The American short seller firm, Hindenburg, made headlines in early 2023 for its explosive revelations about Indian billionaire Gautam Adani, who quickly fell from being one of the world's top 3 billionaires to outside the top 30. Roughly 18 months later, Hindenburg is back in the spotlight for targeting India's market regulator SEBI and its chief Madhabi Puri Buch, alleging connections between Buch, her husband, and the Adani Group. Let's delve into how the Hindenburg Report is prepared and the origins of this notorious short seller firm.

How Did Hindenburg Target SEBI?

The recent Hindenburg report, released on Saturday evening, takes aim at SEBI Chairperson Madhabi Puri Buch and her husband Dhaval Buch. The American short seller firm claims they have stakes in funds based in tax havens Bermuda and Mauritius, used by Gautam Adani's elder brother Vinod Adani. However, on Sunday, SEBI Chairperson issued a statement denying these allegations, stating, "There is no truth in these allegations. Our life and finances are an open book."

Source: aajtak

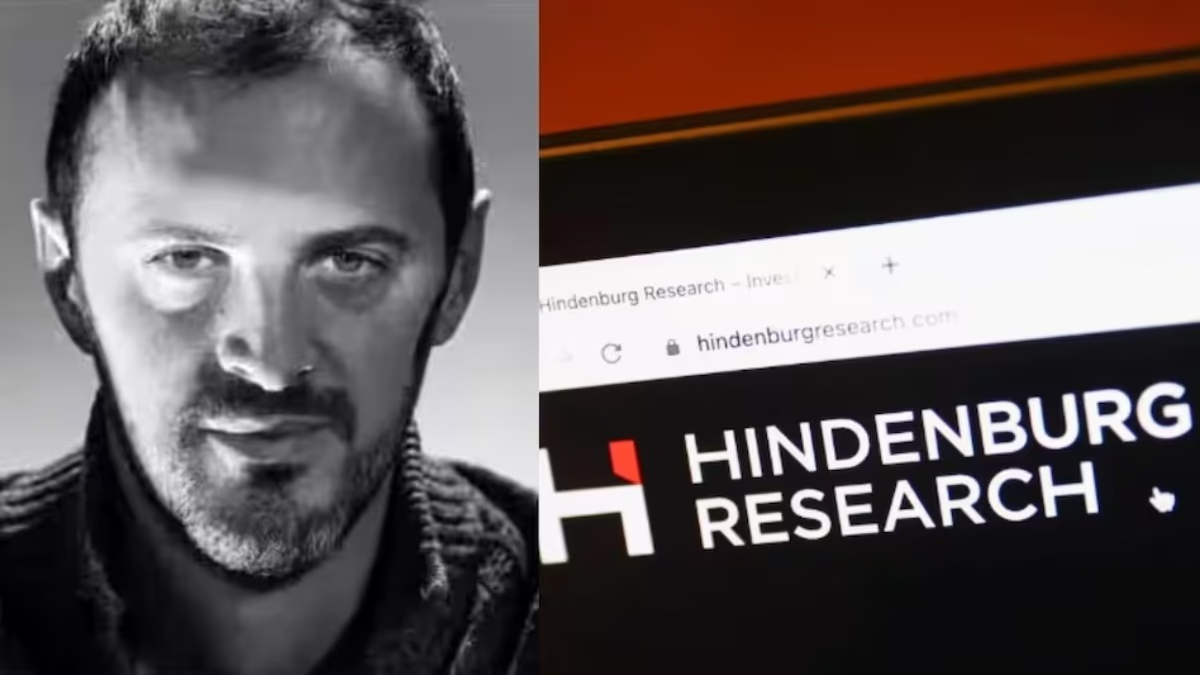

Nathan Anderson's Company: Hindenburg Research

Nathan Anderson, a graduate in International Business from the University of Connecticut, started his career in a data research company focusing on investment data. Through this experience, he gained profound insights into data and the stock market, realizing it was a major hub for the wealthy.

Gaining Insights and Starting His Own Company

While working, Nathan understood that many activities in the stock market are beyond the grasp of average people. This realization sparked the idea of starting his research company to uncover corporate malfeasance and profit from shorting their stocks. In 2017, he left his job and founded Hindenburg, naming it after the 1937 Hindenburg Airship disaster in Manchester Township, New Jersey.

Source: aajtak

Hindenburg's Research Endeavors

Nathan Anderson's firm focuses on in-depth research into the stock market, equities, credit, and derivatives. Their goal is to uncover financial mismanagement, improper accounting practices, or unethical stock trading activities conducted by major corporations. Following exhaustive research, they publish comprehensive reports to shed light on these issues.

How Nathan Anderson Profits

So, how does Hindenburg make substantial profits? Nathan Anderson's company is both an investment firm and an activist short seller, earning billions through these roles. Short selling is a trading or investment strategy where a person buys stocks or securities and sells them when prices rise, reaping significant profits.

The Mechanics of Short Selling

To illustrate, if a short seller buys a company's stock with the expectation that its price will drop from ₹200 to ₹100, they borrow the stock from other brokers and sell it to willing buyers at ₹200. When the stock price drops to ₹100 as expected, the short seller buys it back from the market and returns it to the broker, making a profit of ₹100 per share. Hindenburg uses this strategy to profit by shorting companies.