During the 56th GST Council meeting on Wednesday, several important decisions were made, providing relief to the common people and businesses alike. It was decided to keep only two GST slabs: 5% and 18%, eliminating the 12% and 28% slabs. This move by the central government will make everyday items more affordable and exempt life-saving medicines from tax.

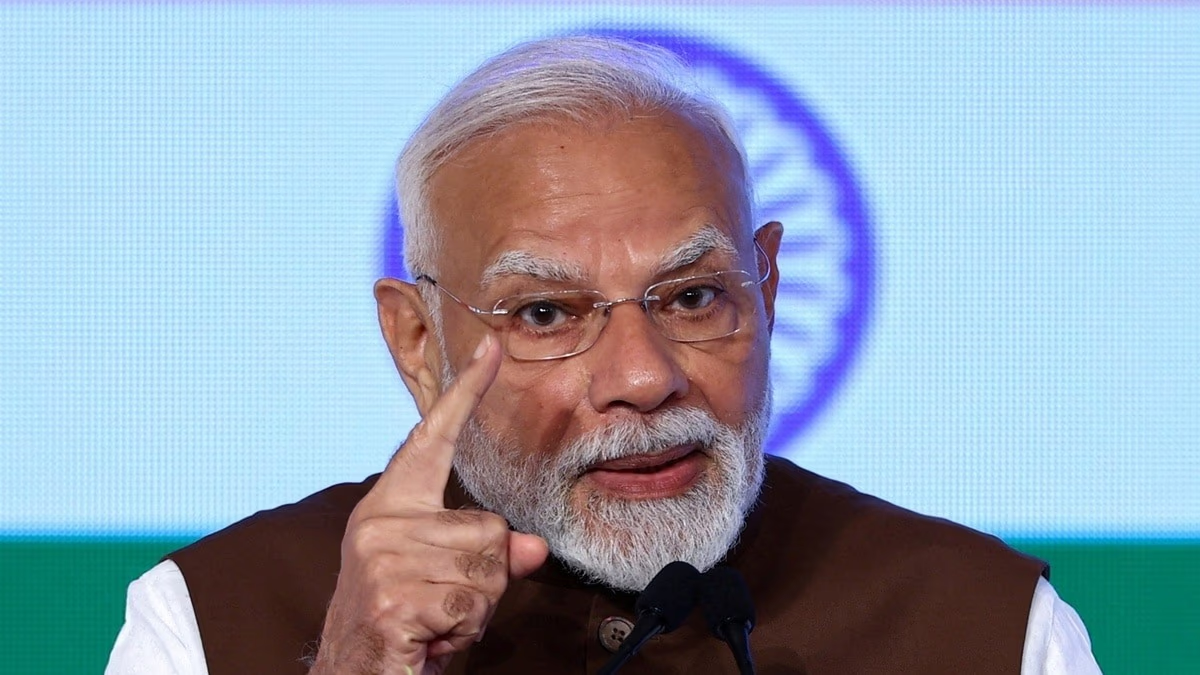

Following these decisions, Prime Minister Narendra Modi hailed the reforms as historic, stating that the Next-Generation GST reforms will simplify life for the common man and strengthen the economy. In a post, PM Modi shared, "During my Independence Day speech, I spoke about introducing next-generation reforms in GST. The central government crafted a comprehensive proposal to streamline GST rates and procedural reforms aiming to ease the common man's life and bolster the economy."

He further expressed, "It gives me immense pleasure that the GST Council, comprising both the central and state governments, collectively agreed on the proposals presented to reduce and reform GST rates, benefiting the common man, farmers, MSMEs, the middle class, women, and the youth. These comprehensive reforms will enhance the quality of life for our citizens and ensure ease of doing business for everyone, especially for small traders and businesses."

