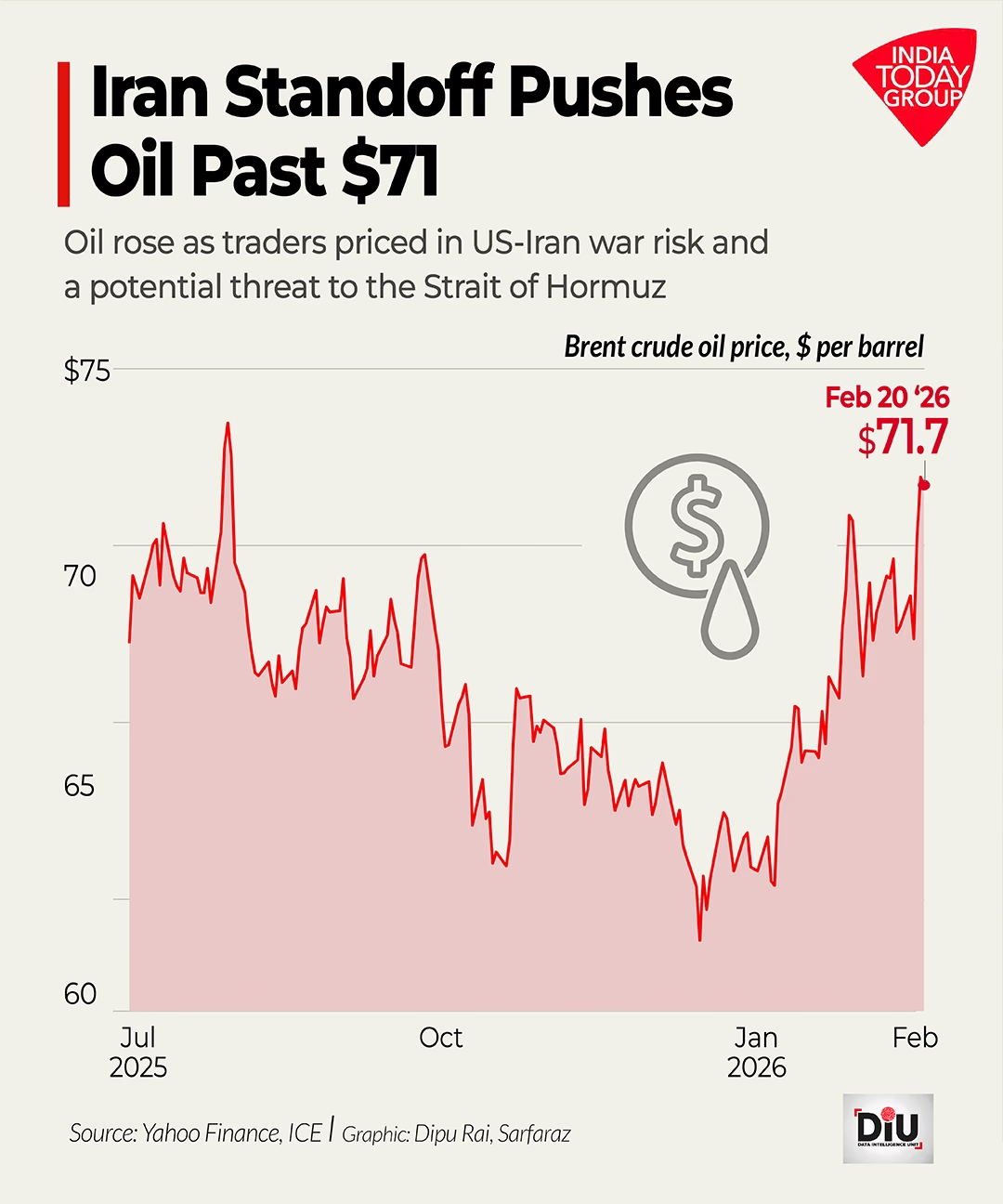

With the US deploying aircraft carriers and fighter jets in the Middle East, markets reacted swiftly. Oil prices surged beyond $71 per barrel, stocks took a dip, and gold hovered near a record high. President Trump has issued a 10-day deadline to Iran for reaching a nuclear agreement.

Why is this Issue Crucial?

