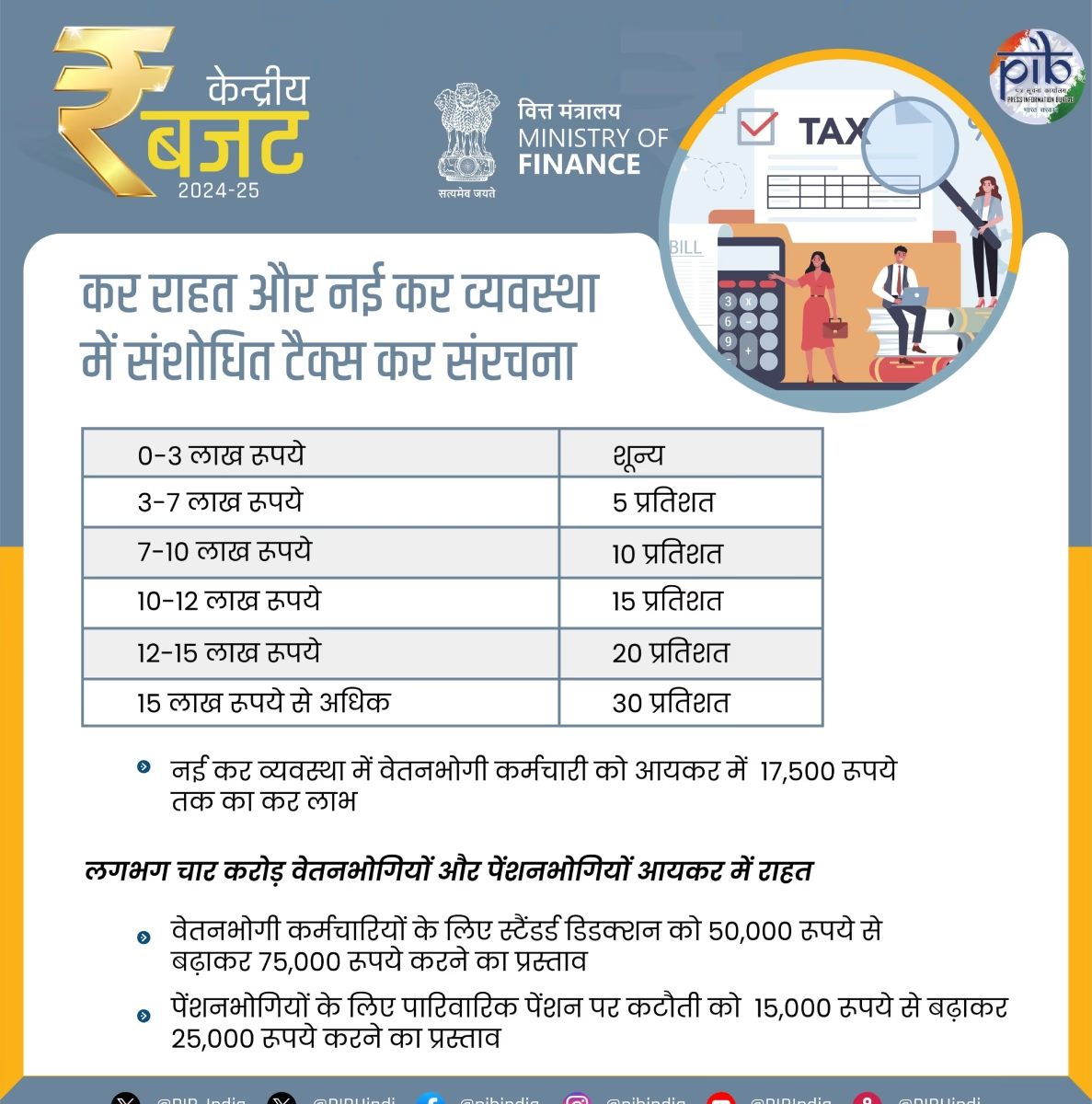

The Union Finance Minister has provided significant relief to taxpayers by increasing the standard deduction limit. In the budget, the standard deduction limit under the new tax regime has been raised to ₹75,000 annually, up from the previous ₹50,000 annually. Additionally, changes have been made to the tax slabs under the New Tax Regime. Furthermore, in Budget 2024, alongside major announcements, an additional declaration has been made for government pensioners.

During the budget presentation on Tuesday, Nirmala Sitharaman increased the tax deduction limit on family pensions. The family pension tax deduction limit has proposed to be raised from ₹15,000 annually to ₹25,000. This means pensioners benefiting from family pensions can now avail a tax relief of up to ₹25,000 on their pension income, which is great news for pensioners.

Source: aajtak

What is Family Pension?

Family pension is the amount paid by the government to the retired employees for their lifetime. Similarly, family pension is an amount given to the family of a government employee who dies during their service. If a retired employee dies, the government provides a family pension if he/she was receiving a pension or allowance.

Who is Eligible for Family Pension?

According to government rules until 2004, a deceased employee’s widow or widower is granted a family pension until they remarry. If there's no widow or widower, it is given to the employee's dependent children who are under 25 years of age.

How Much is Family Pension?

According to pension rules, family pension is 30% of the basic salary of the government employee but cannot be less than ₹3,500 per month. An unmarried son is eligible for family pension until the age of 25 or until he marries or starts earning.