Today, the 54th GST Council Meeting, chaired by Finance Minister Nirmala Sitharaman, will take place. Key issues will be discussed, including the potential reduction of the GST on life and health insurance premiums, which has been a pressing concern. Even Nitin Gadkari, the Minister of Road Transport and Highways in the Modi 3.0 government, has expressed his concerns regarding this.

Important Argument by Nitin Gadkari

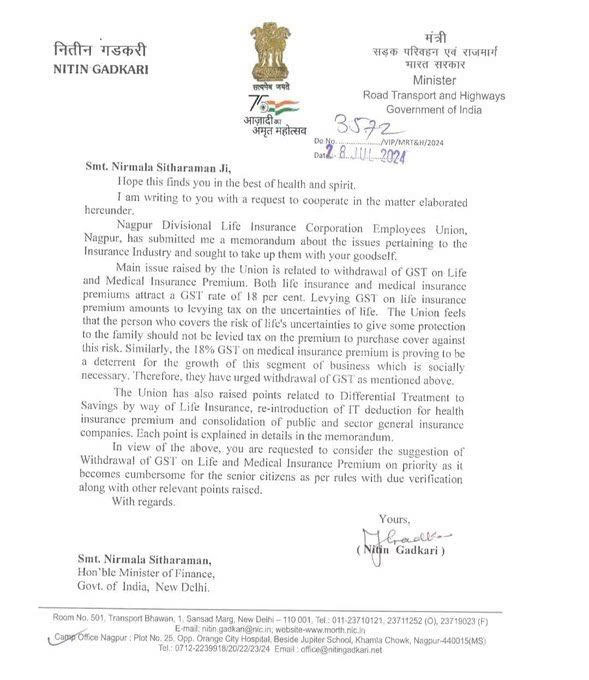

In the meeting led by Finance Minister Nirmala Sitharaman on Monday, a significant announcement may be made about reducing the 18% GST on health and life insurance premiums, a demand that has resonated widely. On July 28, 2024, Union Minister Nitin Gadkari wrote a letter to the Finance Minister, advocating for the removal of GST on life and medical insurance, describing it as a tax on the uncertainties of life.

In his letter to Sitharaman, Gadkari mentioned that the Nagpur Division Life Insurance Corporation Employees Union had presented him with a memorandum on these issues. The union believes that taxing insurance premiums discourages people from purchasing coverage against risk. Similarly, the 18% GST on medical insurance premiums hampers the growth of this socially necessary business sector.

Source: aajtak

Benefit for Policyholders with Reduced GST?

If Gadkari's request is accepted in today's GST Council meeting, life and medical insurance could become more affordable as the GST drives up the premium costs. However, a concern is whether insurers would pass on this benefit to the policyholders or retain the financial gain themselves. Reports suggest that the GST on health and life insurance premiums may be reduced from 18% to 5%.

GST as a Financial Service

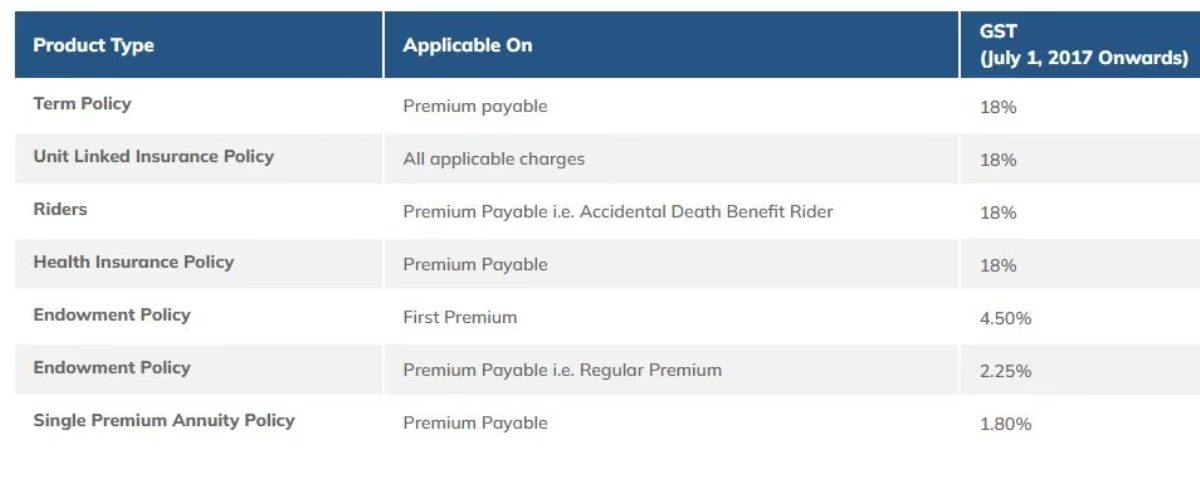

Implemented nationwide on July 1, 2017, the Goods and Services Tax (GST) has changed India's tax system, replacing various individual taxes with a single tax. GST, an indirect tax, is levied on domestic products, clothing, consumer goods, electronics, transportation, real estate, and services. Insurance is categorized under financial services, with both term and medical insurance subjected to 18% GST.

Source: aajtak

How Premium Increases Affect Your Wallet

For term and health insurance, GST is applied to the total premium amount. For example, if you buy a health insurance policy with a coverage of INR 500,000 and an annual premium of about INR 11,000, the 18% GST calculation means an additional INR 1,980 on your premium, bringing it to INR 12,980 per year. Thus, GST increases the premium costs for term policy buyers.

Tax Rates Before GST

Before GST, the tax rate on insurance was 15%, which increased to 18% with GST implementation on July 1, 2017. This 3% rise directly affected insurance premiums. The GST Council's meeting will also consider the revenue implications of reducing premium taxes. In the fiscal year 2023-24, the central and state governments earned INR 8,262.94 crores from health insurance premiums and INR 1,484.36 crores from health re-insurance premiums.