Following the exit poll results, Congress MP Rahul Gandhi accused Prime Minister Narendra Modi, Home Minister Amit Shah, and Finance Minister Nirmala Sitharaman of serious allegations on June 6th, concerning the volatility of the Stock Market. Gandhi asserted that people were advised to purchase stocks prior to June 4th, which he demanded to be investigated by the Joint Parliamentary Committee (JPC). In response, the BJP claimed that Gandhi was instilling fear among investors and concocting conspiracies.

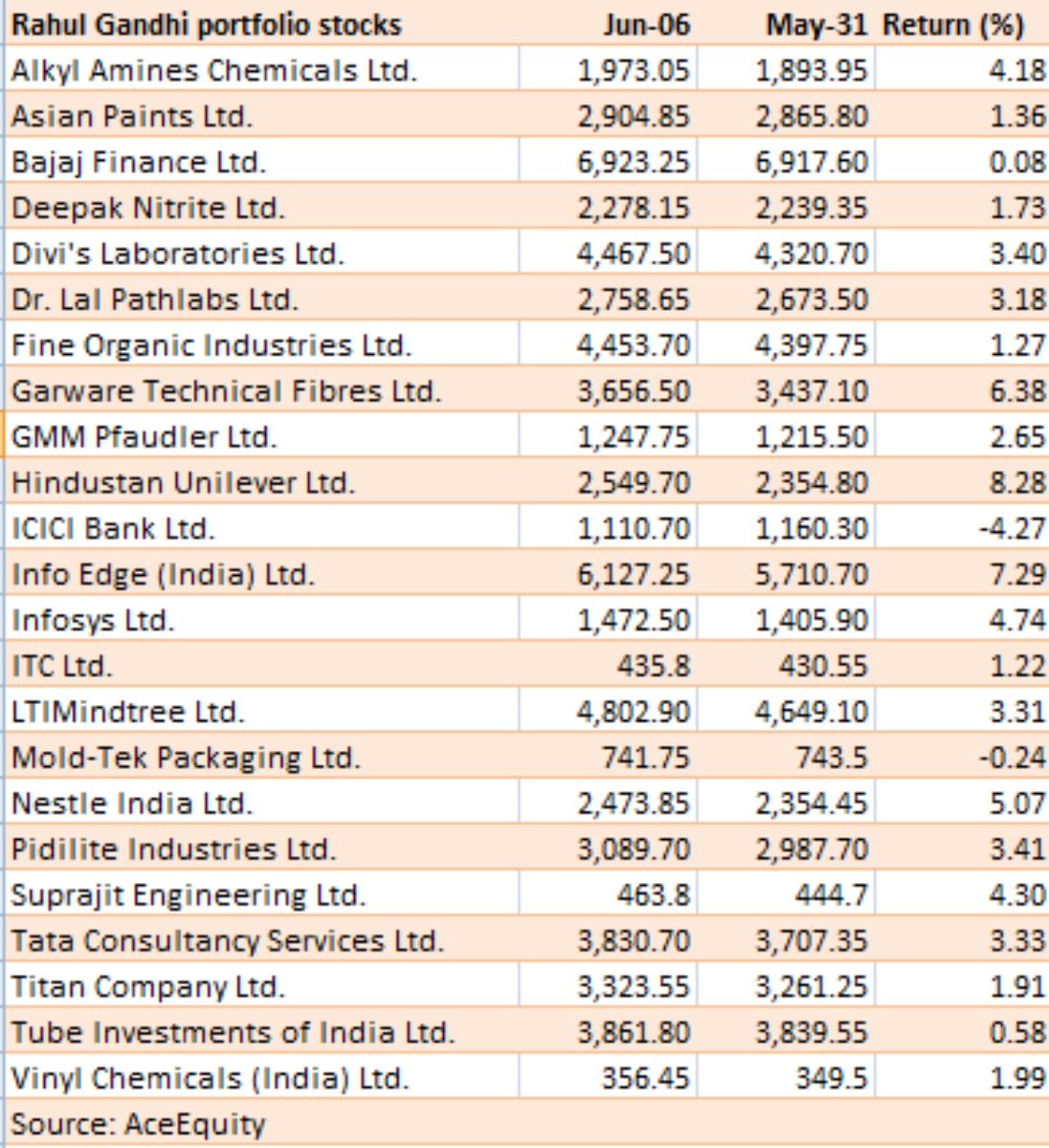

Upon close examination of Rahul Gandhi's stock portfolio, which he claimed to be the biggest stock market scam on June 3rd, it reveals he too has notable investments in several shares. According to his electoral affidavit, his portfolio includes shares ranging from Asian Paints to Pidilite. On the day of the Lok Sabha election results, the Indian markets suffered significantly, impacting Gandhi's portfolio as well. However, by Thursday, June 6th, the market value of his shares had fully recovered, whereas just two days earlier, the Indian share market had faced an excess of 30 lakh crore rupees in market cap loss.

Key Shares in Rahul Gandhi's Portfolio

Rahul Gandhi's noteworthy holdings in his portfolio include stocks of Infosys, LTIMindtree, TCS, ITC, Hindustan Unilever, Nestle India, Asian Paints, and Pidilite Industries. Market veterans consider his stock picks as defensive sector large-cap index stocks, which yield good long-term returns.

