US President Donald Trump has implemented Reciprocal Tariffs across numerous global nations, stirring turmoil in markets spanning from Asia to the US. Opposition to Trump's tariff strategy is also on the rise.

Meanwhile, an alert issued by US market experts predicts the first trading day of the week could echo the infamous 1987's Black Monday.

Global Ripple from Trump Tariffs

This week, US President Donald Trump's tariffs have sparked reactions worldwide, impacting countries from China and Taiwan to Pakistan and India. This has resulted in a significant downturn across global stock markets, including a notable decline in the US Stock Market.

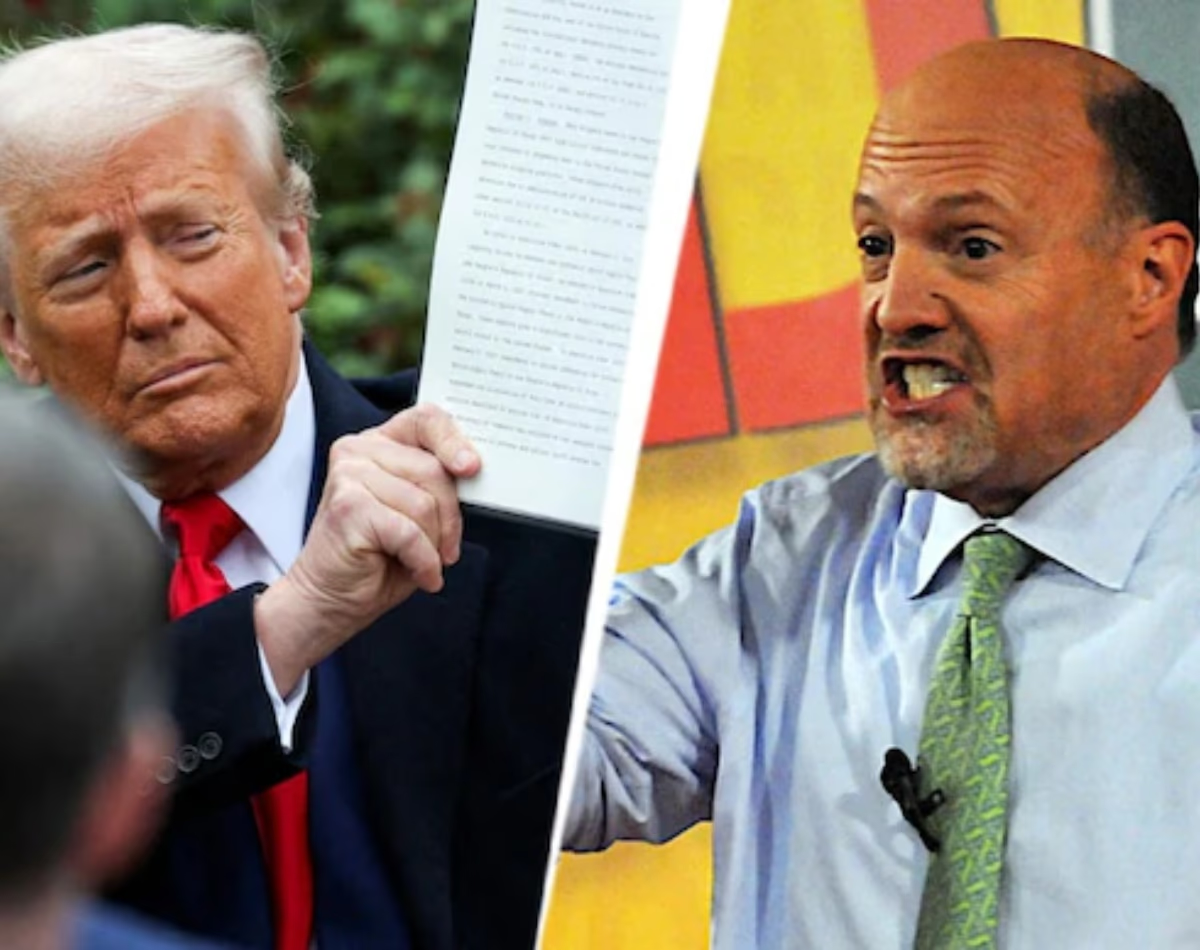

This trend is far from over, as analysts predict further declines from the Dow Jones to Nasdaq. US Market Analyst Jim Cramer cautions that turmoil akin to 1987's might unfold in American markets.

Source: aajtak

Major Drop Expected Monday

Jim Cramer has warned that a disaster reminiscent of 1987 might hit US markets, as historically large one-day declines like the Dow Jones once witnessed could repeat.

During a television show appearance, Cramer mentioned that the Monday following Black Monday of 1987 might face similarly massive one-day declines led by the American Dow Jones Industrial Average. He asserts that if the US President doesn't communicate with countries countering the tariffs, the situation could worsen.

What is 'Black Monday'?

To clarify, the experts, including Jim Cramer, remind us of Monday, October 19, 1987, a day marked by severe US market collapse. It saw the Dow Jones Industrial Average dive 22.6% and a 20.4% dip in the S&P-500 Index, which resonated globally. Cramer has now drawn parallels, suggesting that Trump Tariffs could incite the largest market drop since 1987.

Source: aajtak

On a TV show on Saturday, Jim Cramer hosted an episode warning about the severe impact of Trump's tariffs. He speculated that we won't have to wait long to see the effects, as Monday's market performance will reveal much. Despite the gloomy predictions, he noted that strong employment data in the US could be a saving grace, lessening the chance of an inevitable recession-driven market crash.

According to a report by India Today, examining the past shows Cramer has forecasted pivotal global economic shifts from the 2000 dot-com bubble to the 2007 Global Recession, though many predictions fell short.

The Current State of US Markets

Shortly after President Donald Trump's tariff declarations, US markets experienced crashes last Thursday and Friday, with the Dow Jones plunging 1,679 points on Thursday and 2,231 points on Friday.

Following China's retaliatory tariffs, the S&P 500 slipped by 6%. This marks the largest decline in US markets since the COVID-19 outbreak in March 2020. Notably, this drop didn't just affect the US but also shook markets across Europe, Asia, and India.