One more happy family has fallen victim to the shackles of debt. Saurabh Babbar, a jeweler from Saharanpur, UP, and his wife Mona Babbar, ended their lives by jumping into the Ganga River. They clicked a selfie before the act and sent it to their friends along with a suicide note stating, 'We are drowning in debt. The burden of interest payments has become unbearable. We can no longer manage to pay the interest. Hence, we are embracing death. We will send a selfie from where we commit suicide.'

Hailing from Saharanpur, Saurabh and Mona traveled approximately 100 kilometers to Haridwar on their bike. After sending that final selfie, they plunged into the Ganga River.

Currently, Saurabh's body has been recovered and his last rites have been performed in Saharanpur. However, the search for Mona's body continues.

Saurabh and Mona were married for 18 years and had two children. Their daughter is 12 years old and their son is 7 years old. Their suicide has shattered a once-happy family.

In our country, suicides driven by debt or financial distress are alarmingly rising. Last year in Bhopal, the capital of Madhya Pradesh, an entire family succumbed to similar despair. A couple poisoned their two young children before taking their own lives.

Just this May, six members of a single family in Faridabad attempted suicide by consuming sleeping pills. They too were crushed under debt. While five were saved, a 73-year-old elderly man did not survive.

Debt: The Silent Killer?

These are just a few instances. A cursory internet search will reveal numerous cases where financial strain and debt have annihilated entire families.

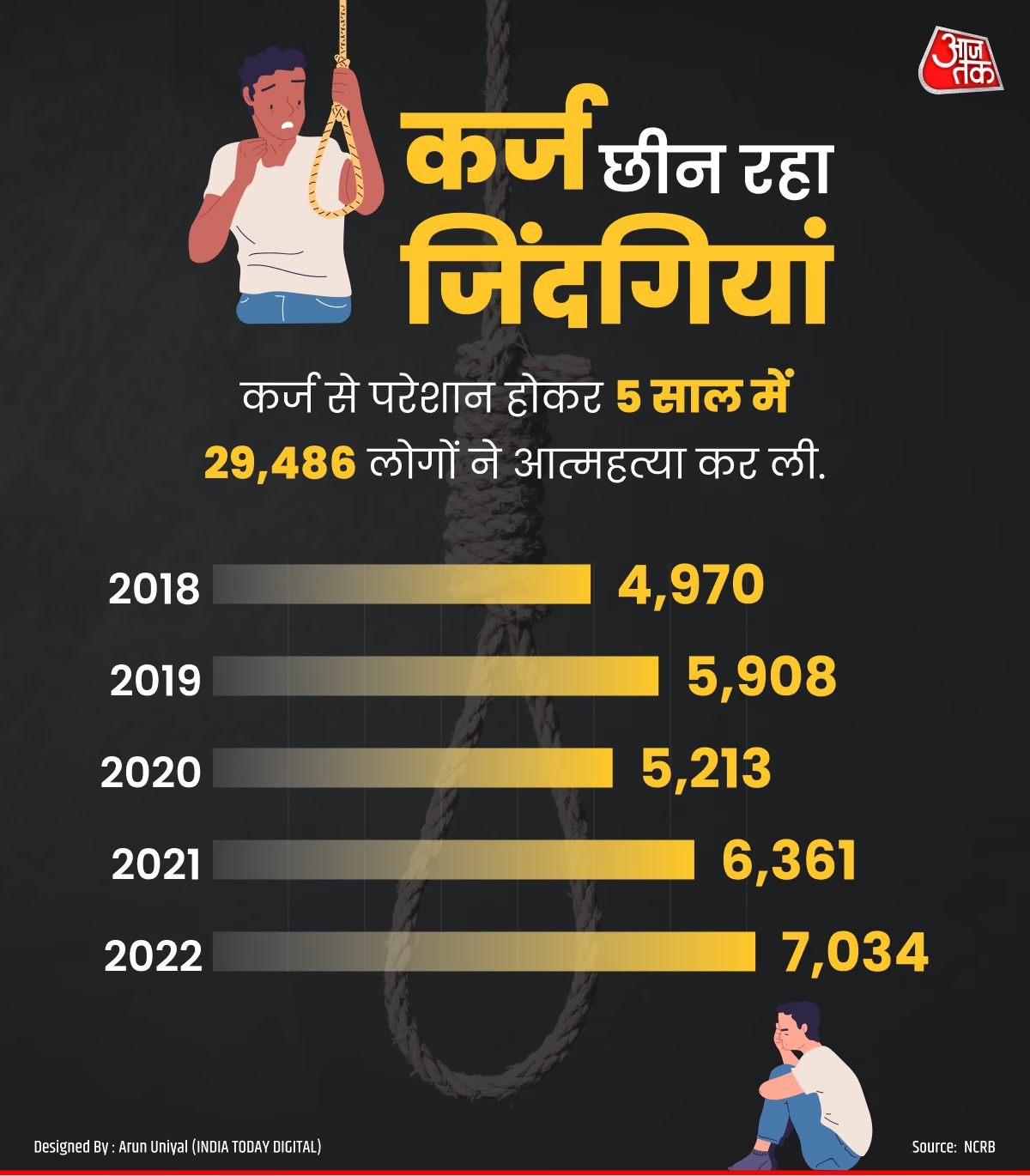

The National Crime Records Bureau (NCRB) collects data on this issue. Their records up to 2022 paint a dire picture of how fatal debt has become in India. The statistics show that one in every four suicides in the country is due to debt or economic distress.

In 2022 alone, over 1.70 lakh (170,000) people committed suicide across the country. Out of these, more than 7,000 were driven by debt-related issues. On average, this translates to about 19 debt-related suicides every day.

Data indicates that between 2018 and 2022, a period of five years, 29,486 people ended their lives due to financial woes.

Source: aajtak

How Many Families are Becoming Debtors?

The debt burden on Indian families is continuously increasing, leading to a decrease in savings. Government statistics show that family savings are consistently declining as debt accumulates.

In 2020-21, household savings hit a record high of ₹23.29 lakh crore. However, this figure has been dwindling since. In 2021-22, it fell to ₹17.12 lakh crore, and further dropped to ₹14.16 lakh crore in 2022-23.

Data from the Reserve Bank of India (RBI) reveals that net household savings in India plummeted to a 47-year low in 2022-23, dropping to 5.3% of the GDP from 7.3% in 2021-22.

Savings are depleting because a significant portion of earnings is being used to pay off debt. The increasing debt load is eating into household incomes.

The National Sample Survey Office (NSSO) has reported that in 2018, 22.4% of urban households and 35% of rural households were indebted. In 2012, this figure was 22.4% in urban areas and 31% in rural areas.

According to NSSO, by June 2018, the average debt on rural households was ₹59,748, while urban households carried an average debt of ₹1,20,336. These figures from six years ago have likely increased.

Recently, RBI Governor Shaktikanta Das expressed concern over people taking loans to invest in the stock market and mutual funds. He noted that while bank credit growth is rising, deposits are not, posing a risk to the banks.