.

Read Also:

Tax expert Ved Jain also remarked that the changes to the tax slabs could become part of the new bill, potentially remaining in effect for the fiscal year 2026-27. Discussing the new income tax bill, he explained that it is being introduced to replace a law that's over six decades old. The Finance Minister emphasized the need to simplify the law as it's quite outdated. According to Ved Jain, several provisions no longer necessary will be removed in the new bill. Although significant changes to the fundamental calculation of tax are unlikely, the language can be simplified to make the law more concise.

Source: aajtak

Budget Adjustments for Immediate Needs

The proposed amendments in the budget are designed to address immediate needs before the new income law is enacted. Temporary modifications have been made through the budget, considering economic factors such as inflation, GDP, and foreign investment, to prevent any disruptions in the economy. With the new tax slabs, the government is also working towards simplifying the income tax act, aiming to ease the process for taxpayers.

Tax expert Sunil Garg commented that the new income tax law is not expected to bring direct changes to the common man's life; instead, it's designed to simplify tax operations. He noted that the income tax bill hasn't even been presented yet; once it is, it will be debated in Parliament, and if needed, amendments will be made. Therefore, revisions have been made to the budget for the upcoming fiscal year, which will not affect the upcoming bill. Sunil Garg added that the new bill's provisions would be effective starting from next year.

Aim to Simplify the Tax System

Currently, the 1961 Income Tax Act is in effect. In the 2020 budget, the government introduced a new tax regime under this law. However, in the budget presented in July 2024, the government clearly stated a need for change in the income tax law. A review committee was set up for this, based on which the Finance Minister announced in her budget speech the introduction of a new bill. Regarding the new income tax law, the Finance Minister mentioned that for the past decade, efforts have been made to implement tax reforms so that the tax system can be understood in simple language, with the same intent; the new income tax bill will be brought next week.