The New Labour Code is specifically designed with retirement in mind. While it might initially throw off some household budgets due to lower take-home salaries, the increased PF contribution sets up a robust safety net for the future. Though initially unwelcoming, the reduction in in-hand salary means tighter management of expenses like children's fees, rent, and EMIs might be necessary. Yet, this initial sacrifice ensures a well-padded future. The shifting dynamics in salary and PF contributions introduced by the New Labour Codes are monumental. While immediate salary might take a hit, preparations for a comfortable retirement are robust. Let's delve into how this unfolds.

The

decrease in salary and increased PF contributions

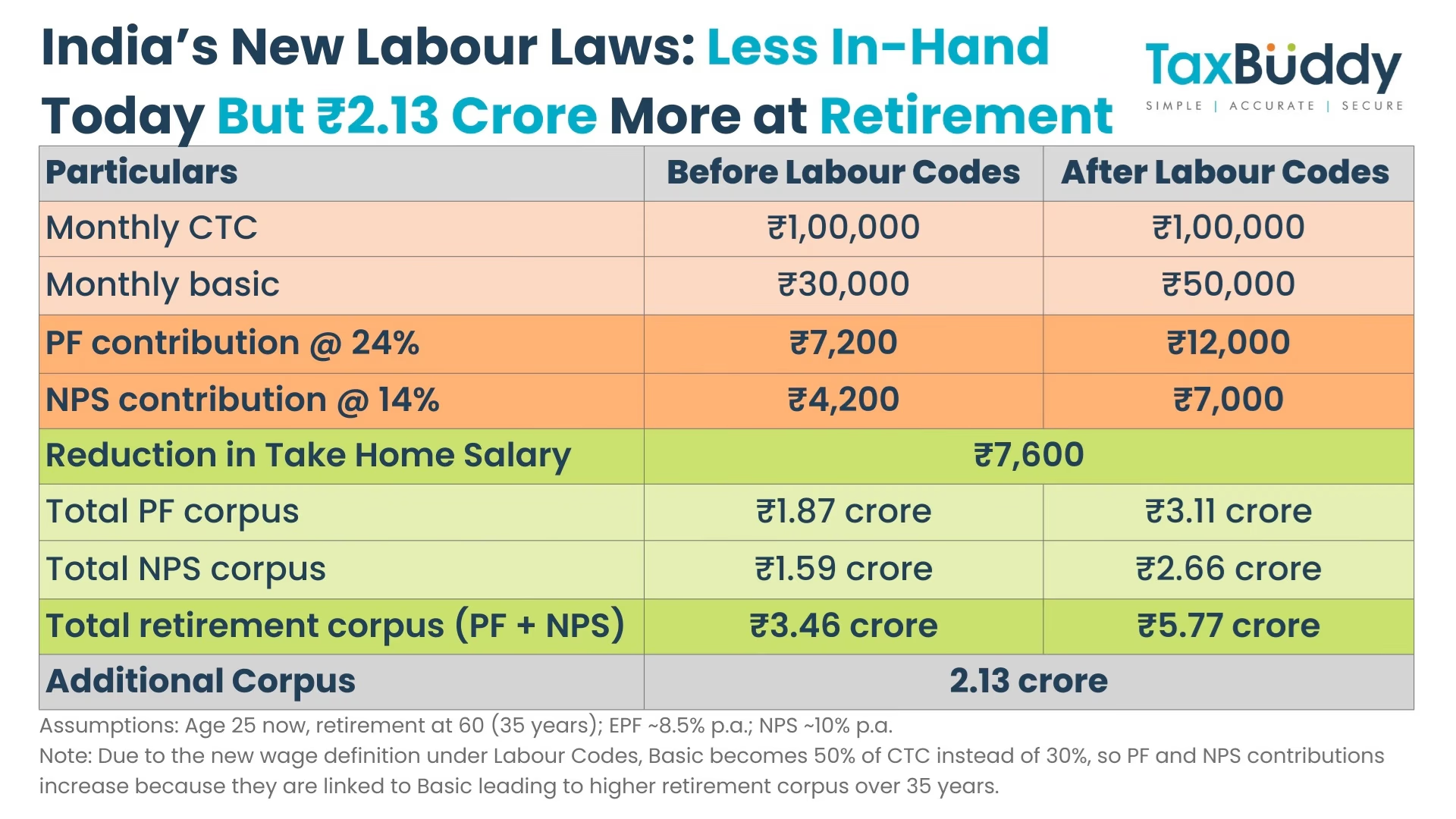

are pivotal shifts. Currently, most companies define their CTC with the basic salary pegged typically around 30-35%, resulting in lower PF contributions and, subsequently, reduced benefits linked to gratuity and NPS.

Under the revamped Labour Codes, the salary definition emphasizes that basic + DA should constitute at least 50% of the total salary. This brings down your take-home pay but significantly boosts PF, Gratuity and potentially NPS contributions.

To put this in perspective: a 30-year-old employee with a 12 lakh INR CTC had a basic salary of around 35%. Now, the basic amounting closer to 50% will see PF contributions (employee + employer) increase from about 7,200 INR monthly to 12,000 INR, adding savings of approximately 4,800 INR monthly. This spike in basic salary not only raises PF contribution but also enhances NPS and Gratuity accumulated.

The

changing salary structure has tangible benefits

. Under this new code, an employee stands to gain significant returns over 35 years. Compared to the former code, the New Labour Code could potentially boost your PF by 12.4 million INR and NPS by 10.7 million INR. Ultimately, the corpus at retirement grows substantially, from about 34.6 million INR to 57.7 million INR, marking a significant increase of approximately 23.1 million INR.

This transformation in salary structure for employees earning around 1 lakh INR monthly translates to an expanded retirement fund after 30 years by about 23.1 million INR, forming a substantial nest egg. If you're between 25 and 30 years old, earning 1 lakh INR a month under these codes, retirement could see a fund of approximately 57.7 million INR, compared to 34.6 million INR with the old code.

Source: aajtak

The

declaration of increased basic

is crucial. New labour laws mandate that the basic salary be at least 50% of the CTC. Consequently, required contributions to PF and NPS have increased significantly. Consider an employee whose monthly CTC is 100,000 INR; previously, their basic was 30,000 INR, which has now been raised to 50,000 INR due to the new laws. This increased basic means PF contributions rise from 7,200 INR to 12,000 INR, and NPS contributions from 4,200 INR to 7,000 INR.

While this results in a monthly reduction of about 7,600 INR in salary, leading to initial discomfort, the long-term benefits are substantial. Over 35 years, an employee's PF corpus can climb from 18.7 million INR to 31.1 million INR, and their NPS corpus from 15.9 million INR to 26.6 million INR. Overall, the retirement corpus can grow from 34.6 million INR to 57.7 million INR. However, the employer contribution facet of NPS might not be available in all companies.