Scammers employ various methods to exploit unsuspecting individuals. From sneakily extracting OTPs to manipulating conversations, these fraudsters are financially devastating their victims. But what transpires when you realize a stranger has used your name to obtain a GST number and conduct massive transactions?

Such an instance has emerged where someone's Aadhaar and PAN were misused to acquire a GST number. This GST account facilitated transactions worth crores, and the intrigue unravelled when the victim commenced their ITR filing.

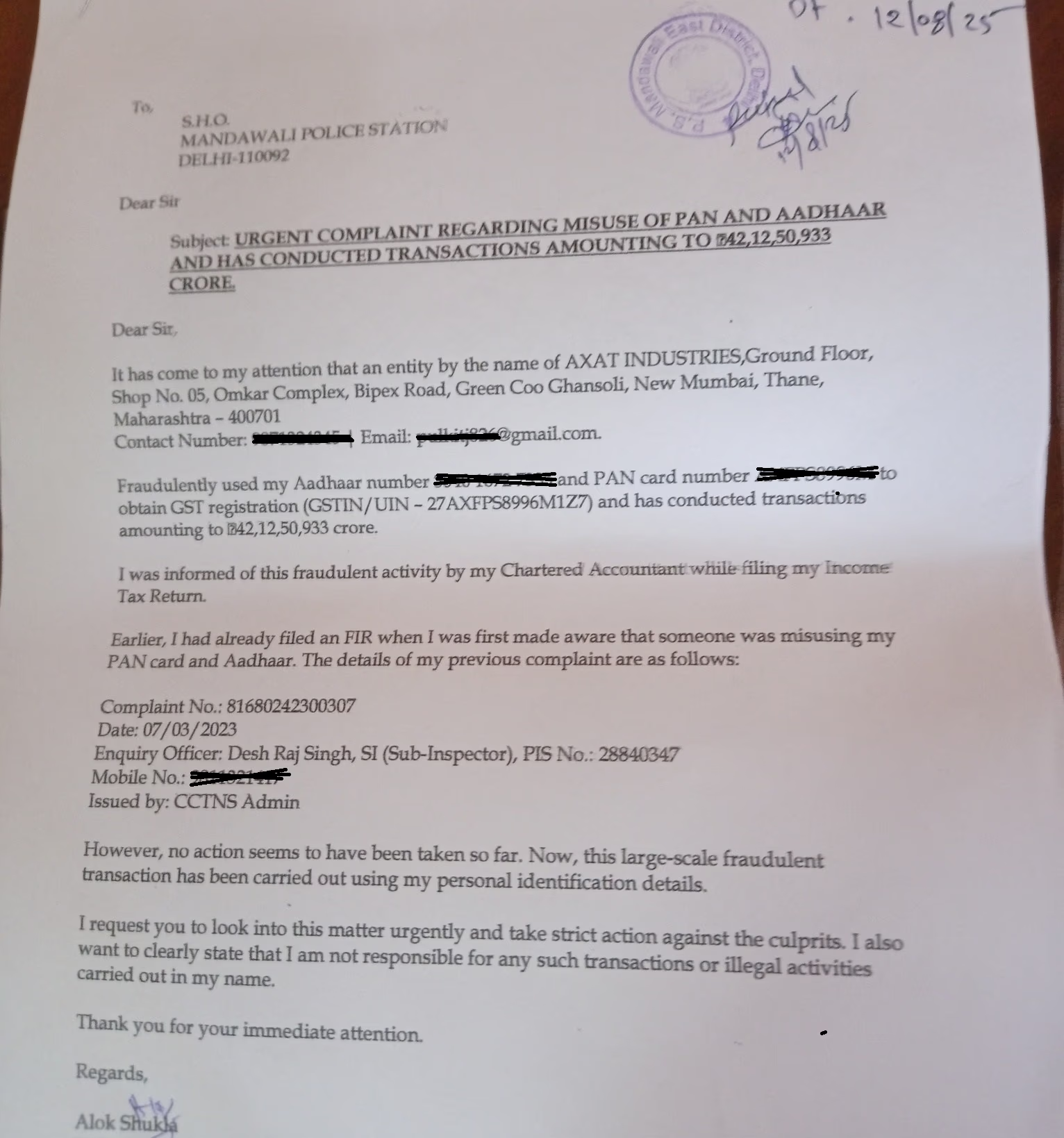

Resident of Delhi, Alok Shukla shared the ordeal on the social media platform Facebook. He recounted the shock encountered by his Chartered Accountant during the filing of the Income Tax Return. A company named AXAT Industries had registered a GST number under his PAN, enabling transactions over 420 million rupees.

Read Also: 3,075 Arrested in Digital Fraud Cases

This entire operation also saw the misuse of the Aadhaar card. The victim remained oblivious until the ITR filing. The exact modus operandi remains unclear, though.

Source: aajtak

After discovering this fraud, the victim noted that the GST number was promptly surrendered. Remarkably, no emails or SMS alerts were received during the entire episode. As soon as the victim uncovered the fraud, they lodged a complaint at Mandawali Police Station in Delhi.

Read Also: SALE FRAUD: Fleecing Buyers Under the Guise of Deals and Discounts

Founder and Global President of CyberPeace, Vineet Kumar, elucidated that such frauds often exploit vulnerabilities in digital ID verification and interconnected government systems. Criminals many times acquire PAN and Aadhaar information through data breaches, phishing scams, or third-party database leaks.

Alarmingly, misuse of generative AI tools is on the rise. These tools manufacture realistic fake PAN and Aadhaar cards that pass initial screening tests. Sometimes, the oversight of a reviewer can perpetuate this. In some cases, offenders deploy SIM swapping to authenticate OTPs. Anyone could fall prey to such scams, necessitating vigilance.

Routinely check your credit report on the GST portal.

Utilize the UIDAI portal to lock your Aadhaar biometrics.

Enable two-factor authentication wherever feasible.

Stay alert against messages prompting KYC updates.

Report any type of fraud at cybercrime.gov.in.