President Donald Trump has imposed heavy tariffs on many countries, and China is not exempt. Now, China faces the threat of an additional 100% tariff starting next month. This is because China has recently imposed stringent controls on Rare Earth Elements, which have become as powerful as oil and gold in the international market.

What's happening with Rare Earths globally?

The U.S. has threatened a 100% tariff on China's Rare Earth restrictions. Afghanistan has invited India to invest in its mineral sector.

Meanwhile, Japan will invest $120 million in France's Rare Earth project. The first Rare Earth processing plant in Australia has started in Kalgoorlie. Estonia is moving towards creating magnets sufficient for 1.5 million electric cars.

What makes Rare Earths so valuable?

Rare Earths are unique minerals powering new technology, from smartphones, laptops, clean energy, to electric vehicles. They are also crucial in missiles, radar systems, drones, and jet engines. These metals possess magnetic, shiny, and electrochemical properties unmatched by any other materials, making them irreplaceable. As the world pivots towards AI and clean energy, the sustainable supply of Rare Earths is a global strategic concern.

Why is America troubled by China's new rules?

The U.S. military power is heavily reliant on these rare minerals.

. The problem is, while the U.S. is trying to ramp up production, China is advancing 5-6 times faster.

New rules from China take effect December 1

Under the new rules, China will not permit Rare Earth exports to companies linked to any foreign military, including the U.S. Any company requesting Rare Earths for military use will face immediate rejection. This policy aims to eliminate the use of Chinese Rare Earths in foreign defense supply chains.

Source: aajtak

Who are the key players, and what are the projections?

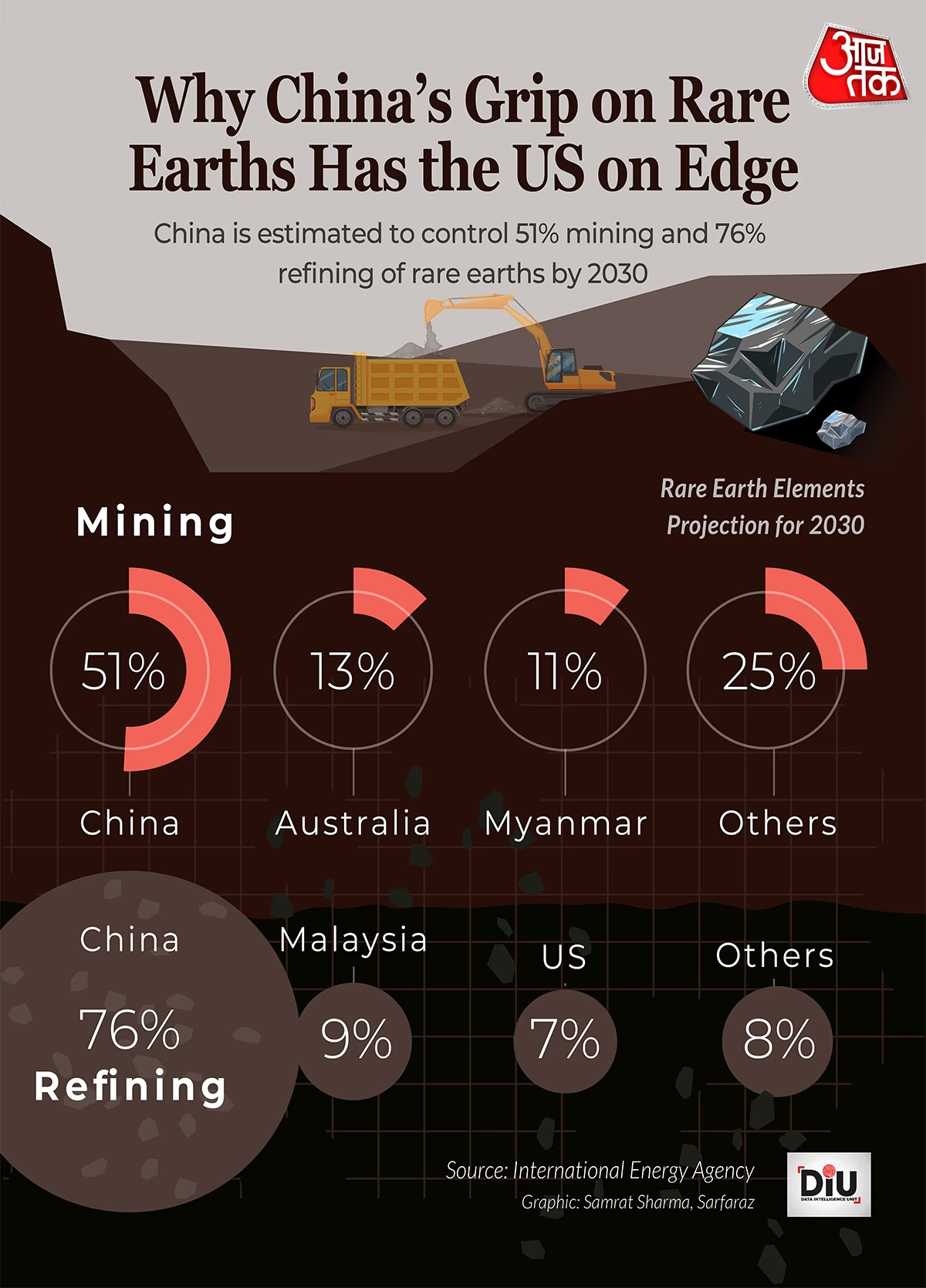

Rare Earth production is split into two segments: Mining and Refining. By 2024, China, Australia, and Myanmar will jointly produce 86% of the world's Rare Earths. The IEA forecasts that

China's dominance in refining

China, Malaysia, and the U.S. are the top three countries controlling 97% of world refining. By 2030, it's anticipated that China will partake in 76%, with Malaysia at 9% and the U.S. at 7%.

Source: aajtak

Why is refining so difficult?

Refining is more complicated than mining because it produces radioactive waste. According to the IEA's

, Rare Earth minerals often contain radioactive elements like uranium and thorium. Very few countries have the ability to handle or store these safely. Without proper storage, these elements can leak into the environment causing damage. The report notes that only 17% of Rare Earth miners worldwide comply with the Global Industry Standard on Tailings Management.

America's new strategy

To counter China's growing influence, the Pentagon has recently prepared to spend up to $1 billion on critical minerals. Thus, the battle over Rare Earths is no longer just about minerals, but a strategic conflict.