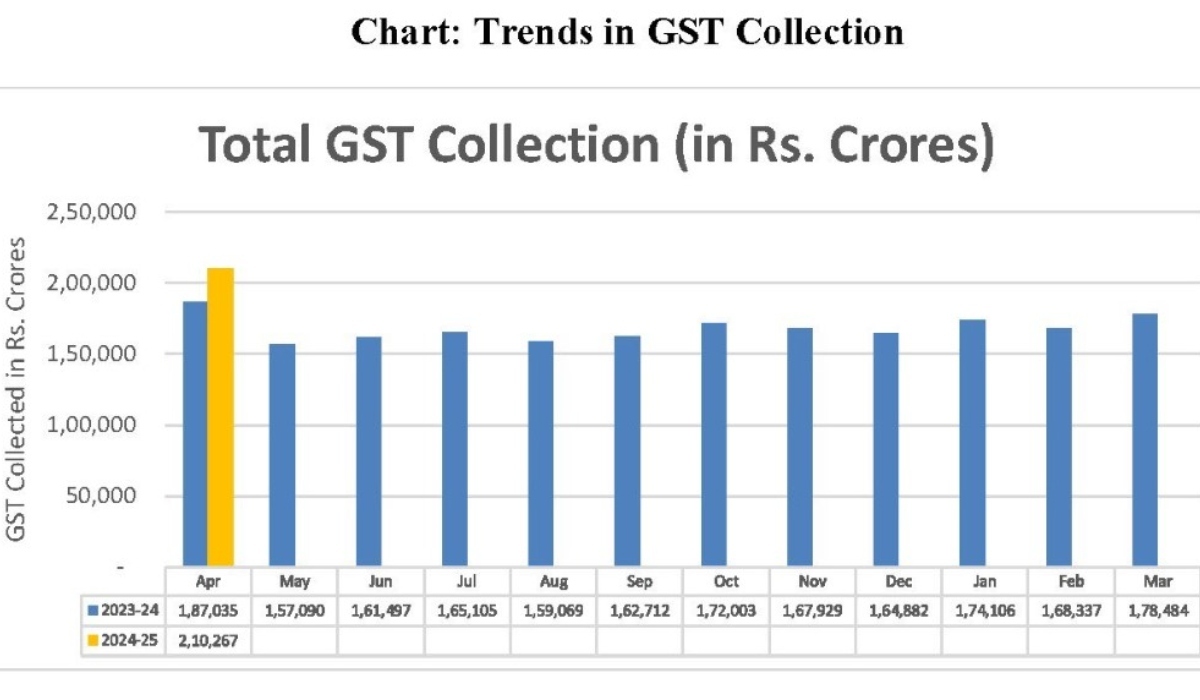

Amidst the 2024 Loksabha elections, Prime Minister Narendra Modi's government received exhilarating financial news. The GST Collection for April 2024 has been released, shattering records and reaching a new pinnacle. For the first time since its inception, GST collections have surpassed the 2 trillion rupee mark. As per government data, the GST Collection for April stood at an all-time high of 2.10 trillion rupees.

For the First Time, Collections Cross the 2 Trillion Rupee Mark

The historic GST Collection this April not only surpassed the 2 trillion rupees for the first time but also witnessed an impressive year-on-year increment of 12.4 percent in gross revenue. Additionally, the net revenue (post-refunds) stood at 1.92 trillion rupees, with a year-over-year increase of 17.1 percent. The total GST Collection for April 2024 includes Central GST (CGST) at 43,846 crores rupees, State GST (SGST) at 53,538 crores rupees, Integrated GST (IGST) at 99,623 crores rupees, and cess at 13,260 crores rupees.

Previous Record Set in April 2023

Prior to this record-breaking GST collection in April, the government's coffers were already filling up in March 2024, registering a collection of 1.78 trillion rupees. The highest GST Collection until then had been recorded in April 2023, when the government treasury received 1.87 trillion rupees.

According to government data, the total gross GST collection for the financial year 2023-24 was 20.18 trillion rupees, which is 0.18 trillion more than the previous fiscal year 2022-23 where the collection was 20 trillion rupees.

Source: aajtak

India's Biggest Tax Reform, GST, Launched in 2017

Worth noting is that GST was implemented on 1st July 2017 and is considered the most significant tax reform in India since independence. It eliminated several complications within the indirect tax regime, replacing 17 different taxes including VAT, excise duty on various items, and service tax. To promote small businesses, the government exempted businesses with an annual turnover of up to 40 lakh rupees from the GST regime. The introduction of GST was heralded for not only benefitting the central but also state governments in terms of revenue generation.

It is to be mentioned that the GST concept was first introduced in the year 2000, and a committee was formed to craft a unique model for our country. It took 17 long years after expert recommendations and political consensus on a suitable draft of the GST bill. Eventually, both houses of the parliament passed it by 2016, and following the approval and ratification by state governments, the GST Act of 2017 came into existence.