The GST Council has initiated its meeting today, with significant decisions expected by tomorrow. The government has proposed reducing the current four-tier GST system to a two-tier structure. Some products may also see a tax increase. Should the council approve the proposal, many prices could see a drastic reduction.

On August 15th, Prime Minister Narendra Modi announced a new GST reform from the Red Fort, promising major relief to the public. Simultaneously, the Finance Ministry proposed a reduction in GST slabs. This ongoing GST Council meeting could approve the slab reduction, potentially implementing it by Diwali.

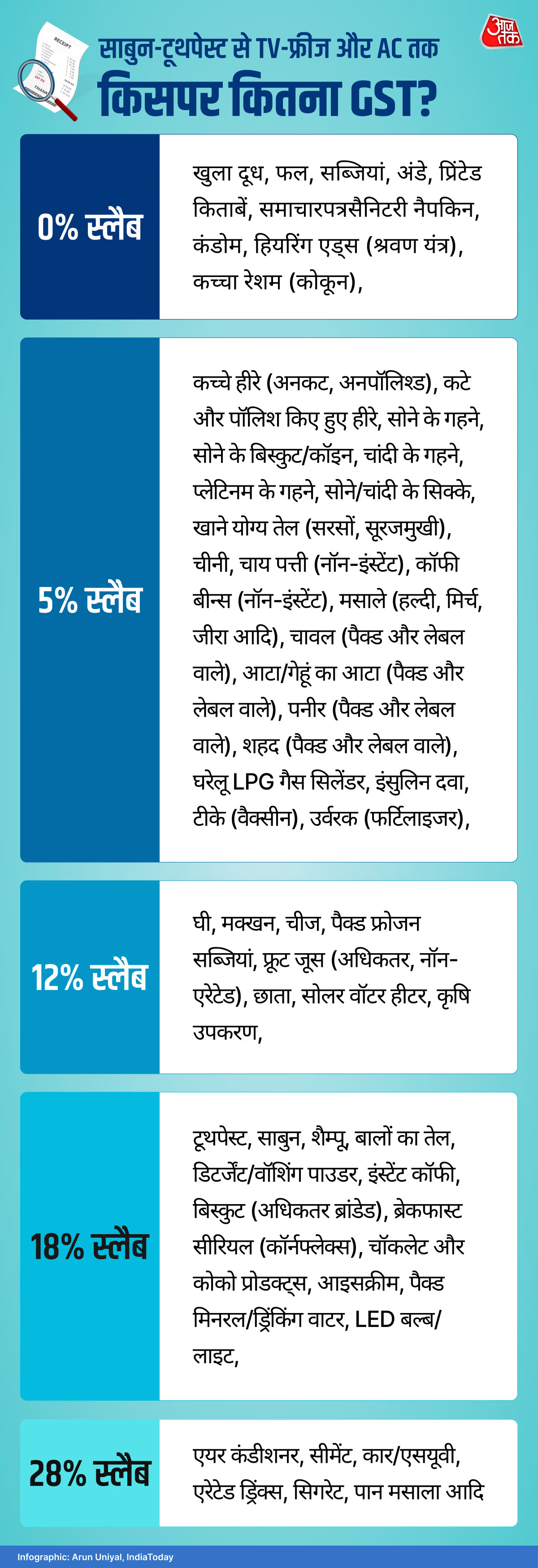

Currently, GST comprises four slabs: 5%, 12%, 18%, and 28%. Post-council decision, these might be streamlined to just two slabs: 5% and 18%. Consequently, the prices of clothes, shoes, ACs, TVs, and vehicles could decrease. But first, let’s discover which products currently fall into each slab to understand the potential price drops.

Current GST on Different Items

Source: aajtak

Price Drops for Items in 12-28% Slabs

Ghee, butter, cheese, and paneer

Frozen packed vegetables, snacks, biscuits, etc.

Fruit juices (mostly non-aerated)

Umbrellas, clothes, and shoes

Solar water heaters

Agricultural equipment

Air conditioners

Cement, paint, tiles

Cars/SUVs

Zero GST Proposal on Health and Life Insurance

A proposal suggests removing GST on health and life insurance premiums, reducing the tax to 0%. However, this might lead to a revenue loss of approximately ₹9,700 crores annually.