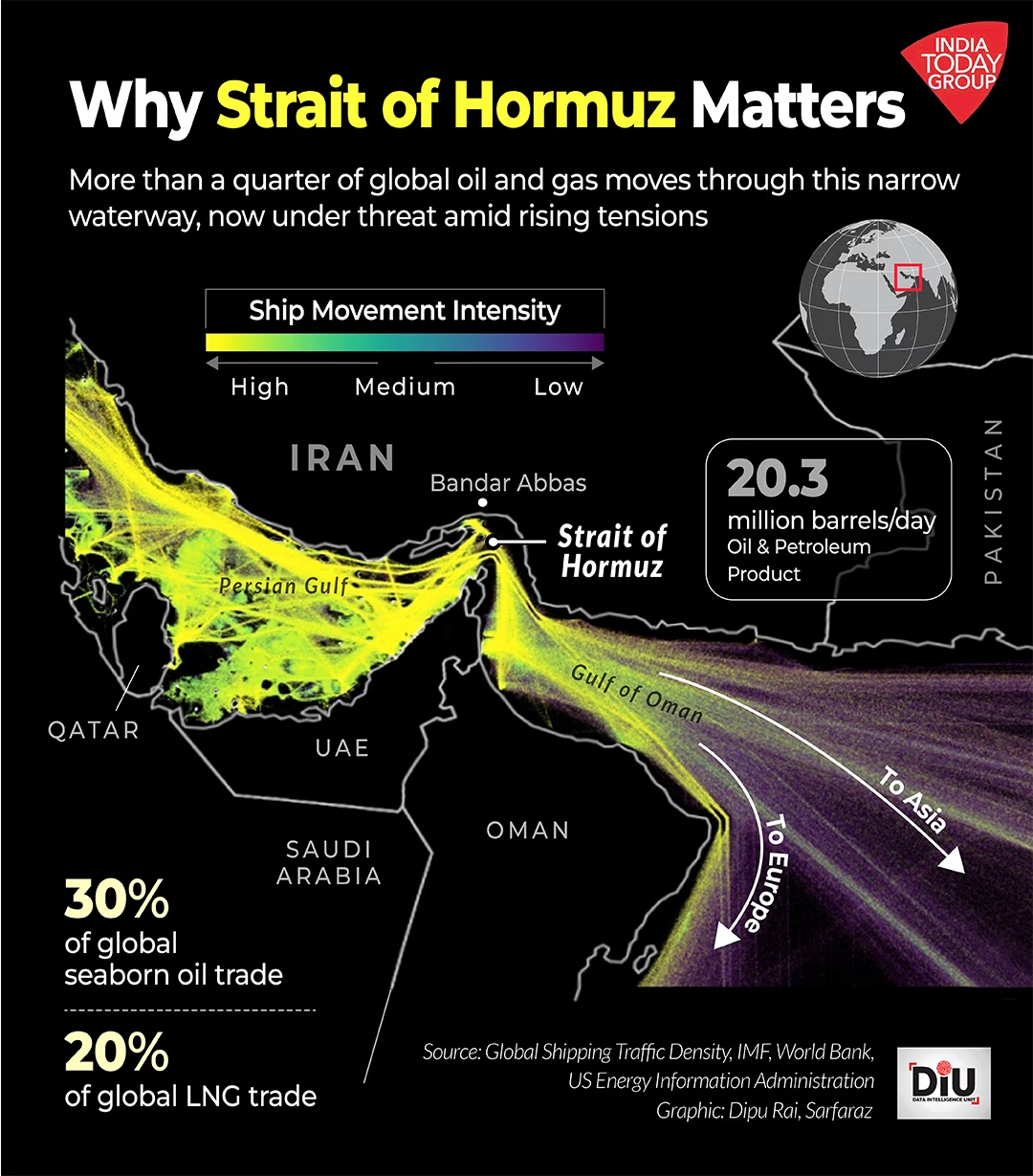

The Middle East's Strait of Hormuz handles about 25% of the world's maritime oil trade. Any disruptions here initially lead to pricier petrol and diesel, which then disrupts household budgets and elevates inflation expectations. Even before this, equity markets were under pressure after a sell-off in the AI sector, and this situation has added further strain.

Understanding the Market Movements

Brent crude soared above $71 and later rose by 0.5% to $72. Asian stocks dropped by 0.4%; US and European index futures rose slightly by 0.3%. Gold, after a two-day surge, remained close to $5,000 per ounce.

Source: aajtak

Market Dynamics at a Glance

Before any missiles were fired, markets felt the tremor. Oil prices spiked further upon deployment reports. Brent breached the $71 mark, reaching $72 after Trump's repeated 10-day warning. Traders keenly observe whether Iran will attempt to block the Strait of Hormuz, the main route for oil exports from the Gulf.

Source: aajtak

Investors sold shares and bought gold. Asian markets declined by 0.4%, while US and European futures showed mild green, indicating alertness rather than panic. The tension disrupted the recovery initiated post AI sector sell-off.

Gold serves as a 'pressure gauge' this time around. After a two-day rise, it stays close to $5,000. Note, it fell from $5,595 to $4,400 earlier this month, indicating that gold can rapidly rebound when risk perceptions change.

Source: aajtak

Behind the Scenes

According to the US administration, this is the largest deployment in the region since 2003, keeping both the dialogue and military options open. Meanwhile, Iran carried out a live exercise in the Strait of Hormuz on Monday, precisely when nuclear talks were poised to resume, escalating tensions further.

The Bigger Picture

Markets fear two things the most: uncertainty and supply chokepoints. Military deployment alongside a deadline exacerbates both. If oil prices climb further, repercussions will extend from trading screens to petrol pumps and household budgets, inevitably impacting the stock market.

Trump's Statement

President Trump emphasized the need for a solid deal, cautioning that absence of one would lead to dire consequences.