In recent years, the cost of education has risen sharply while inflation rates in the country hover between 5 to 5.5%. Educational expenses have seen an increase of around 11 to 12 percent. Furthermore, it's estimated that within six to seven months, the expenditure on education could even double, significantly impacting middle-class and less affluent families.

Private engineering colleges, for example, charged an annual fee of 1 lakh rupees back in 2010, which by 2022 increased to 3 lakh rupees, marking a 200% hike in fees. If you’re considering sending your child abroad for their studies, in addition to tuition, you should also factor in an annual inflation rate of 4-5%.

What's the plan for a 2 Crore education fund?

The gist is, if you're sending your child for higher education abroad, you should have a sizeable amount saved. You need to plan according to this goal.

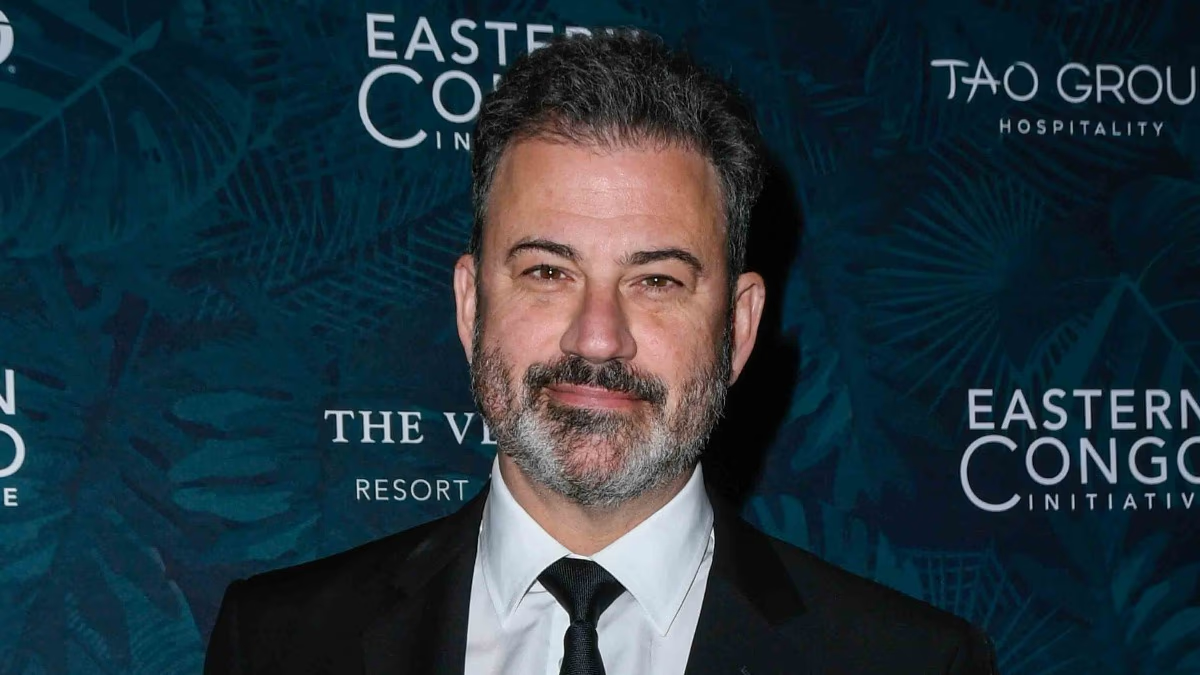

We're revealing a strategy that not only secures your child's educational expenses but will also ease your worries about their marriage or other future expenses. Jay Shah, founder and CEO of Finwisor, told Business Today that investing in Mutual Funds wisely can be very profitable.

Shah suggests starting a Systematic Investment Plan (SIP) for your child's education as soon as possible to accumulate a substantial amount over the long term, avoiding heavy financial burden later on.

Source: aajtak

Invest ₹14,000 Monthly and Aim for ₹2 Crore

According to Jay Shah, with a monthly SIP of ₹14550 and an average return of 15%, you could accumulate ₹2 Crores in 15 years, provided you increase your SIP investment by 15% annually.

If you start with a monthly SIP of ₹14550 and escalate it by 15% each year, assuming an average return of 15%, the total sum after 15 years could be ₹2 Crores.