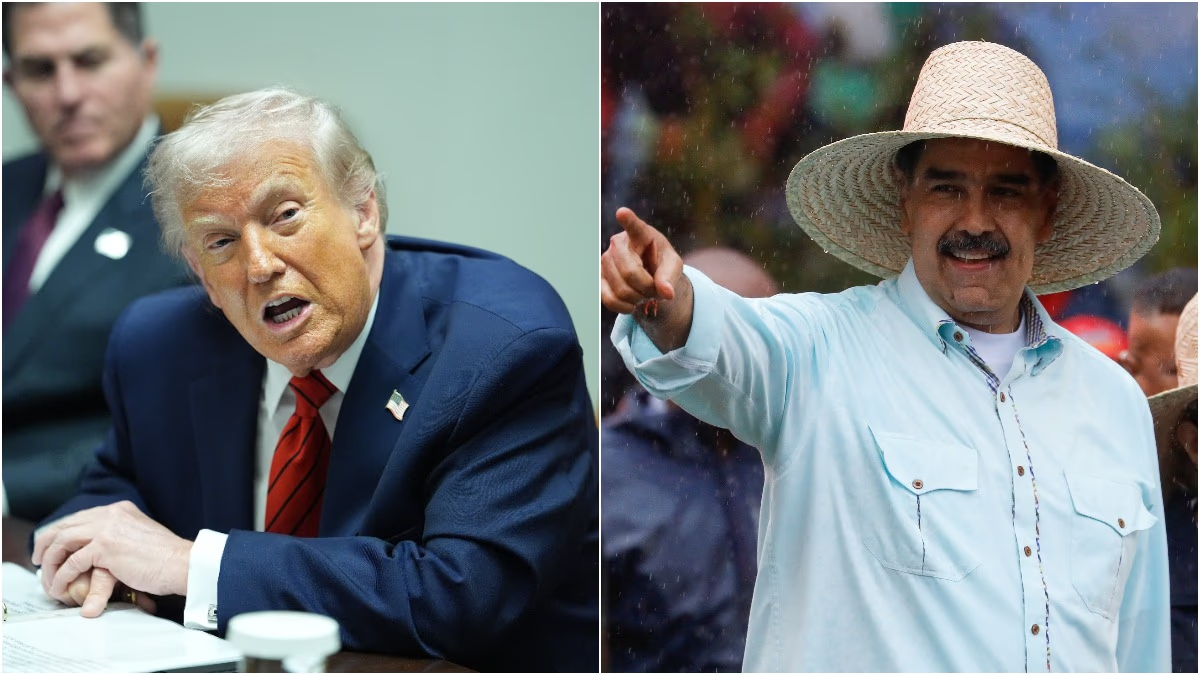

Tensions between the United States and Venezuela have been simmering for months. The Trump administration frames this as a fight against narco-terrorism. Meanwhile, Venezuela's Maduro government views it as a battle for control over their vast oil reserves. So, what's the story behind this Caribbean country's oil treasure, and why is Trump so interested in it?

Venezuela's oil reserves are often dubbed a 'treasure of black gold.' President Nicolás Maduro consistently claims that, under the guise of fighting drugs, the United States aims to control Venezuela's extensive oil wealth. Some experts predict Venezuela might face a situation similar to Iraq.

Venezuela's oil is a fifth of the world's total reserves

Venezuela holds more oil reserves than Iraq. According to CNN, the U.S. Energy Information Administration (EIA) states that Venezuela's oil reserves amount to a massive 303 billion barrels, constituting about a fifth of the world's total reserves. It’s the largest known crude oil reserve on Earth. Yet, Venezuela's capacity far exceeds its actual production.

Why is Venezuela's crude oil production declining?

Venezuela produces about 1 million barrels of oil daily—not a trifling amount, but just 0.8% of global crude oil production. Before Maduro's ascendancy in 2013, production was nearly double. In 1999, before the socialist regime's rise, production was at 3.5 million barrels daily. Now, Venezuela’s production is less than half of those figures.

The collapse of Venezuela’s oil industry is majorly due to international sanctions and severe economic crises. Additionally, as per the EIA, lack of investment and maintenance also contribute. Venezuela's energy infrastructure is deteriorating, leading to a substantial decline in oil production capacity over the years.

Restrictions on International Oil Companies

The type of oil found in Venezuela—heavy and crude—requires specialized equipment and high technical expertise for production. Though international oil companies can extract and refine it, they are barred from operating in the country.

Since 2005, the U.S. government has imposed sanctions on Venezuela, and the Trump administration effectively banned all crude oil exports from Venezuela’s state oil company, Petróleos de Venezuela, to the U.S. in 2019. In an effort to lower gas prices, then-President Joe Biden granted Chevron an operational permit in Venezuela in 2022, which Trump initially revoked in March but later reinstated on the condition that revenue does not benefit the Maduro government.

Why does the U.S. desire Venezuela's oil?

The U.S. produces more oil than any other country historically but still needs to import oil—particularly Venezuela's crude, for a significant reason.

The U.S. produces light, sweet crude that's excellent for gasoline but not for other products. In contrast, Venezuela produces heavy and sour crude which, when refined, yields several key products, including diesel, asphalt, and fuels for factories and other heavy equipment.

This causes a global shortfall in diesel supply

Due to sanctions on Venezuelan oil, global diesel supplies have dwindled. As per the EIA, by September, the United States was importing 102,000 barrels of oil per day from Venezuela. Despite being the tenth largest source of imported oil in the U.S., it pales in comparison to the 254,000 barrels imported daily from Saudi Arabia and 4.1 million barrels from Canada.

Venezuela's oil offers a cheaper alternative for America

For decades, the U.S. was more reliant on Venezuelan oil than today. Venezuela's proximity and relatively cheaper oil, due to its sticky, dense nature requiring extensive refining, contribute to this reliance.

According to Phil Flynn, Senior Market Analyst at the Price Futures Group, most U.S. refineries are designed to process Venezuela’s heavy oil, making them more efficient at using it than American oil.

What if Maduro is ousted from power?

Opening up Venezuela's oil to the world could benefit the U.S. and its allies—and potentially Venezuela's economy as well. Declining production, constrained by sanctions, signals Venezuela's potential to become a significant oil supplier. This scenario would create opportunities for Western oil companies.

A regime change in Venezuela might stabilize oil prices, yet lower prices might dissuade some American companies from oil production. Flynn suggests that with a legitimate government in place, taking power in Venezuela could globally boost oil supply, mitigating the risks of abrupt price hikes and drops.

Accessing Venezuela’s oil won’t be easy for the world

Even with a change in Venezuela's situation, allowing full international access to its oil reserves would still take years to fully restore its production, incurring hefty expenses. The pipelines haven't been updated in 50 years, and returning production to peak levels would require $58 billion to upgrade the infrastructure.

Western nations could gain geopolitically

If a government more amicable to the West comes to power in Venezuela, investing heavily in the country's oil and refinery potentials could be deemed worthwhile. Currently, Russian oil, similar to Venezuela's, explains why India and China remain dependent despite international sanctions aimed at weakening Russia's funding capacity for the Ukraine war. Western countries would thus gain significant geopolitical advantages.

India's imports from Venezuela have dwindled

An increase in Venezuelan production could provide an alternative to Russian oil, undermining Russia's economy and its ability to wage war in Ukraine. As for India, it once imported crude oil from Venezuela. Until 2015-16, Venezuela accounted for over 10% of India's total oil imports. Following U.S. sanctions, this has dwindled to just 1%.