Saturday, July 19, 1969...

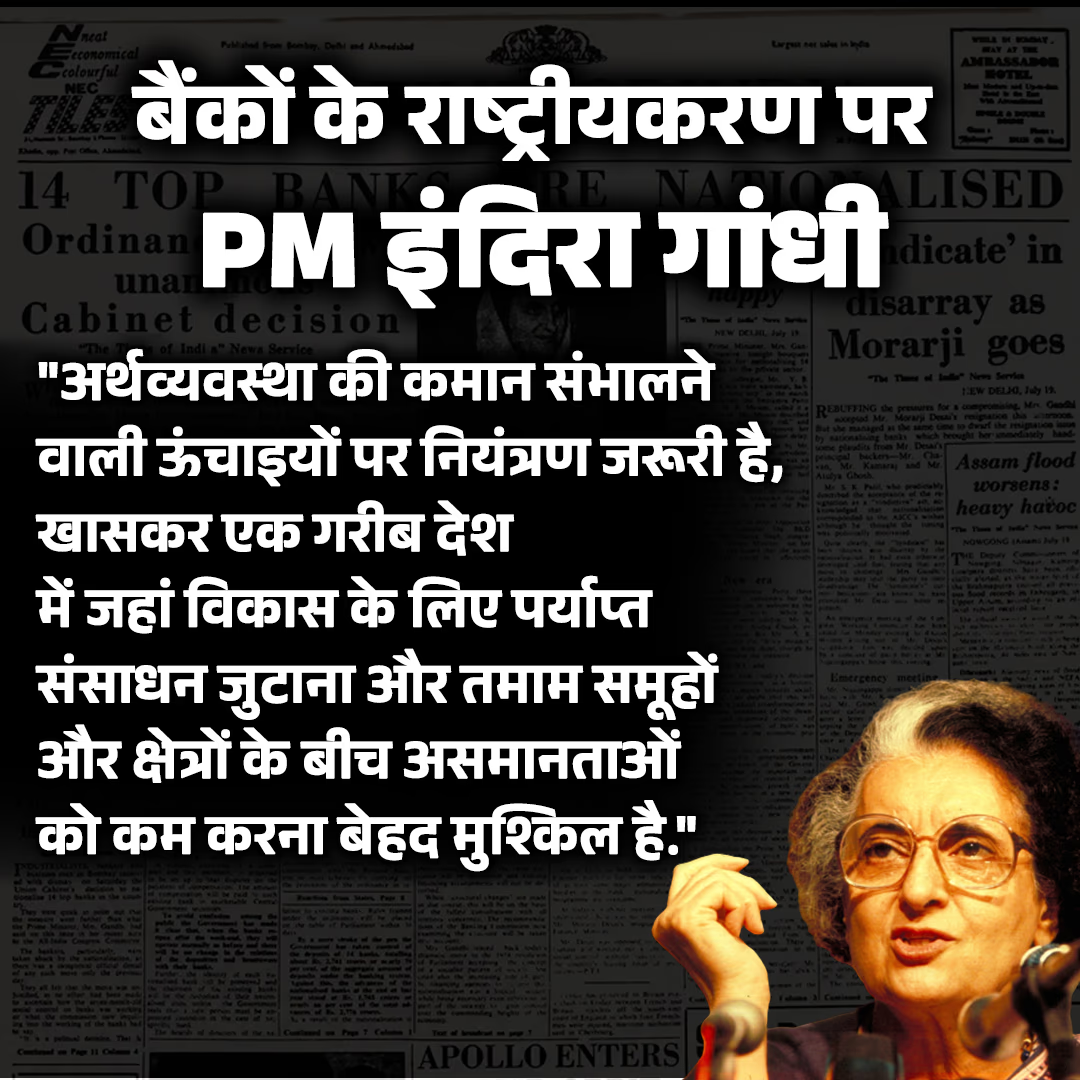

Exactly 55 years ago, India witnessed a major shakeup in its financial sector. Indira Gandhi’s government, without any prior warning or consultation with the Planning Commission, rolled out the 'Banking Companies (Acquisition and Transfer of Undertakings) Ordinance, 1969.' This move nationalized the country's 14 largest commercial banks, thereby taking control of 70% of the national deposit pool. This decisive action left the nation in awe and was considered the most significant economic policy decision since independence in 1947.

Source: aajtak

Following the nationalization, it was said, "Politics has outmaneuvered economics." It was a time when Morarji Desai served as the nation's Finance Minister. When he discussed the nationalization with Indira Gandhi, he dismissed her proposal. Three days before the ordinance, Indira Gandhi discharged Desai and, on July 16, 1969, assumed control of the Finance Ministry herself.

Source: aajtak

Morarji Desai, a fierce critic of nationalization, prioritized 'social control' over banks. Reflecting on his dismissal, Desai later lamented to Indira, "You treated me in a way that one would not treat even a clerk."

Source: aajtak

PM Indira Gandhi asserted the necessity to control the heights of the economy, especially in a poor country where collecting adequate resources for development and reducing disparities among various groups and regions was challenging.

In July 1969, her government nationalized banks like Allahabad Bank, Canara Bank, United Bank of India, UCO Bank, Syndicate Bank, Indian Overseas Bank, Bank of Baroda, Punjab National Bank, Bank of India, Bank of Maharashtra, Central Bank of India, Indian Bank, Dena Bank, and Union Bank of India.

Source: aajtak

The nationalization era arrived as Asia was leaning towards market-oriented policies; however, India embraced socialist strategies. Now, debates on bank privatization spark questions about the legacy and validity of Gandhi's nationalization policy. But let's first look back at the historical decisions regarding banks post-independence.

In 1955, the Imperial Bank of India was nationalized, transforming into the State Bank of India, with a broad mandate, especially in rural and semi-urban regions.

The State Bank of India was later entrusted with the role of RBI's principal agent and took over banking transactions for Union and State Governments nationwide.

On July 19, 1969, the massive nationalization of banks occurred.

The 1980 Indian Banking Sector Reform targeted 6 more banks: Vijaya Bank Limited, Punjab & Sind Bank Limited, Oriental Bank of Commerce Limited, New Bank of India Limited, Corporation Bank Limited, and Andhra Bank Limited.

Source: aajtak

After the second wave of nationalization, approximately 80% of the Indian banking sector came under government ownership.

Indira Gandhi, a proponent of aggressive socialism, paralleled her governance style with the Soviet centralization model. The prime driver behind her nationalization approach was to make banking finances available to marginalized sectors, specifically agriculture, because farmers' issues were significant at the time.

In late September 1969, addressing a meeting with the owners of 14 banks, PM Gandhi asserted that banks, closely linked to the economy, cannot remain unaffected by political dynamics. India's current political scene demanded a heightened expansion of banking facilities into backward regions, agriculture, small industries, etc. She assured the bank owners that they would have the liberty and margin necessary to operate as competent and professional bankers under the set policy framework.

To gain further insights, let us delve into the profound impacts and unravel whether nationalization was a sound strategy or a significant misstep.