The debt mountain surrounding Himachal Pradesh is growing taller. The financial situation is so dire that for the next two months, the Chief Minister, ministers, chief parliamentary secretary, and chairmen of boards and corporations will not draw salary and allowances. Chief Minister Sukhvinder Singh Sukhu announced on Thursday that the state's financial condition is not good, so he and his ministers are foregoing their salary and allowances for two months.

About two and a half years ago, the Congress government came into power in Himachal, and the state has been sinking deeper into debt. The free giveaways distributed by the government are considered responsible for the financial crisis. During the assembly elections two and a half years ago, the Congress made many promises of free schemes. When they formed the government, fulfilling these promises increased the debt further.

According to the Reserve Bank's report, the debt in Himachal was less than Rs 69,000 crore before the Congress came to power in March 2022. But after taking office, by March 2024, the debt increased to over Rs 86,600 crore. By March 2025, the Himachal government’s debt is expected to grow to nearly Rs 95,000 crore.

Expensive Promises?

In the 2022 elections, the Congress made big promises to make a comeback in power. After coming to power, these promises have led to excessive spending. About 40% of Himachal’s budget goes towards salary and pensions. Nearly 20% is used to repay debts and interest.

The Sukhu government gives Rs 1,500 to women each month, which costs Rs 800 crore annually. The old pension scheme has been implemented here, increasing expenses by Rs 1,000 crore. Free electricity costs Rs 18,000 crore annually. These three schemes alone cost the government around Rs 20,000 crore annually.

Himachal suffered another blow when the central government reduced the borrowing limit. Previously, the Himachal government could borrow up to 5% of its GDP. Now, it can only borrow up to 3.5%. This means the state government could borrow Rs 14,500 crore earlier, but now it can only borrow Rs 9,000 crore.

The RBI report indicates that the debt on Himachal has increased by Rs 30,000 crore in five years. Currently, the debt stands at over Rs 86,000 crore. Each person in Himachal is roughly carrying a debt of Rs 1.17 lakh.

Source: aajtak

Will Two Months of Salary Help?

If the Chief Minister, ministers, and parliamentary secretaries do not take their salaries and allowances for two months, it wouldn’t make much of a difference. It’s like a drop in the ocean.

The Chief Minister receives a salary and allowances of Rs 2.5 lakh each month. Over two months, this amounts to Rs 5 lakh. The 10 ministers in the Himachal government also get Rs 2.5 lakh each month. Over two months, their salaries and allowances add up to Rs 50 lakh. Six parliamentary secretaries receive Rs 2.5 lakh each month, and their two-month salary and allowances cost Rs 30 lakh.

So, if the Chief Minister, ministers, and parliamentary secretaries go without salary and allowances for two months, a total of Rs 85 lakh will be saved. However, Himachal’s debt will still be around Rs 95,000 crore by March 2025.

Not Just Himachal, Other States Are Also in Similar Situation

The simple math is, if the income is lower and expenses are higher, debt will be inevitable. Without proper management of income and expenses, situations could become so dire that there would be neither avenues for new income nor the potential to borrow further.

State governments are increasingly accumulating debt. They are spending heavily on subsidies under the guise of free handouts. An RBI report highlights that states’ spending on subsidies has been rising. State governments spent 11.2% on subsidies in total, and this increased to 12.9% in 2021-22.

In June 2022, an RBI report titled 'State Finances: A Risk Analysis' indicated that states are giving away freebies instead of subsidies. Governments are spending where there is no return on investment.

According to the RBI, in 2018-19, all state governments spent Rs 1.87 lakh crore on subsidies. This spending increased to over Rs 3 lakh crore in 2022-23. Similarly, all state governments' total debt was Rs 47.86 lakh crore in March 2019, which rose to over Rs 75 lakh crore by March 2024. By March 2025, this debt is expected to exceed Rs 83 lakh crore.

Source: aajtak

Will the Situation Worsen Further?

The culture of giving freebies is a significant example of how it can bring a government to its knees, and Himachal is a prime example of this. Currently, the Chief Minister, ministers, and parliamentary secretaries have given up their salaries and allowances for two months. The situation might worsen further.

Last year, RBI also warned that unnecessary expenditures could deteriorate states' financial conditions. In its report, the RBI warned that economic dangers loom over Arunachal Pradesh, Bihar, Goa, Himachal, Kerala, Manipur, Meghalaya, Mizoram, Nagaland, Punjab, Rajasthan, and West Bengal.

