Be it a festive sale or a new phone launch, one line remains constant everywhere: No-Cost EMI, starting at just 1,999 INR a month. Or sometimes even zero down payment. But is it truly beneficial for you?

From online platforms to malls, this offer has become the biggest trigger for purchasing smartphones. Industry insiders and statistics suggest that today, almost every second premium phone in India is bought on EMI. Easy monthly installments have undeniably simplified purchasing phones, but along with it has emerged a new pattern. It's known as the Upgrade Trap, a part of what can be considered dark marketing techniques.

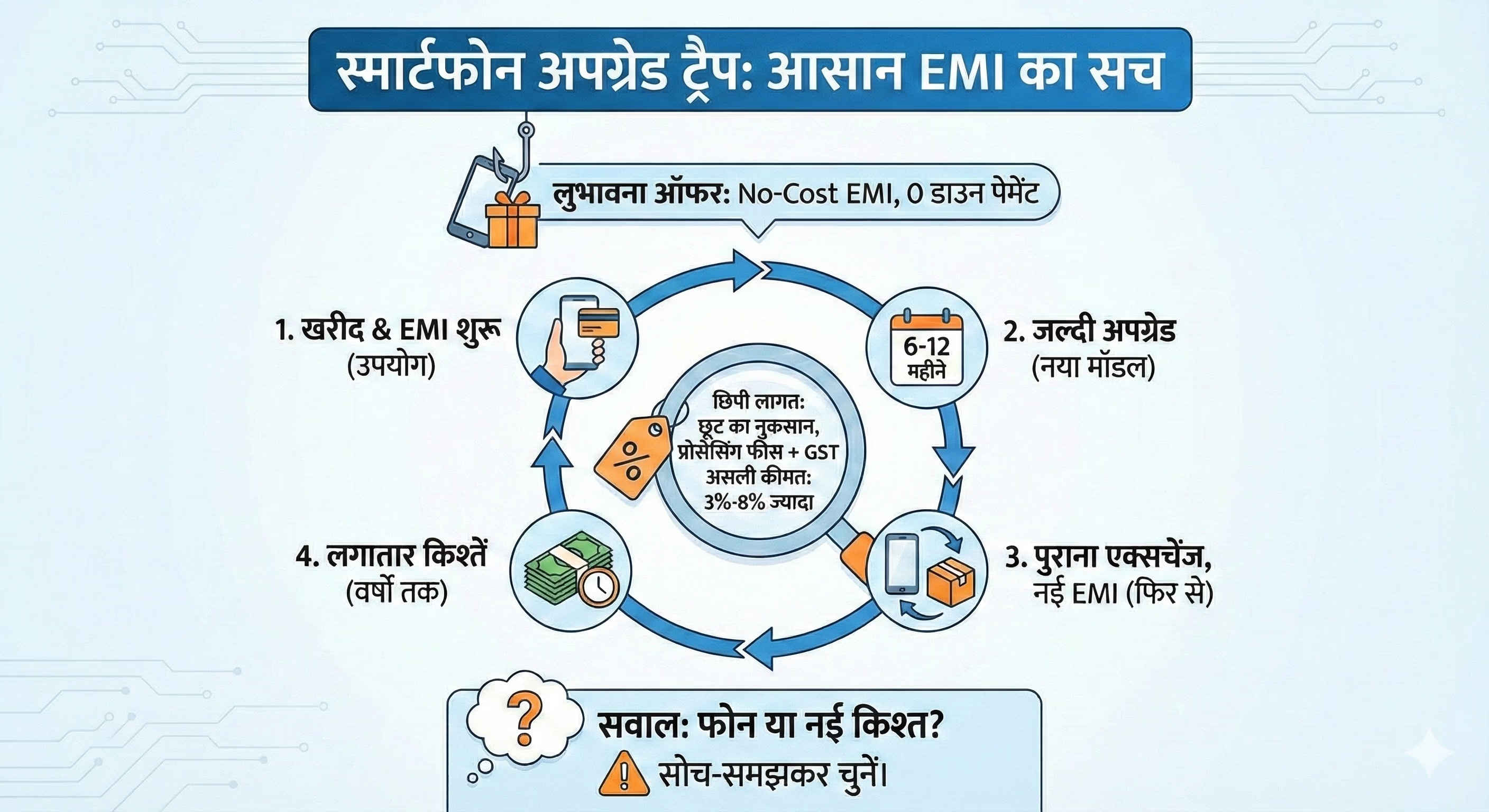

Initially, users would buy a smartphone and use it for 3-4 years. Now, the same phones are being replaced in just 6-12 months. This isn't solely due to the fast pace of technology, but largely influenced by convenient EMI options.

Phones Are Becoming More Subscription-Based Than Just Devices

In today’s market, phones aren’t just sold as standalone devices anymore; they’re pitched as constantly upgrading products. The customer doesn’t pay the full amount, just monthly installments. A new model appears a year later. The old phone is exchanged. A new EMI begins. Some have been paying smartphone EMIs for a decade, consistently taking new phones on these terms every two years. But is paying phone EMI for 10 years wise?

The direct result is that customers find themselves trapped in endless installments while companies secure a new buyer each year.

Source: aajtak

No-Cost EMI: Sounds Good, Costs More

The No-Cost EMI model is cleverly combined with regular EMI offers. The name suggests there’s no interest. However, if you buy the same phone outright, you typically get a direct discount. Choosing EMI means that discount disappears.

People from retail channels in the industry say that sometimes a phone bought upfront is 5% to 7% cheaper, but selecting the EMI option makes the phone appear just as expensive as before. On top, there are processing fees, GST, and late payment conditions that aren’t initially visible.

Exchange Offer: Another Trap Linking to EMI

The second part of the Upgrade Trap is the Exchange Offer. Trade in an old phone, get benefits worth 15,000 INR... looks beneficial to the customer.