Source: aajtak

A Diwali Gift for Every Indian: PM

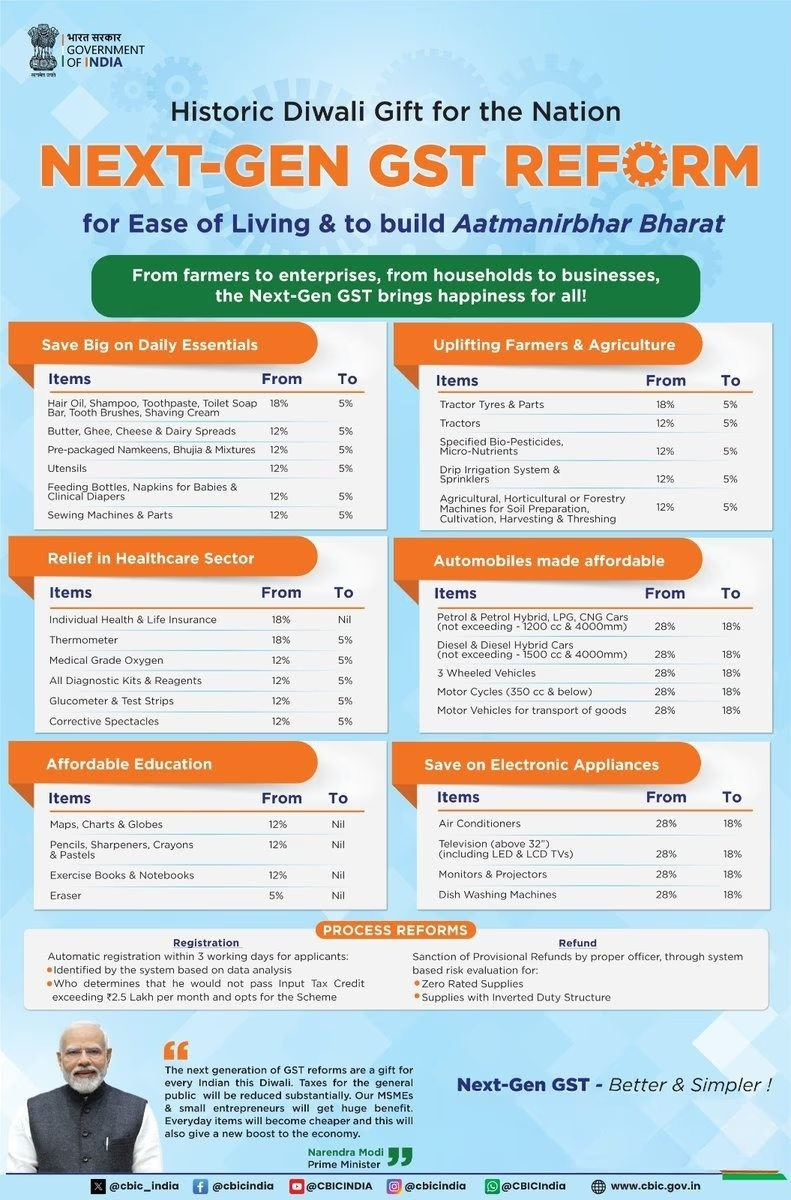

The government released a poster outlining the new GST slabs for various items. In this poster, PM Modi's message for the citizens highlights that the next generation of GST reforms is a gift for every Indian this Diwali, significantly reducing taxes for the common people. MSMEs and small entrepreneurs will receive substantial benefits. Everyday essentials will become cheaper, strengthening the economy.

These Items Will Become Cheaper

UHT milk, chhena cheese, pizza bread, and paratha are now placed in the zero GST slab and will not attract any GST. The GST on individual insurance policies has also been reduced to zero. Goods related to education, like pencils, cutters, erasers, and notebooks, have been made tax-free by removing the 12% tax.

The Finance Minister shared that in order to provide significant relief to the common man and the middle class, household essentials, including shampoo, soap, oil, and more, have been brought under the 5% GST slab. Furthermore, taxes on snacks, pasta, coffee, and noodles have been reduced to 5%. Thermometers and glucometers will now fall under this category too.

Items previously in the 28% slab, including cars, bikes, and three-wheelers, have now been moved to the 18% slab, making them more affordable. ACs and refrigerators are also on this list, their GST dropping from 28% to 18%. Additionally, building a house will be cheaper as GST on cement has been reduced to fall under the 18% category. Bikes over 350cc and auto parts too will benefit from this new classification.