The dawn of June (June 2024) brings with it a slew of substantial modifications (Rule Change From 1st June), directly affecting household budgets and wallets. These range from alterations in LPG cylinder pricing (LPG Cylinder Price) to amended credit card regulations (Credit Card Rule). Let's delve into these 5 pivotal transformations poised to reshape economic landscapes...

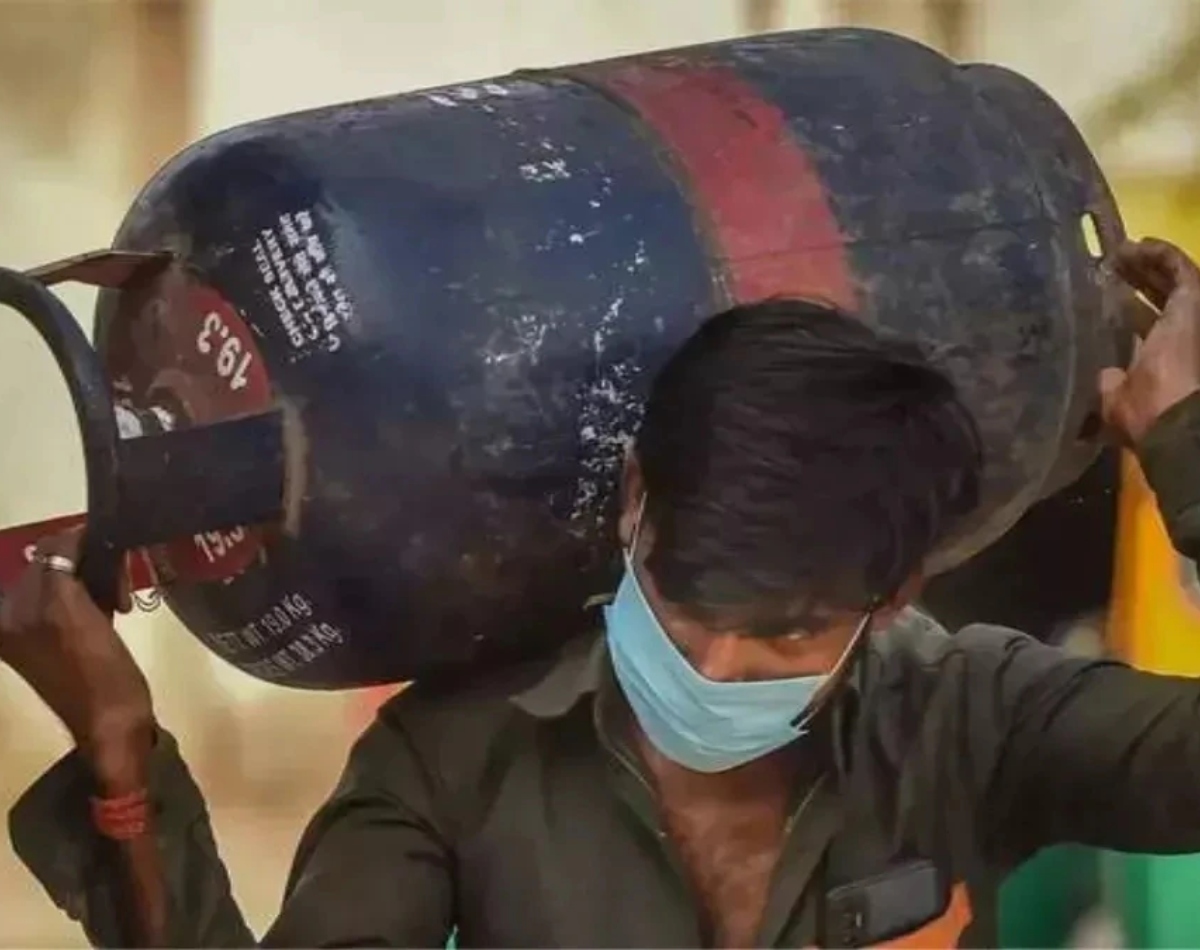

First Change: Drop in LPG Prices

With the start of the month, oil marketing companies have adjusted the prices of LPG cylinders (LPG Cylinder Price), with updated costs released at 6 a.m. on June 1, 2024. According to IOCL's website, there has been a reduction in LPG prices for the third consecutive month. The cost of a 19 kg commercial gas cylinder has been slashed by up to 72 rupees (Commercial LPG Cylinder Price Cut), yet once more, the 14 kg domestic gas cylinder price remains static.

Source: aajtak

In the wake of the final phase of Lok Sabha elections, oil marketing companies have proffered a significant gift to LPG consumers early this morning. Following recent changes, the price of a 19 kg commercial gas cylinder has dropped by 69.50 rupees in Delhi, 72 rupees in Kolkata, 69.50 rupees in Mumbai, and 70.50 rupees in Chennai effective June 1. As per IOCL's website, the new rates across these major cities are as follows...

Second Change: Reduction in ATF Rates

Coinciding with decisions to reduce commercial LPG cylinder prices, the oil marketing firms have also cut Aviation Turbine Fuel (ATF) prices which may impact air travel costs. IOCL reports a significant price reduction in Delhi's ATF rates from 1,01,643.88 rupees per kilolitre to 94,969.01 rupees per kilolitre. Additionally, reductions are seen in Kolkata (from 1,10,583.13 to 1,03,715 rupees per kilolitre), Mumbai (from 95,173.70 to 88,834.27 rupees per kilolitre), and Chennai (from 1,09,898.61 to 98,557.14 rupees per kilolitre).

Source: aajtak

Third Change: SBI Credit Card Policies

An important alteration taking effect on June 1 relates to credit card users. India's largest public sector bank, SBI, has implemented changes to its credit card regulations. For cardholders, it's pertinent to note that certain SBI credit cards will no longer earn reward points on governmental transactions.

This encompasses SBI's AURUM, SBI Card ELITE, SBI Card ELITE Advantage, SBI Card Pulse, SimplyCLICK SBI Card, SimplyCLICK Advantage SBI Card, SBI Card PRIME, among others.

Source: aajtak

Fourth Change: Driving License Test

Commencing this June, a major alteration concerns the issuance of driving licenses. New provisions allow private institutes (driving schools) to administer driving tests, previously exclusive to government centers managed by RTOs. However, only those institutes accredited by the RTO are eligible. Moreover, should a minor under 18 be caught driving, they'll incur a hefty fine of 25,000 rupees, and a license will be withheld for up to 25 years.

Fifth Change: Free Aadhaar Card Updates

Although the fifth change will come into effect on June 14, it's notable. The UIDAI (Unique Identification Authority of India) extended the deadline for free Aadhaar card updates to June 14, with no further extensions anticipated. Aadhaar card holders are advised to utilize this opportunity promptly, as subsequent updates at Aadhaar centers will cost 50 rupees per change.