President Donald Trump has struck a significant blow to the global economy with his tariff policy. The alarming part is, Trump's decision is proving detrimental to the world. It's affecting investments and global trade, with people becoming more cautious about spending. While Trump dubbed April 2 as 'Liberation Day', it might actually become 'Recession Day' for the rest of the world.

If Donald Trump indeed decides to implement tariffs for the long term, it could result in reduced consumption, disrupted supply chains, and weakened economic conditions for countries, raising fears of a massive global recession. Trump's decision has sparked turmoil worldwide, akin to the uproar stirred by another American president in 1930. Read the full story...

At the start of 2025, President Donald Trump began imposing tariffs on countries including China. On February 4, Trump decided on a 10% tariff on all Chinese imports, excluding Canada-Mexico. Though he temporarily paused tariffs for 30 days, the 10% tariff on China remained, leading to disputes at the trade front.

On April 2, Trump announced a 10% baseline tariff effective from April 5, followed by additional 'reciprocal' tariffs on countries with which the US had trade deficits. These tariffs, effective from April 9, shook the world.

Source: aajtak

Trump didn't spare allies on the reciprocal tariffs front, applying them based on trade deficits with numerous countries, including India and Israel. However, a 90-day implementation hold was placed shortly after (until July 9), while the 10% base tariff remained.

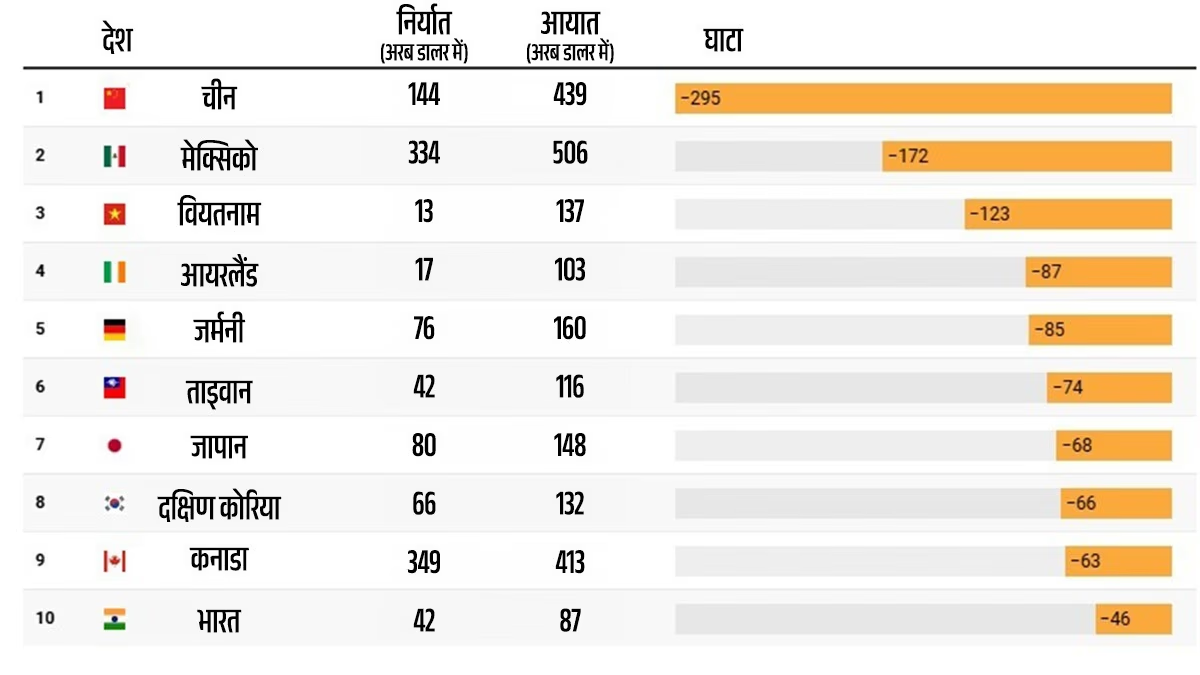

The trade deficit with China is nearly $295 billion, prompting the US to slap heavy tariffs. After an initial 10% in February, Trump's escalated tariffs to 34% in March and 125% by April. China retaliated, mirroring Trump's tariffs at 125% on American imports.

The situation is such that both nations are imposing over 100% taxes on each other's products, affecting local markets. Contrary to White House clarification, the US actually levied 145% tariffs on China.

Source: aajtak

This rivalry isn’t just hitting these two countries; it's causing global markets to plunge. Trump believes in the effectiveness of tariffs, citing alleged research from his previous tenure.

Trump has also used harsh rhetoric, suggesting countries are pleading to drop tariffs and sign deals. It’s believed he meant countries choosing deals to reduce trade and tariffs over retaliation.

With a $49 billion trade deficit, India hasn't been spared from Trump's tariffs. India's exports are at significant risk. Before a 90-day tariff pause, Trump had imposed a 26% tariff on India, but relief has allowed India to negotiate trade deals. Currently, a 10% reciprocal tariff is applied to India.

