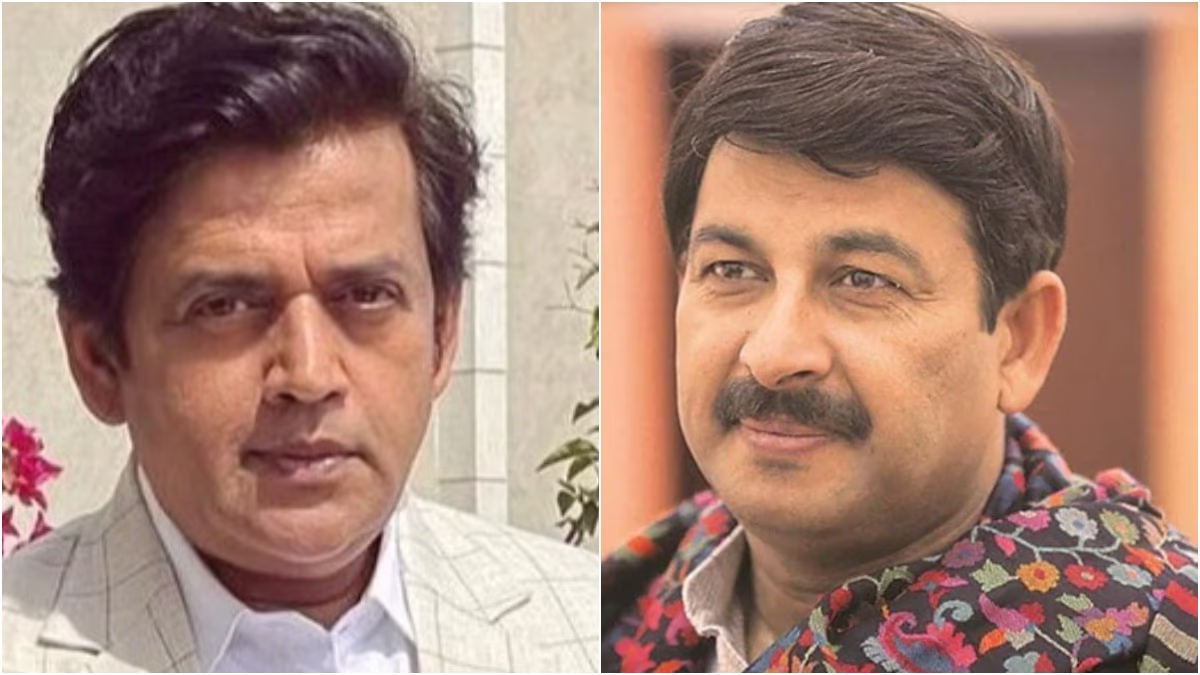

As the election season heats up in India, the opposition Congress Party finds itself embroiled in a fresh controversy. Sam Pitroda, head of the Indian Overseas Congress, sparked a furor with his recent remarks on the American Inheritance Tax, a duty levied on the estate passed to the children of the deceased.

What did Sam Pitroda say?

Pitroda noted that in the US, Inheritance Tax is imposed. This means if someone has an estate worth $10 million, only 45% of it would be inherited by their children, with the government claiming the remaining 55% posthumously.

According to Pitroda, there is no such law in India. Here, if someone owns property worth 10 billion rupees, its entirety goes to the progeny upon death, leaving nothing for the public benefit.

Prime Minister Modi Strikes Hard

The political storm over Pitroda's statement rages on. Prime Minister Narendra Modi, at a rally in Sarguja, Chhattisgarh, on Wednesday, remarked that Congress's 'dangerous intentions' have become evident, hence their support for Inheritance Tax. Home Minister Amit Shah also stated that Pitroda's comments have exposed the Congress Party. BJP IT cell chief Amit Malviya has accused Congress of deciding to destroy the nation.

Congress Distances Itself from Pitroda's Statement

Consequently, Congress seems to have kept its distance from Pitroda's remarks. Congress leader Jairam Ramesh mentioned that even though every individual in a democracy has the right to voice their opinion, it doesn't mean Pitroda's views always align with the party's stance.

The Practice of Inheritance Tax in the United States

Amidst political conflicts, questions arise about what Inheritance Tax is, whom it affects, and its rate. In essence, Inheritance Tax is imposed on the division of assets after one's death. Six states in the US actively collect Inheritance Tax. The specifics of the tax depend on where the decedent lived and their relationship to their heirs.

Further Details on Inheritance Tax:

In the US, no federal-level Inheritance Tax exists. However, Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania have such a tax in place. Iowa plans to phase out this tax by 2025. Tax rates vary by state.

- In Iowa, Inheritance Tax ranges from 1% to 4%. Spouses, children, parents, and charities are exempt from this tax.

- Kentucky imposes the tax based on the relationship to the deceased, with rates between 4% and 16%, though close relatives are exempt.

- Maryland imposes a 10% tax on estates worth more than $1,000, with similar exemptions.

- Nebraska's tax rate varies, with exemptions only given to direct lineage.

- New Jersey taxes at 11% to 16%, dependent on the heir's relationship, with several exemptions.

- Pennsylvania has varied rates and tax classes, with some family members having a lower rate.

Estate Tax Coexists

Even though the Inheritance Tax isn't a federal imposition in the US, the Estate Tax applies nationwide. In states with Inheritance Tax, heirs must pay both Estate and Inheritance Tax.

The Estate Tax rate in the US can be between 15% to 20%, and as of this year, it applies to estates exceeding $11.6 million.

Ways to Avoid Inheritance Tax

There are strategies to circumvent the Inheritance Tax. One such method is to disperse one's estate as gifts while still alive.

In America, gifts up to $18,000 are not taxable. Individuals wishing to avoid burdening their heirs with Inheritance Tax can gift their assets. Married couples can jointly gift up to $36,000 without incurring taxes.