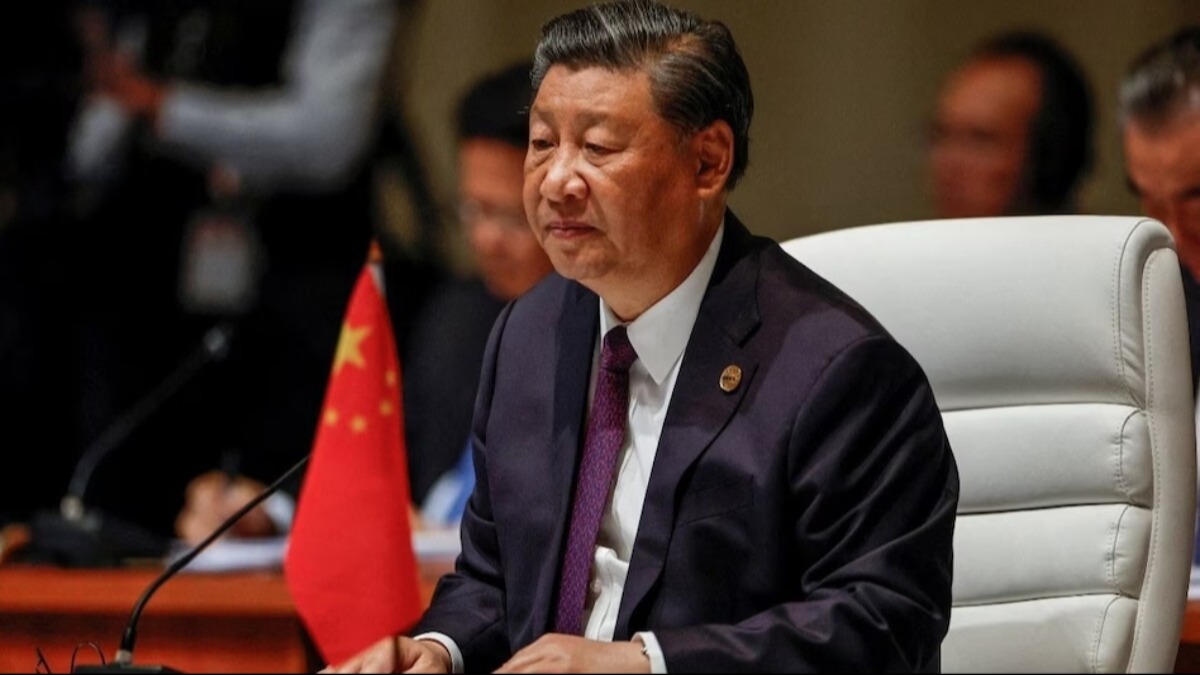

While India surges as one of the fastest-growing economies globally, China's economy reels from successive blows. Now, a disconcerting report from the United States signals heightened woes for the Asian giant. Global rating agency Fitch Ratings has revised its outlook for China in light of risks within the real estate sector and beyond, adjusting its Sovereign Credit Rating from stable to negative.

Real Estate Crisis Reveals Economic Strain

Citing risks for China, Fitch adjusts the outlook amidst ongoing real estate turmoil, moving China's Sovereign Credit Rating from stable to negative. The agency explains that the nation is moving away from property-led growth, facing uncertain economic prospects—concerning the sectors the Chinese government views and promotes as part of a more sustainable development model.

China's Debt Burden Set to Rise

Fitch's report suggests that burgeoning fiscal deficits and rising state debt in recent years have eroded fiscal buffers. The agency believes fiscal policy will play a crucial role in driving growth in the coming years, potentially increasing China's indebtedness.

Governmental Deficit to Exceed 7%!

According to ANI reports, China's fiscal stimulus is on the rise to overcome economic hurdles. Amid these developments, Fitch Ratings projects the general government deficit will grow from 5.8 percent in 2023 to 7.1 percent of the Gross Domestic Product in 2024. Their latest report reveals that the deficit since 2020 is substantially higher, nearly double the average of 3.1 percent of GDP from 2015-2019.

India to Outpace China on Yearly Growth

World Of Statistics recently released yearly GDP growth figures for various countries, with China trailing significantly behind India. Surpassing economic heavyweights like the USA, Japan, and the UK, India's growth outstrips these nations. With annual GDP growth rates of 1.5% for the US, 1% for Japan, 0.6% for the UK, and China at 4.2%, India leads with a robust 6.3% growth rate.