However, insiders say the market value of the traded phone is often less than claimed. The remaining bonus amount is tied to the EMI plan. This is why even exchange offers are designed to make EMIs look attractive.

Data Shows... We’re Rapidly Changing

The numbers tell the same story. Market analyses reveal that by 2024, nearly 48% of smartphones purchased in India are through EMI or credit options. This figure is about 22% higher than in 2019, indicating a rapid shift from upfront purchases to installment agreements.

This report also highlights that users are now swapping phones within 6 to 12 months compared to the 30 months previously. Keeping a phone for a long duration was once common, but frequent upgrading is a new trend. This isn’t just because of new features, as phones keep appearing similar for years. But when users see they can exchange and get the latest model on EMI, even if it means a two-year commitment, they opt into it, often skipping essential expenses.

The Real Cost... Impact on Your Wallet

Data also reveals that most No-Cost EMI plans end up costing customers 3% to 8% more than the upfront price, even without formal interest charges. This difference may seem marginal, but across thousands and millions of transactions, the impact on consumers’ wallets becomes significant, especially in the mid-range segment where every penny counts.

What If Installments Are Missed?

Finance experts point out that EMIs aren’t inherently bad. But trouble arises when customers make decisions based solely on monthly installments without considering the total cost.

Missing a payment or two results in late fees and affects credit scores. This directly impacts future loans, credit cards, and banking offers. Monthly hidden costs accrue and if EMIs are delayed, daily additional charges come into play.

Why Are We Choosing Such Easy Credit?

A combination of middle-class aspirations, online sale cultures, and easy credit options in India has created a new consumer pattern. Smartphones are no longer just technical devices but lifestyle products constantly updated.

EMIs are seen as convenient because they seem to reduce monthly burdens. However, this easy path often increases overall spending.

The Real Question

Are we buying phones today? Or are we purchasing new EMIs every year? The answer isn’t just in the payment options; it lies in your spending habits, preferences, and consumer mentality. The Upgrade Trap is a significant truth to ponder.