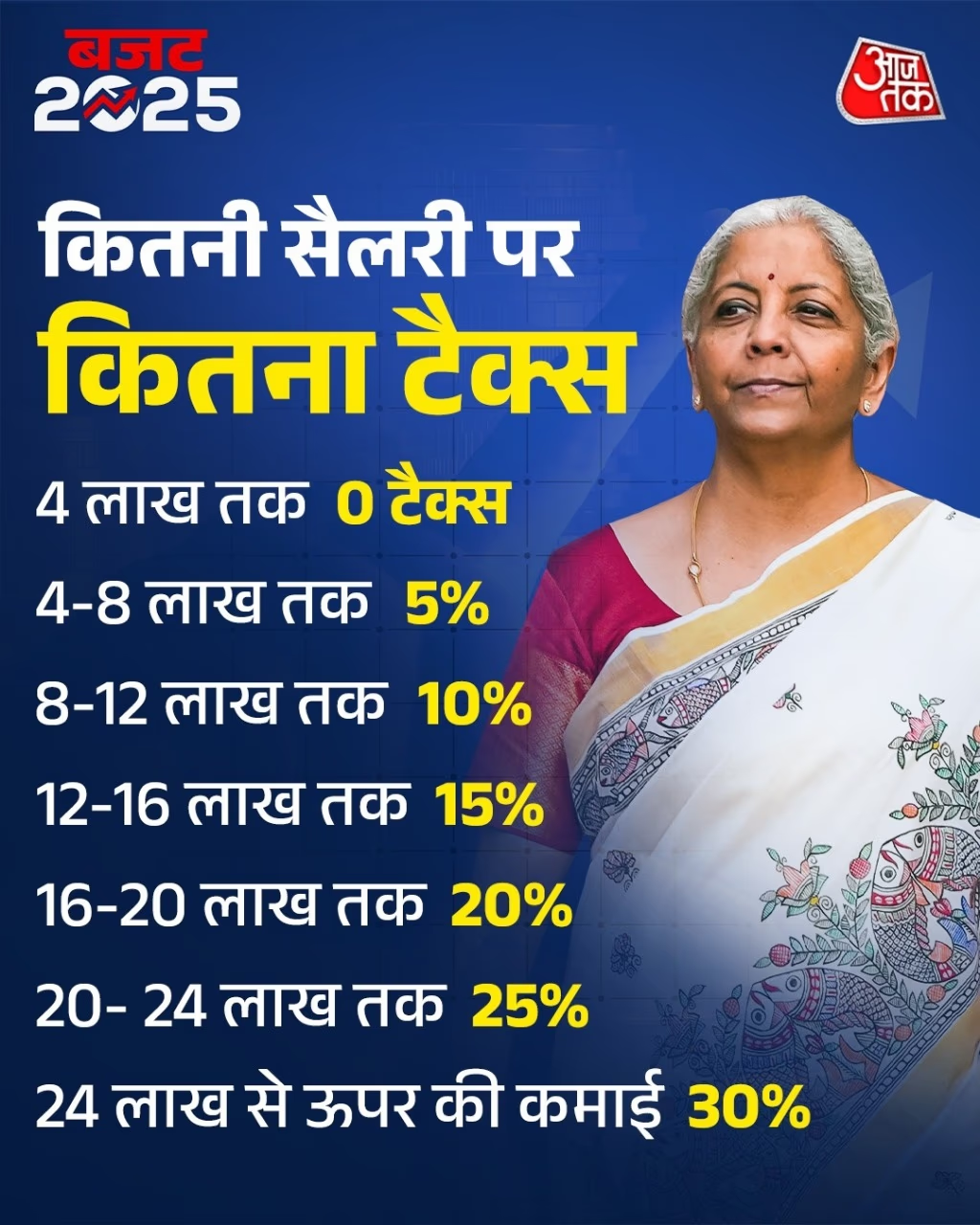

Finance Minister Nirmala Sitharaman unveiled the budget on Saturday, bringing substantial relief to the middle class. The proposal includes placing a zero-income tax on annual earnings up to 1.2 million, meaning individuals earning up to this amount will no longer need to pay taxes. Additionally, other income groups will also benefit from income tax relief. Before implementing the changes in the tax slab, the Finance Minister announced in her budget speech that a new Income Tax Bill would be introduced next week. This has left people wondering why there was a need to change the tax slab if a new bill is coming.

New Provisions to Take Effect Next Year

Former President of the Institute of Chartered Accountants and tax expert Ved Jain answered this question, stating that the new Income Tax Bill is anticipated to be introduced in Parliament next week and might be passed by the monsoon session. He suggested that while the new bill could be implemented in the financial year 2026-27, it's not feasible to enforce it just yet. Nonetheless, the changes in tax slabs defined in this budget will take effect starting April 1, 2025. However, the provisions of the new bill will not affect the proposed tax slabs from the budget.

Immediate Amendments to Address Current Needs

The amendments proposed in the budget are designed to address immediate requirements before the new income law is implemented. Considering economic factors such as inflation, GDP, and foreign investment, immediate revisions have been executed through the budget to ensure no disturbances in the economy. The government has also taken steps towards simplifying the Income Tax Act with the new tax slabs, promising ease for taxpayers.

Source: aajtak

Simplifying the Tax System

Currently, the Income Tax Act of 1961 is in effect in the country. In the 2020 budget, the government introduced a new tax regime under this act. However, the budget presented in July 2024 clearly indicated the need for amendments to the Income Tax Act. A review committee was established for this purpose, based on which the Finance Minister announced the introduction of a new bill in her budget speech. Regarding the new Income Tax Act, the Finance Minister emphasized continued tax reform efforts over the past decade to create an understandable tax system. In this spirit, the new Income Tax Bill will be introduced next week.