Source: aajtak

Indian exporters have expressed concerns over their businesses. According to an analysis by Global Trade Research Initiative, if Trump's excesses continue, India may face a $5.76 billion or 6.4% decline in exports.

India exported over $89 billion to the US in 2024. If deal hurdles persist and Trump maintains tariffs, it could be a significant blow to India's US-dependent economy.

India has cautiously responded to Trump's tariffs, choosing negotiation over retaliation to minimize economic damage, striving to sign a trade deal with the US.

If trade rivalry between the two largest economies continues, it may result in severe recessions in the US and China, impacting developing countries like India, which depend on raw material imports for exports. India must remain vigilant on multiple fronts.

Should this happen, India's challenges may extend beyond bi-lateral tariffs. India relies heavily on both the US and China for raw materials. For instance, it imports raw materials from these nations, processes them, and exports finished products globally, the cornerstone of India's trade.

Source: aajtak

India exports significant quantities of steel, aluminum, and generic pharmaceuticals to the US. During 2023-24, India's pharmaceutical exports to the US totaled $9.7 billion. Trump targets the pharma sector, directly impacting India. India contributes 20% globally in this sector, with 2023 revenue around $50 billion.

In sectors like textiles, Indian gains might come as manufacturers seek alternatives to China, but the global economic slowdown could offset these benefits.

China asserts its trade with the US is mutually beneficial, not a favor. Similarly, India imports APIs from China, transforms them into medicines, and exports them globally. Chinese raw materials are processed in India and exported. Amid rivalry with the US, China appeals for India's cooperation to tackle the issue.

Donald Trump's actions impact this mutual benefit, urging serious global reflection to prevent a potential recession akin to 1930, predicted by agencies such as JP Morgan which see a 60% possibility, warning of depression. Goldman Sachs and Morningstar estimate a 40-50% chance of a looming recession.

The trade war initiated by Donald Trump isn't just restricted to the US, China, and India, but could lower GDP across numerous countries, hitting nations with significant export volumes to the US.

