Recently, the government declared a tax exemption on income up to 12 lakh rupees. Nevertheless, many have questions such as, if one’s salary is 13 lakh, what would be the tax amount? The main confusion revolves around whether only an income over 12 lakh will be taxed. The answer is– no.

Another common query is whether a 13 lakh salary incurs a 15% tax. Here too, the reply is– no.

The third question on everyone's mind is, if income up to 12 lakh is tax-free, why has the government set this tax slab system: 5% for 4 to 8 lakh, and 10% for 8 to 12 lakh?

Let's tackle each question in turn.

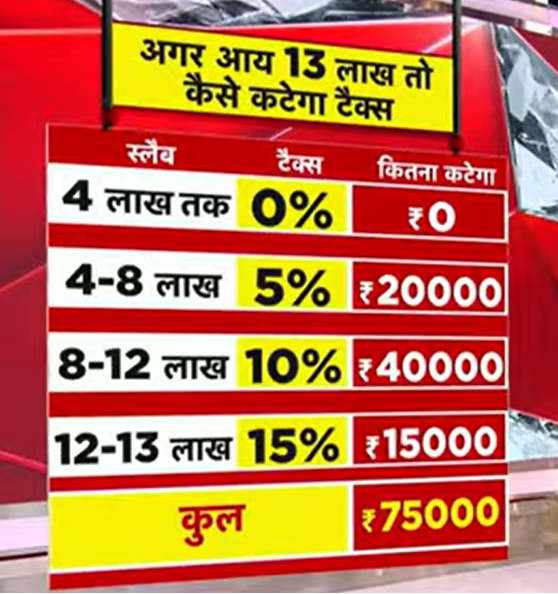

If your salary amounts to 13 lakh rupees, it divides into four portions by tax slab standards. The first four lakh incurs no tax. The 5% tax applies to the next segment, 4 to 8 lakh, summing up to 20,000 rupees. The 10% rate applies to the 8 to 12 lakh segment, equating to about 40,000 rupees. The final one lakh is under a 15% tax... This one lakh taxed at 15% equals 15,000 rupees. When totaled, the entire tax on this 13 lakh income comes to 75,000 rupees.

Source: aajtak

Related:

This formula applies to higher salaries too. For instance, on a 14 lakh income, the tax is 90,000 rupees; for 15 lakh, it'a 105,000 rupees; and for 16 lakh, it's 120,000 rupees. Previously, the old tax rule mandated a 170,000 rupee tax on 16 lakh income. Now, with the new slab, it's merely 120,000 rupees, indicating substantial savings.

Source: aajtak

Who Benefits from the Tax Reduction?

There’s widespread confusion regarding whether this decision benefits only salaried individuals. The government clearly states in the budget that regardless of profession—whether you’re employed, engaged in business, or operate a shop—if your annual income is 12 lakh or below, you owe no income tax. For employees, this exemption comes with the added benefit of a standard deduction of 75,000 rupees. For instance, if one’s annual salary is 12 lakh 75 thousand, with the standard deduction, one’s taxable salary reduces to 12 lakh, nullifying the income tax.