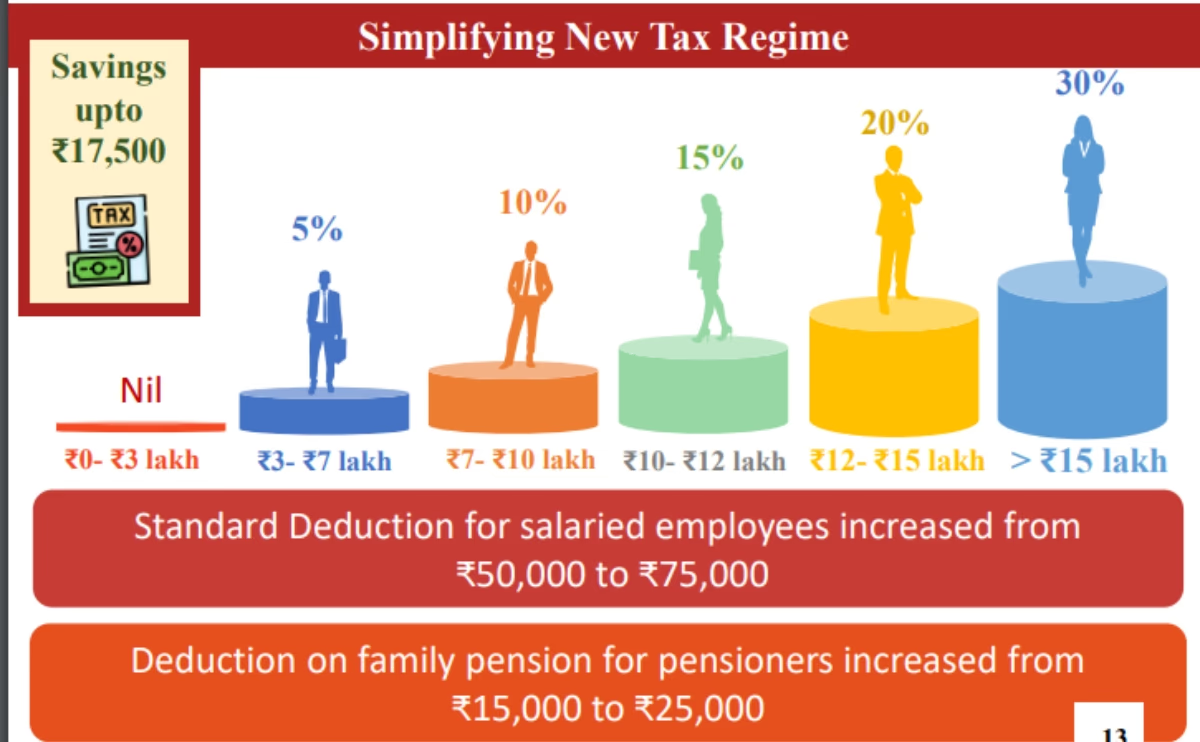

Finance Minister Nirmala Sitharaman has made a significant change in the tax slab under the New Tax Regime. Additionally, the limit for Standard Deduction has been increased. The Standard Deduction has now been raised from 50,000 per year to 75,000 per year. In the New Tax Regime, there is already a tax exemption on annual income up to 7 lakh rupees.

Because of this, if someone’s annual earnings amount to 7 lakh 75,000 rupees and they choose the New Tax Regime, they will not have to pay a single rupee in tax, as the Standard Deduction has been raised to 75,000 rupees per year. Earlier, this deduction was 50,000 rupees per year, meaning that no tax was payable on an annual income of 7.50 lakh rupees. Now this exemption has increased by 25,000 rupees, making it 7.75 lakh rupees annually.

What if the salary exceeds 7.75 lakh rupees annually?

If a person’s salary or annual income exceeds 7.75 lakh rupees by even one rupee and they choose the New Tax Regime, they will have to pay 10% tax according to the revised tax slab.

How much tax on income over 10 lakhs?

According to the new tax slab under the New Tax Regime, if someone’s income is between 7 and 10 lakh rupees, they will have to pay 10% tax. On income above 10 lakh rupees and up to 12 lakhs, the tax rate will be 15%. On income above 10 lakh rupees and up to 12 lakhs, the tax rate will be 15%.

How about 12 to 15 lakhs?

If a taxpayer earns more than 12 lakh rupees annually and chooses the New Tax Regime, they will have to pay 20% tax. If someone’s income is more than 15 lakh rupees, the tax rate will be 30%.

Source: aajtak

Revised Tax Slabs Under the New Tax Regime:

0-3 lakhs: 0% tax

3-7 lakhs: 5% tax

7-10 lakhs: 10% tax

10-12 lakhs: 15% tax

12-15 lakhs: 20% tax

Above 15 lakhs: 30% tax