Anticipation mounts as the Reserve Bank of India's (RBI) first Monetary Policy Committee (MPC) meeting of the fiscal year 2024-25 is poised to conclude today. After a three-day session, the verdict on the Repo Rate, a key determinant for interest rates, is expected to be delivered. Any alteration could significantly impact borrowing costs.

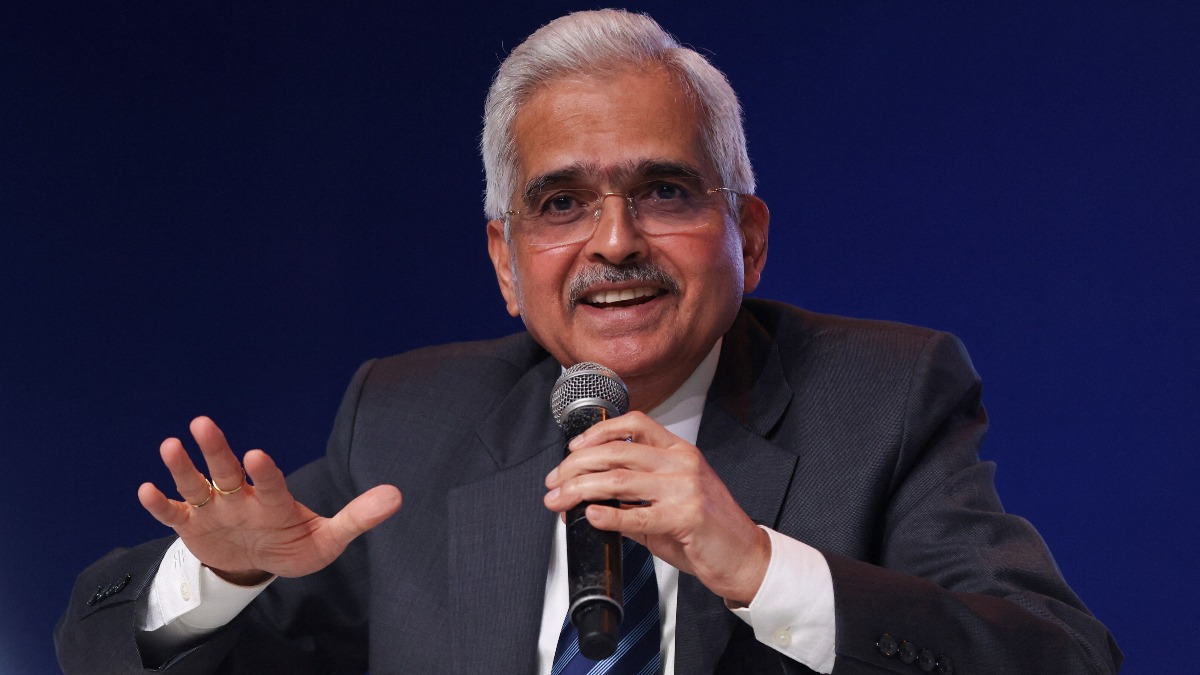

The RBI has consistently maintained the Repo Rate for six consecutive times. It's largely believed that it will continue this trend for the seventh instance, potentially until year's end when a rate cut is forecasted. However, Governor Shaktikanta Das is known for his unexpected decisions.

A recent SBI report hypothesizes that the MPC may slice the Repo Rate in the October-December quarter. Global trends reveal that, often, emerging economies adjust their interest rates about two months following developed countries like the USA and UK.

Inflation Rates to Dictate Borrowing Costs!

According to SBI research, the current inflation, influenced by fluctuating fuel prices and food costs, suggests the RBI will hold its stance for now. The inflation rate, primarily driven by food price dynamics, is likely to hover slightly above 5% for the January-March quarter, as detailed in SBI's comprehensive report.

Meanwhile, the core retail inflation has dropped to a 52-month low of 3.37%. By July, the total inflation rate is expected to decline, with an eventual rebound to a peak of 5.4% in September, before tapering off again. During the fiscal year 2024-25, the retail inflation rate is projected to average around four and a half percent.

EMI Reduction Predicted for October-December!

RBI's MPC will be closely monitoring the policy direction of developed economies. Switzerland, for instance, has cut policy rates, marking the first major economy to do so. Meanwhile, Japan concluded its eight-year-long negative interest rate policy.

Prior to the MPC meeting, CareEdge Ratings suggested that the RBI's policy would be balanced with a focus on liquidity. They anticipate interest rate cuts during the latter half of the October 2024 to March 2025 period, expecting inflation to approach the 4% threshold. The MPC meeting, chaired by Governor Shaktikanta Das, spans from Wednesday to Friday, April 5th. After increasing the Repo Rate to 6.5% in February 2023, the RBI has since maintained it at this level.

With the economic stage set for strategic moves, stakeholders eagerly await the impact these decisions will have on both the market and their wallets.