Struggling with an already fragile economy, Bangladesh might be heading towards another predicament. The country's dues to Adani Power are mounting, as it sources the majority of its electricity from this energy giant.

Adani Power Jharkhand Limited (APJL) supplies this critical resource, channeling power from its plant in Godda. Around 30% of Bangladesh's electricity needs are met by APJL.

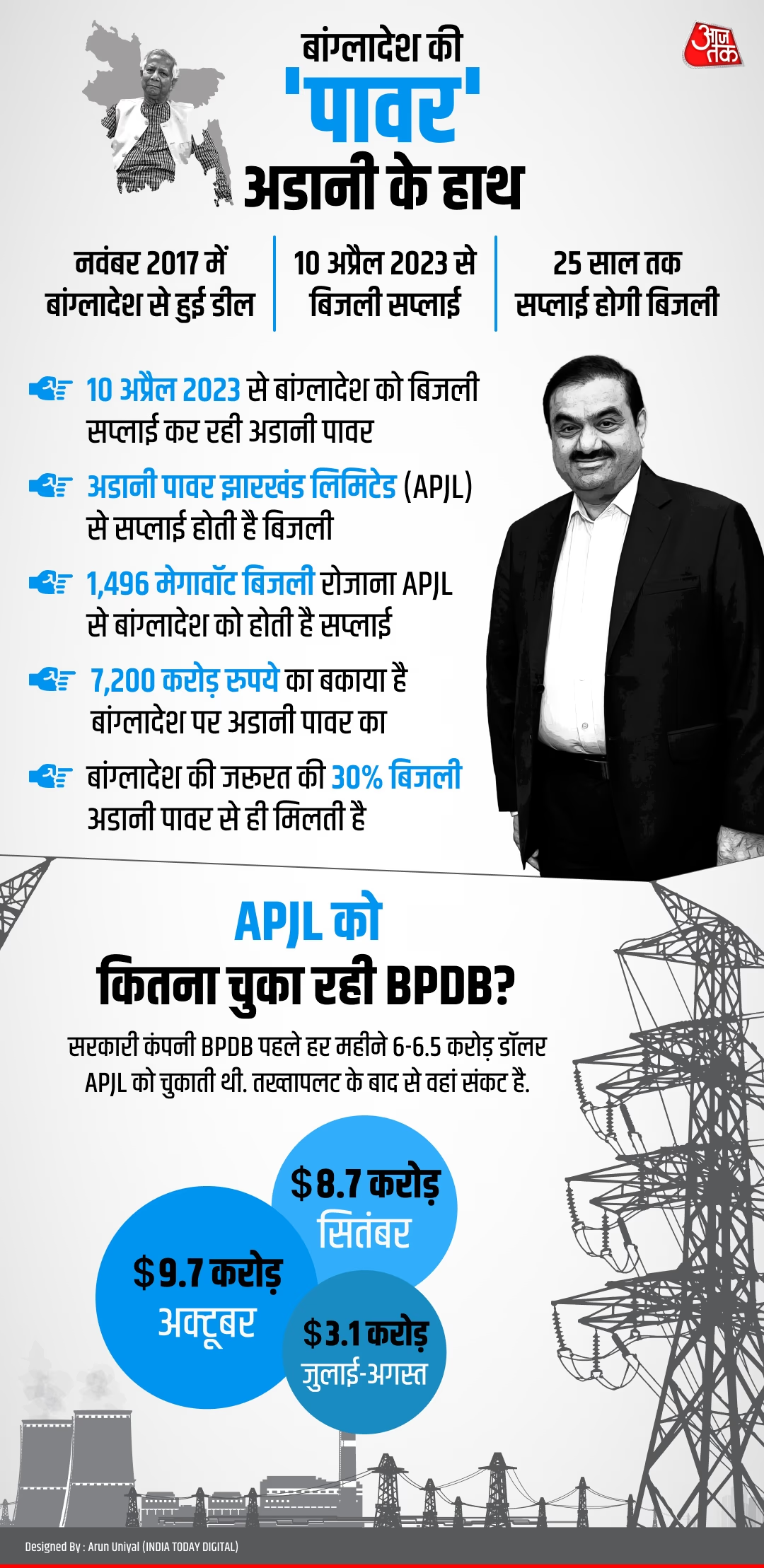

The Bangladesh Power Development Board (BPDB) owes APJL a staggering $850 million (approximately 7,200 crore rupees). Reports suggest that Adani Group has given a deadline until November 7 to clear these dues. Should this not happen, Adani Power could significantly disrupt Bangladesh's electricity supply.

If Adani Power halts supply, a looming energy crisis could severely impact Bangladesh's already faltering economy.

Adani Power and Bangladesh

The relationship between Adani Power and the government of Bangladesh was formalized in a November 2017 deal. Since April 10, 2023, APJL began supplying electricity to Bangladesh. Under the agreement, Adani Power will provide electricity to Bangladesh for the next 25 years.

Daily, from the Godda plant, 1,496 megawatts of power are supplied. Electricity is priced between 10 to 12 taka per unit for Bangladesh.

Aside from Adani Power, Bangladesh hosts three other major plants contributing to its power supply. There is a plant in Patuakhali district's Pyara, producing 1,244 megawatts daily, another in Khulna division's Rampal, supplying 1,234 megawatts daily, and a third in Chittagong's Banskhali, generating 1,224 megawatts each day.

The Pyara plant was built with Chinese assistance, while the Rampal plant is a joint venture between Bangladesh and India. The Banskhali plant is under the ownership of Bangladesh's giant conglomerate, S. Alam Group.

Source: aajtak

Promises Turned Sour?

The rising dues to Adani Power resulted from reduced payments. Under Sheikh Hasina's government, monthly payments were between $60 to $65 million. However, under Mohammad Yunus's tenure, this decreased.

Local reports state that Bangladesh paid Adani Power $31 million in July and August, with $87 million in September and $97 million in October.

When dues surged, Adani Power demanded payment by October's end. Under pressure, Bangladesh offered a letter of credit for $170 million (approximately 1,500 crore rupees). Adani Power agreed but rejected Bangladesh’s decision to source the letter from an agricultural bank, preferring a commercial bank.

Why Can't Bangladesh Pay?

Bangladesh has long been grappling with economic challenges. Its foreign reserves are dwindling, recorded at over $25,823 million in June, reduced to $24,863 million by September.

Experts suggest Bangladesh's economy can't sustain large payments to Adani Power at present. The government also hesitates to take financial risks of substantial payouts.

Upon assuming power, Mohammad Yunus opted to review the deal with Adani Power, citing high electricity costs.

What Lies Ahead?

Adani Power has reportedly issued an ultimatum until November 7. If unresolved, power supply might be suspended, with dire economic consequences for Bangladesh.

Due to a lack of coal, power production has already dropped at Bangladesh’s Rampal and Banskhali plants. Should Adani Power also cut supply, the situation could worsen into a blackout. Supply from India, Indonesia, Australia, and South Africa is already due.

A deepening crisis could heavily impact Bangladesh's garment industry, a vital economic sector contributing over 12% to GDP. Subsequently, exports would suffer, further draining foreign reserves.

Notably, any power supply halt would affect Adani Power as well, as the Godda plant exclusively services Bangladesh.