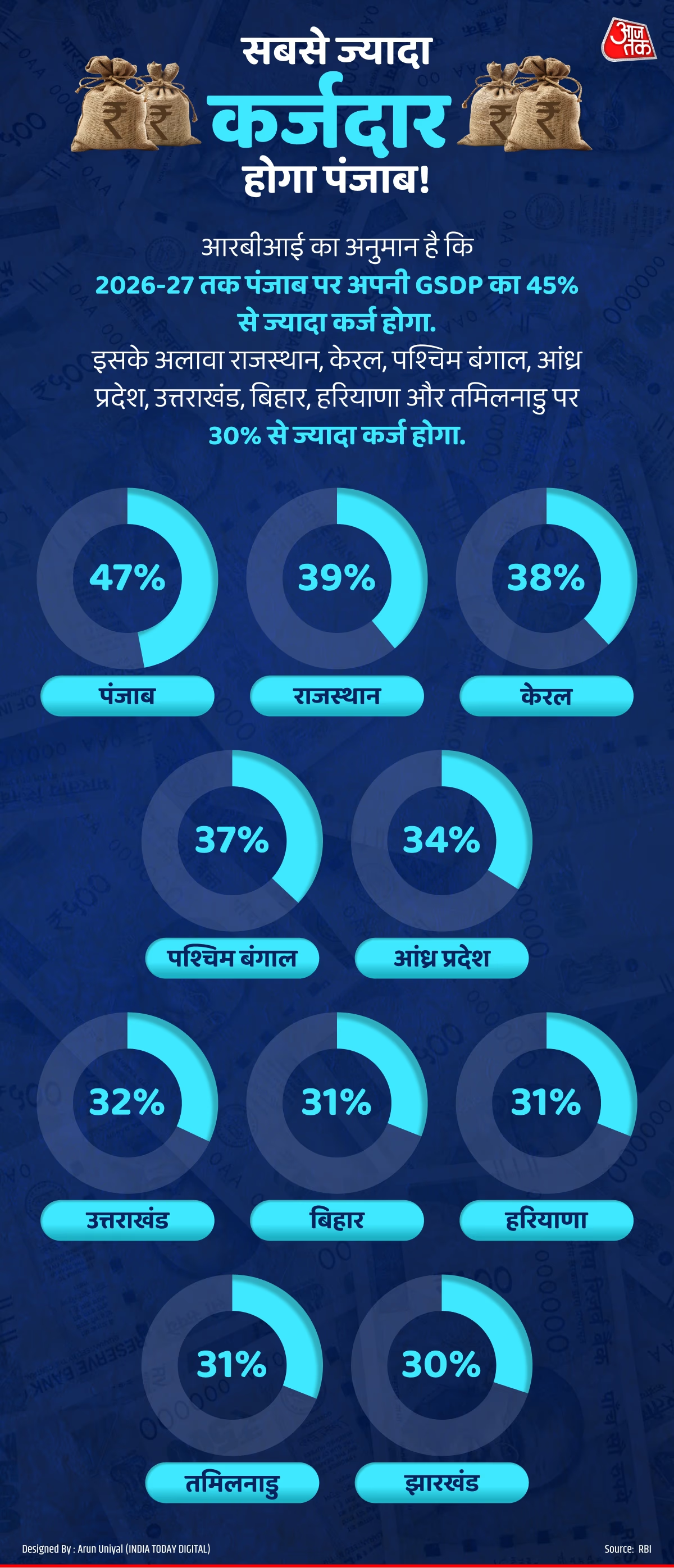

The RBI indicated that some states might have debt exceeding 30% of their State Gross Domestic Product (GSDP) by 2026-27. Punjab’s situation might be the worst, with its debt possibly exceeding 45% of the GSDP by that time. Similarly, Rajasthan, Kerala, and West Bengal might have debt reaching up to 35% of their GSDP.

Higher debts mean the money will not be available for essential areas. Governments may not be able to invest in development projects that could generate future revenue. For example, Punjab spends over 22% of its total expenses on interest payments. Himachal also spends 20% of its total expenses on interest and debt repayments. This reduces capital expenditure.

Source: aajtak

What Are Freebies?

In election-bound states, such 'free giveaways' schemes are common. Critics call them 'freebies' and 'populist measures,' while supporters call them 'welfare schemes.' Critics argue that these schemes burden the government treasury, increase debt, and are implemented only for political gains. Supporters say the purpose is to provide relief to the poor from inflation. Interestingly, a party might criticize such schemes in one state and implement them as welfare measures in another state.

What exactly are freebies? There’s no clear definition. But during a Supreme Court hearing, the Election Commission stated that distributing free medicines, food, or money during natural disasters or pandemics is not considered freebies. However, doing so during normal times can be considered freebies.

The Reserve Bank of India (RBI) had stated that schemes weakening the credit culture, distorting prices due to subsidies, reducing private investment, and lowering labor force participation are freebies.

This raises the question of whether freebies and government welfare schemes are the same or different. Generally, freebies are announced before elections, while welfare schemes can be implemented at any time.

Political parties shower promises to win elections, but this puts a burden on the government treasury. The Supreme Court also stated that the distribution of freebies using taxpayer money could push the government towards bankruptcy.

Source: aajtak

What is the Solution?

To boost state revenues, the 15th Finance Commission, led by N.K. Singh, has advised gradual increases in property taxes, regular hikes in fees for various government services like water, increasing excise duties on liquor, and improving local bodies' accounting practices.

Former RBI Governor D. Subbarao mentioned in an article, ‘Whether it’s a private company or a government, the ideal is to pay off a debt using future revenue. Conversely, spending borrowed money on current consumption without affecting future growth means passing the burden of debt repayment onto our children. There’s no greater sin than that.’

In June 2022, the RBI suggested that state governments need to stabilize their debts, as many states are in precarious situations, using the example of the economic crisis in Sri Lanka.

The RBI suggests that governments should avoid spending on non-essential areas and stabilize their debts. Additionally, there’s a need to rescue power companies from losses. Governments should invest in capital projects that can generate revenue in the future.