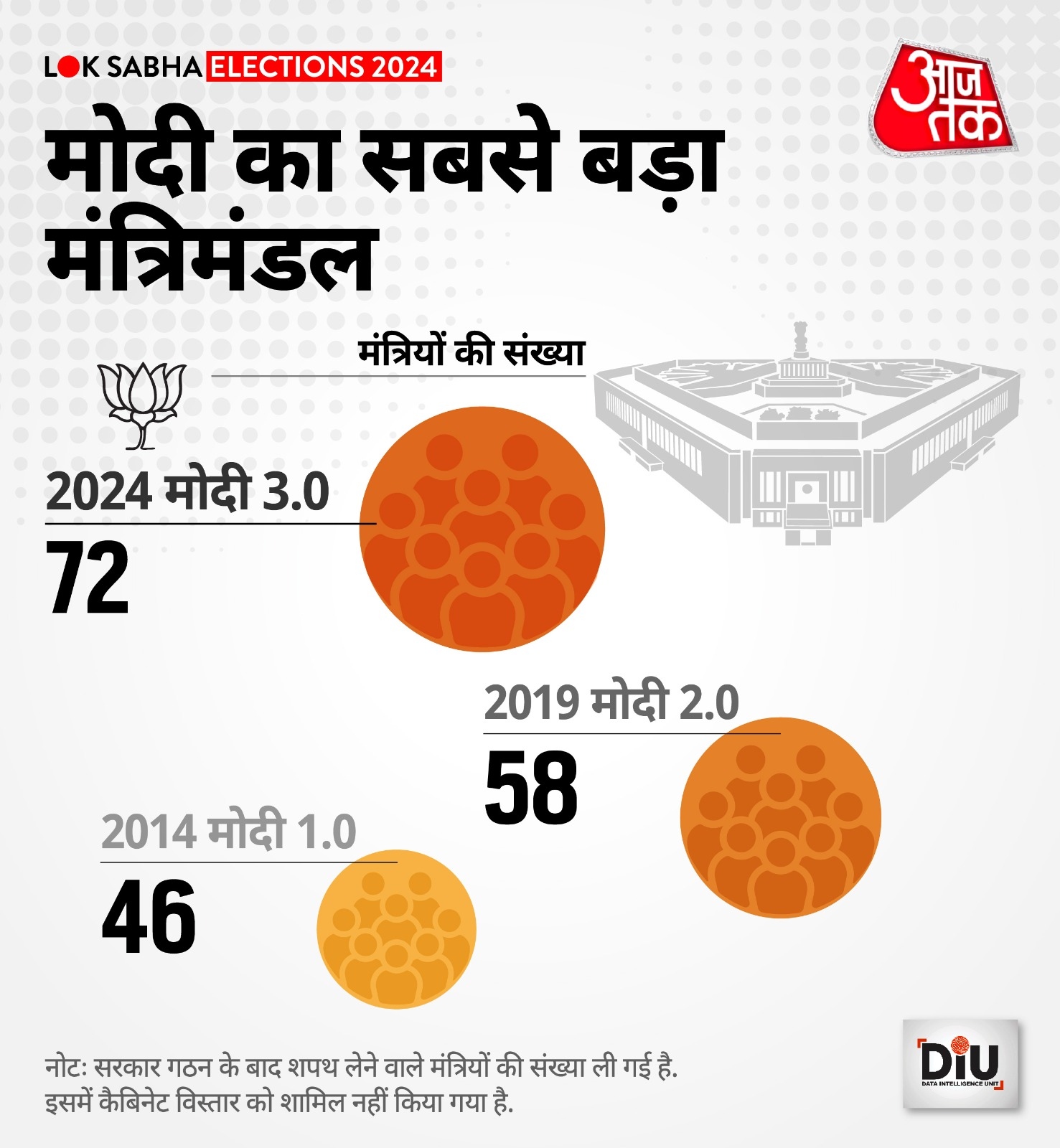

Narendra Modi has been sworn in as the Prime Minister for the third time, marking a grand ceremony on Sunday. Along with him, 71 parliamentarians also took the oath of office, forming Modi’s most expansive cabinet yet. In 2014, when Modi first became Prime Minister, 46 parliamentarians joined him as ministers. By 2019, that number had increased to 59 ministers.

As of 2024 in the NDA government, including the Prime Minister, there are 72 ministers. In Modi 3.0, there are 30 Cabinet Ministers, 5 Ministers of State (Independent Charge), and 36 State Ministers.

Up to 9 more parliamentarians could join Modi's cabinet, as the Constitution caps the number at 81 ministers. According to the 91st amendment, no more than 15% of the total Lok Sabha members can be in the cabinet. With 543 Lok Sabha seats in total, only 81 ministers are possible.

Under Article 75 of the Constitution, the President forms the cabinet on the advice of the Prime Minister. There are three types of ministers in the cabinet: Cabinet Minister, Minister of State (Independent Charge), and State Minister.

The most powerful in the cabinet is the Cabinet Minister. Then comes the Minister of State (Independent Charge), followed by the State Minister. Those included in the ministry receive a separate allowance each month apart from other parliamentarians.

What are their differences?

- Cabinet Minister:

These ministers report directly to the Prime Minister. They are fully responsible for the ministries they are allocated and can handle more than one ministry. It's mandatory for Cabinet Ministers to attend meetings, where the government takes all its decisions.

- Minister of State (Independent Charge):

Following the Cabinet Minister, these ministers report directly to the Prime Minister and have their own ministries. They do not report to a Cabinet Minister and do not partake in the cabinet meetings.

- State Minister:

State Ministers are appointed to assist the Cabinet Ministers. They report to a Cabinet Minister, and multiple State Ministers can be assigned to one ministry. In the absence of a Cabinet Minister, the State Minister takes full responsibility for the ministry. State Ministers also do not attend cabinet meetings.

Source: aajtak

Ministerial Positions Come with Added Privileges

While the salary and allowances of every Lok Sabha member are predetermined, those who become Prime Minister, Cabinet Minister, or State Minister receive an additional monthly allowance in comparison to other parliamentarians.

The salaries and allowances for members of the Lok Sabha are defined under the Salary Act. According to it, every Lok Sabha member receives a basic salary of ₹1 lakh per month. In addition, they are entitled to an electoral allowance of ₹70,000 and an office expense allowance of ₹60,000. Furthermore, during parliamentary sessions, they receive a daily allowance of ₹2,000.

The Prime Minister and ministers also receive a sumptuary allowance each month meant for hospitality expenses. The Prime Minister gets ₹3,000, a Cabinet Minister ₹2,000, a Minister of State (Independent Charge) ₹1,000, and a State Minister ₹600 for this purpose.

Consider this: a Lok Sabha MP's total monthly earnings from salary and allowances come to approximately ₹2.30 lakh. In comparison, the Prime Minister gets ₹2.33 lakh, a Cabinet Minister ₹2.32 lakh, a Minister of State (Independent Charge) ₹2.31 lakh, and a State Minister ₹2,30,600.

Do these office bearers pay taxes?

Whether they are MPs, the Prime Minister, the President, or the Vice-President, all are subject to income tax. However, they are only taxed on their salary component.

According to regulations, members of Lok Sabha and Rajya Sabha, as well as the President and Vice-President, only pay taxes on their salary. Other allowances are exempt from taxation.

Thus, with MPs having a monthly salary of ₹1 lakh, their annual earnings total ₹12 lakh on which they pay taxes.

The office bearers' salary is taxed under the 'Income from Other Sources' category.