Amidst fierce anti-government protests in Iran and rising tensions with Western nations, the world faces a significant energy crisis. Strategists warn that if Iran disrupts the 'Strait of Hormuz' in retaliation, crude oil prices might surge over $110 per barrel globally.

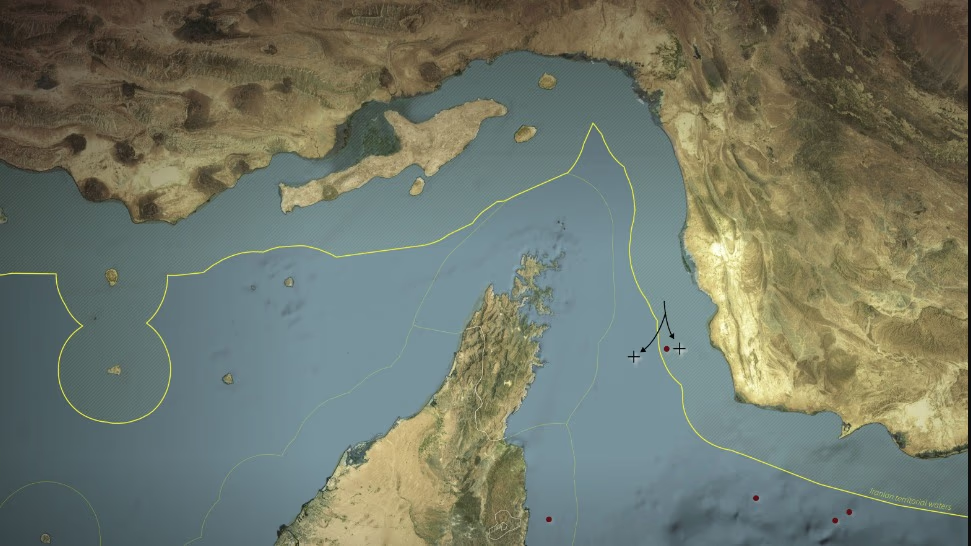

The Strait of Hormuz, located between Iran and Oman, is one of the most crucial maritime paths, linking the Persian Gulf to the Arabian Sea. Known as the world's key 'oil chokepoint,' this narrow route facilitates nearly a fifth of global crude oil and significant LNG trade.

This narrow sea pathway is Earth's lifeline

Iran alleges the U.S. and Israel are behind the anti-government protests. Concerns rise that Iran might target the Strait of Hormuz in retaliation. Disruption tactics might include laying sea mines, deploying missiles and drones, or harassing ships.

Any obstruction in this maritime corridor affects global energy markets, potentially causing a spike in oil prices.

Source: aajtak

The tense environment escalates with reports of increased unrest across Iranian provinces, clampdowns on protests, and thousands reportedly dead amidst internet blackouts. Concurrently, former U.S. President Donald Trump warned of strong military actions against Iranian protest crackdowns, deepening fears that Iran might close the Strait of Hormuz.

In June of last year, following Israel-U.S. joint airstrikes, Tehran had made similar threats. Experts opine that, although the formidable U.S. Navy negates Iran’s ability to block the Strait indefinitely, even temporary disruptions could cause oil prices to spike, triggering inflation and market volatility worldwide.

What makes the Strait of Hormuz vital?

The Strait of Hormuz is one of the paramount sea routes globally. It lies north of Iran and south of Oman and UAE, linking the Persian Gulf with the Gulf of Oman and the Arabian Sea. It serves as the lone maritime route for oil and gas transportation from Gulf countries to international markets.

At its narrowest, it is just about 33 kilometers wide, with shipping lanes barely kilometers wide. Despite this, it accommodates roughly 20% of the world's daily oil consumption, and a substantial volume of LNG is transported through it. In 2025, nearly 13 million barrels of crude oil passed through daily, accounting for approximately 31% of global maritime oil trade.

Source: aajtak

Global economy at stake, India on alert

Major oil-producing nations like Saudi Arabia, Iraq, Iran, Kuwait, and UAE rely on this route to export their energy supplies, particularly to Asia. Hormuz's stability is linked directly to the economic security of countries like China, Japan, India, and South Korea, which consume about 80% of the oil, condensate, and LNG passing through this duct.

Can Iran effectively close the Strait of Hormuz?

Daniel E. Mountean, writing for the US-based think tank ‘Atlantic Council,’ suggests that Iran could hypothetically halt commercial shipping through this pathway. US intelligence estimates highlight Iran’s possession of 5,000 to 6,000 naval mines, rapidly deployable via 25 submarines, with a mere threat impacting commercial traffic.

Iran also boasts a robust network of anti-ship coastal missiles, including the Khalij-e-Fars ballistic missiles, Hormuz-1, Hormuz-2 missiles, and Noor cruise missiles. Additionally, Iran possesses thousands of drones, including domestic and Russian-designed Shaheed drones, previously deployed by Houthi rebels to disrupt Red Sea shipping.

However, Mountean emphasizes that completely and permanently closing the strait is highly challenging for Iran due to the superior US Navy strength. Following the last attempt by Iran to lay mines in 1988, the US retaliated with 'Operation Praying Mantis,' severely incapacitating the Iranian Navy.

Source: aajtak

Could Iran escalate global oil prices?

According to Forbes, the Strait of Hormuz facilitates approximately 30% of the world's oil and one-third of the LPG shipments, predominantly directed toward Asian nations such as China, Japan, India, and South Korea. Any attempts to close this route would have immediate and extensive repercussions. According to CNBC, in a complete closure scenario, oil prices might see a $10 to $20 per barrel increase.

Goldman Sachs, as per Forbes, suggests that if oil flow even halves for a month, prices might jump nearly 30% to exceed $110 per barrel. BBC also cautions that it might spark stock market turbulence, exacerbating inflation in countries like China and India.

CitiGroup forecasts that prolonged disruptions could see oil prices nearing $90 per barrel.