The Indian Rupee continues to hit new lows, setting fresh records every day. On Monday, not only did the stock market plummet significantly, but the Rupee also reached a record low. After a dismal start, the Indian Rupee closed at 87.17 against the dollar, plummeting by 55 paise. Let's understand the governmental measures that can stabilize this freefall.

'Rupee's Sudden Drop'

Monday witnessed a dramatic opening as the Rupee plunged to unprecedented levels in the currency market. After closing at 86.61 last Friday, it crossed 87 in mere minutes, dropping by 67 paise to a record low of 87.29 per dollar. By the end of the day's trade, the Indian Currency recovered slightly, closing at an interim 87.17 per dollar.

Source: aajtak

Finance Secretary Assures Stability

As the Rupee dipped to record lows against the dollar, Finance Secretary Tuhin Kanta Pandey emphasized that there’s no need to panic, as RBI is managing this volatility. He stated that the Indian Rupee operates on a 'free float' system based on market forces, devoid of a fixed rate. According to Pandey, the exchange rates face pressure due to foreign fund outflows.

How Can the Government Stabilize the Rupee?

First Measure:

During severe depreciation, attracting foreign investors back to the Indian markets becomes crucial. Constant selling by foreign investors not only impacts the Rupee but also causes upheaval in the stock market.

Second Measure:

The government might strive to reduce import dependence. Less import means more dollar savings and a strengthened Rupee. India imports numerous items, including crude oil, which requires US dollar payments. Reducing imports and boosting exports is vital since increased exports bring more dollars into the country.

Source: aajtak

Third Measure:

The RBI can utilize its foreign exchange reserves to support a weakening Rupee. In such scenarios, the central bank sells dollars to strengthen the Rupee. Statistics indicate that for the week ending January 24, India's foreign exchange reserves increased by $5.574 billion, reaching $629.557 billion.

Why is the Rupee Falling Against the Dollar?

Let's delve into the persistent decline of the Rupee. The primary factor is increased demand for the dollar, which impacts currencies globally. Continuous foreign investor sell-off puts pressure on the Indian Rupee. Moreover, the dollar index, which indicates the dollar's performance against six major currencies, stood at 109.46.

Source: aajtak

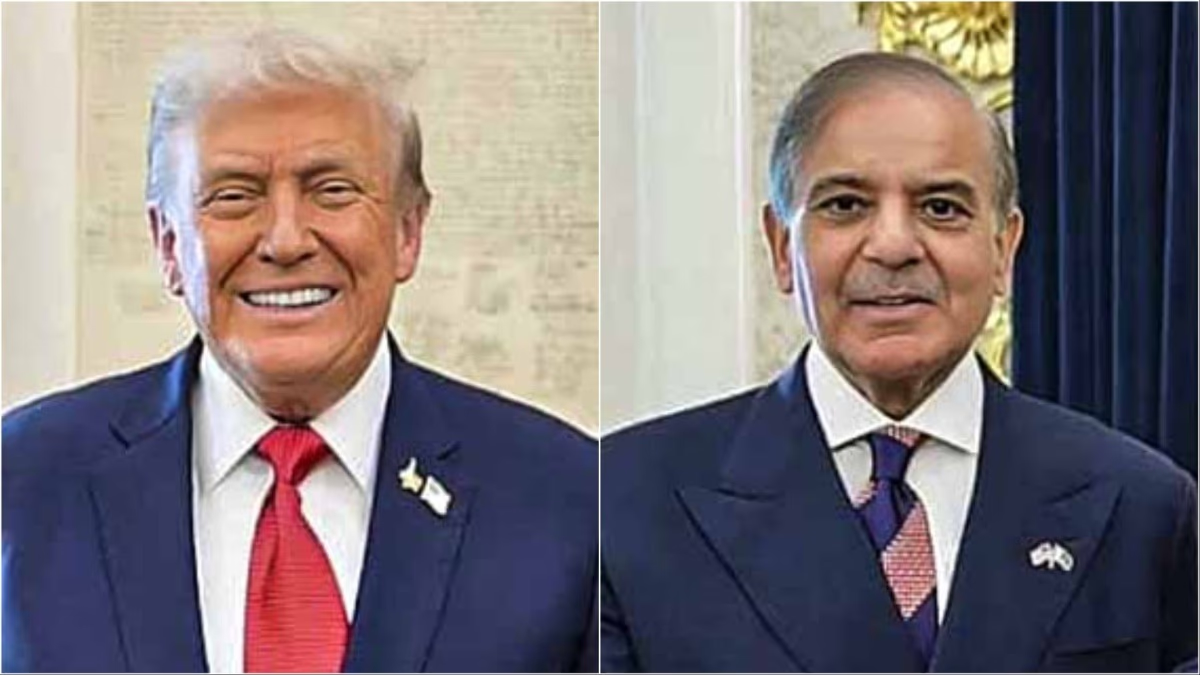

Impact of Trump Tariff?

The Rupee surpassing 87 against the dollar is also attributed to the Trump Tariff implications. Since Donald Trump's inauguration, his tariff policies have sparked concerns globally. Following tariffs on Canada, Mexico, and China, Trump mentioned potential tariffs on the European Union (EU). In retaliation, Canada decided on a 25% tariff on $155 billion of US imports. The tariff war's effects are evident on global stock and currency markets.

Rupee's Decline and Inflation Risks

The depreciation of a nation’s currency can lead to several negative effects. The decline of the Indian Rupee makes imports more expensive, implying higher costs for acquiring foreign goods. Consequently, the risk of inflation within the country escalates. For instance, India imports approximately 80% of its crude oil, with payments made in dollars.