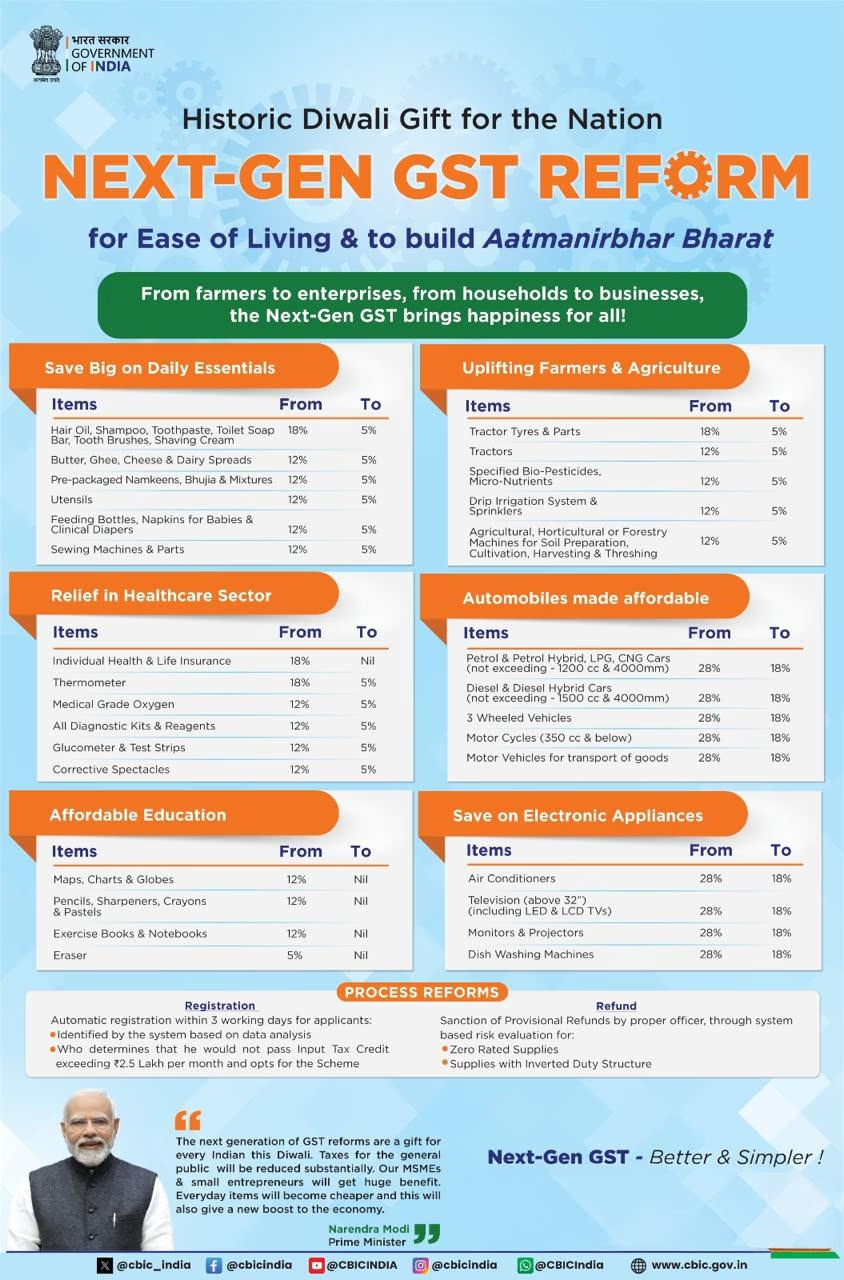

As Diwali approaches, the central government has announced GST reforms to make everyday essentials more affordable. Now, GST on hair oil, shampoo, toothpaste, toilet soap, toothbrush, and shaving cream is reduced from 18% to 5%. Similarly, taxes on butter, ghee, cheese, dairy spreads, packed snacks like bhujia, utensils, baby feeding bottles, clinical diapers, and sewing machines have also been decreased from 12% to 5%.

The Finance Minister mentioned that every state's finance minister extended full support to these GST simplifications. Nirmala Sitharaman shared that PM Modi has been advocating for reduced GST rates for the past eight months.

The Finance Minister announced the GST Council's approval for rationalizing GST rates by removing the 12% and 28% tax slabs.

GST on hair oil, shampoo, toothpaste, toilet soap, toothbrush, and shaving cream is now 5%, reduced from 18%. Similarly, butter, ghee, cheese, and dairy spreads will attract just 5% tax. Packed snacks like bhujia, utensils, baby feeding bottles, and sewing machines also see tax reduced to 5%.

Source: aajtak

Agriculture receives relief with GST on tractor tires and parts, tractors, bio-pesticides, micronutrients, drip irrigation systems, and sprinklers reduced to 5%.

In the health sector, taxes on health and life insurance are entirely eliminated. Taxes on thermometers, medical oxygen, diagnostic kits, glucometers, test strips, and spectacles have been reduced to 5%. Now, 33 life-saving drugs will not attract any tax, previously subject to 12%.

Items related to education are exempted from GST. Maps, charts, pencils, sharpeners, crayons, notebooks, and erasers now have zero tax.

There is also significant relief in electronics. GST on air conditioners, TVs larger than 32 inches (both LED and LCD), monitors, projectors, and dishwashing machines is reduced from 28% to 18%.

Vehicle taxes are lowered, with GST on petrol, diesel, and CNG hybrid cars, three-wheelers, motorcycles up to 350 cc, and freight vehicles reducing from 28% to 18%.

Exclusions like pan masala, cigarettes, gutkha, and beedis will see

implementation from September 22, 2025.

The central government has revised GST rates applying a 40% tax on specific items, including super luxury goods, pan masala, cigarettes, gutkha, chewing tobacco, zarda, sugary carbonated drinks, and personal aircraft.

The central government clarified that products under the 40% GST slab will not have any additional cess. This includes super luxury goods, pan masala, cigarettes, gutkha, chewing tobacco, zarda, sugary carbonated drinks, and personal aircraft.

Prime Minister Narendra Modi tweeted about the GST reforms, stating that the next-generation reforms mentioned in the Independence Day speech are now a reality. He elaborated that the government's comprehensive proposal to reduce GST rates aims to simplify life for citizens and strengthen the economy.

Prime Minister Modi wrote, 'I'm delighted that the GST Council, inclusive of both center and states, collectively approved the government's proposals. The proposed GST cuts and improvements benefit the general public, farmers, MSMEs, the middle class, women, and youth.'

He further stated that the reforms will enhance citizens' lives and significantly ease business operations, especially for small traders and entrepreneurs.