Rahul Gandhi Earns ₹13.9 lakhs on June 5th

According to Business Today's calculations, assuming no changes in Gandhi's shareholding pattern from his Lok Sabha affidavit disclosures, his portfolio saw an increase of ₹3.45 lakhs in market value on Monday, June 3rd. Yet, on the next day of the actual election results, there was a decline of ₹4.08 lakhs. Nonetheless, the market improved every ensuing day. The consistent market upswing resulted in a significant increase in Gandhi's portfolio, with profits of ₹13.9 lakhs on June 5th and an additional ₹1.78 lakhs the following day.

Source: aajtak

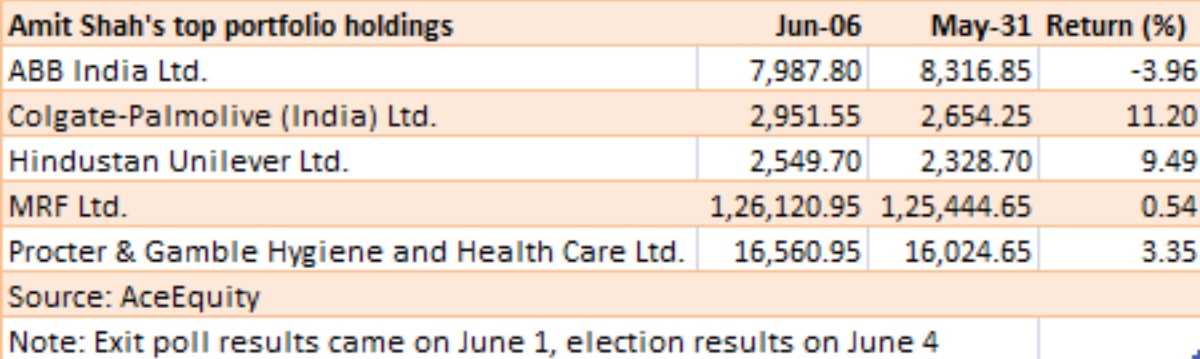

Amit Shah Also Invests in the Stock Market

Amit Shah's stock portfolio comprises over 180 stocks, valued at ₹17.43 crores in March. His top holdings included Hindustan Unilever, MRF, Colgate-Palmolive (India), Procter & Gamble Hygiene and Health Care, and ABB India, among others like Berger Paints, UCO Bank, Tata Power, Vedanta, GAIL, and Anant Raj. Post-exit poll, HUL saw an increase of 1.15%, a spike of 5.96% on the election day, and 4.26% by Thursday. Shah's top holdings experienced fluctuations as the market encountered erratic movements following the election results.

Source: aajtak