Source: aajtak

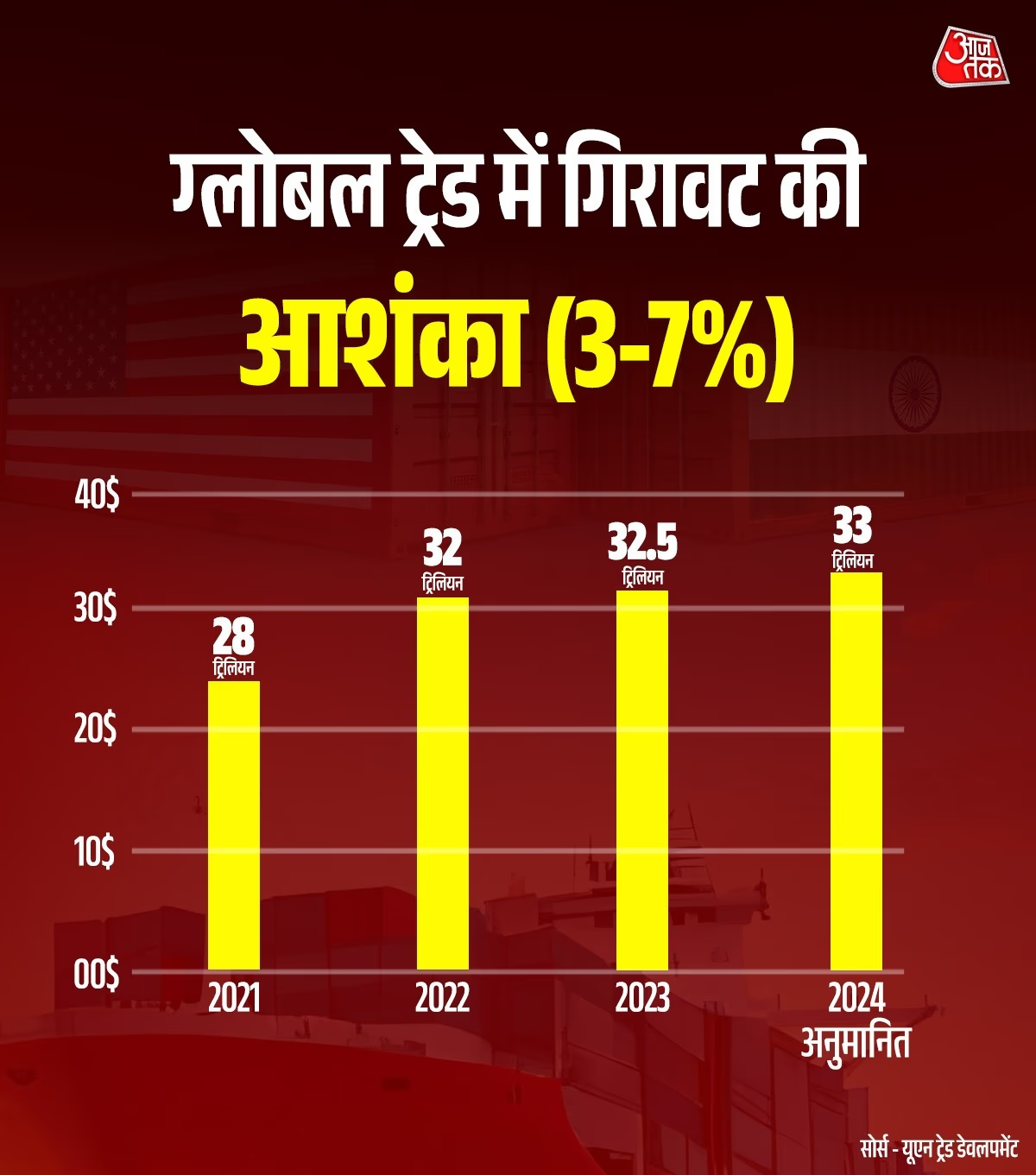

The International Trade Centre suggests Trump's tariffs could reduce global trade by 3-7% and GDP by 0.7%, most affecting developing countries. If tariffs resume post-pause, Bangladesh, as a top textile exporter, could lose $3.3 billion by 2029.

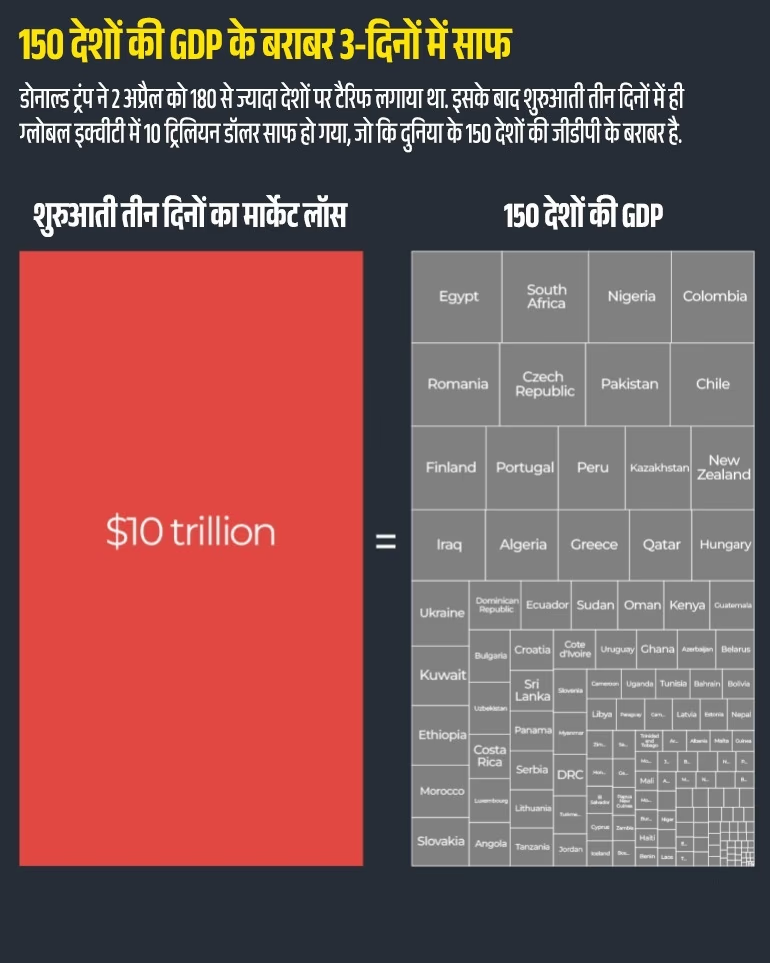

The stock market reaction has been severe. Trump's tariff announcement led to the largest two-day loss in US market history. Following the reciprocal tariff announcement, $6.6 trillion was wiped off the US market in two days, and the three-day loss eroded global equity by about $10 trillion, exceeding the GDP of 150 countries.

Source: aajtak

According to the Penn Wharton Budget Model, Trump's tariff plan might generate some revenue for the US but at a higher cost. Strict tariffs could generate $5.2 trillion in the next decade, but GDP could fall by 8% and employment by 7%, impacting the public.

A look into history shows Trump's tariff policy echoes the 1930 Smoot-Hawley Tariff Act, blamed by historians for triggering the Great Depression under Republican President Herbert Hoover.

Between 1929 and 1934, international trade fell 65%. The US economy sank into depression, with GDP dropping by 30% and unemployment reaching 25% by 1933.

Experts caution Trump's tariffs could mirror the Great Depression-era Smoot-Hawley tariffs, worsening economic conditions. Analysis shows current tariff levels under Trump surpass those during the Smoot-Hawley era.

It remains to be seen if after 90 days Donald Trump retracts his tariffs or continues, potentially crippling the global economy, impacting not just the world but the US itself.