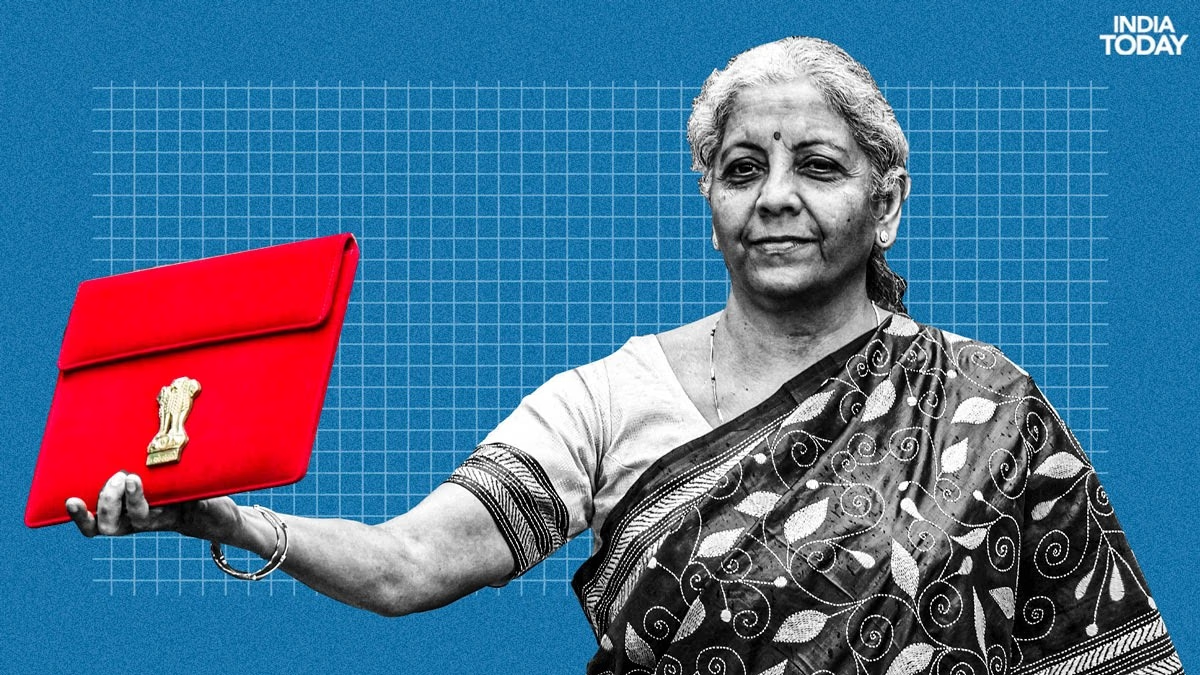

Tomorrow, July 23, Finance Minister Nirmala Sitharaman will present the country's budget. A day before the budget, a panel of experts was invited on Aajtak Live TV, including former BJP MP and ex-Aviation Minister Jayant Sinha, former Vice Chairman of NITI Aayog Rajiv Kumar, former Economics Professor Arun Kumar, former Finance Secretary Subhash Chandra Garg, and economist Gaurav Vallabh. They shared their views on what to expect in the upcoming budget. Let's find out what they think might be announced.

Jayant Sinha mentioned that the budget might focus on the economy. The country's economy is projected to grow between 7 to 9 percent. Arun Kumar emphasized the need to focus on the unorganized sector. Since their income is low, it affects the economy. Therefore, more attention is needed for the unorganized sector.

Gaurav Vallabh stated that India is the only country with high growth and low inflation. The labor force should be increased. This budget might focus on the green and blue economy. Efforts might be made to reduce inflation further. Attention is needed to reduce the prices of tomatoes and other vegetables.

How Will the Country Develop?

Subhash Chandra mentioned that India is growing at the highest rate. Economies like the USA, Japan, and China have already grown significantly, but India still needs growth. We haven't grown much in the last 60 years. A growth rate of 6 to 7 percent is not enough for development. Focus on employment is necessary. Compared to China, we'll need to grow at 8 to 9 percent. India's market will develop only with attention from all sides.

Source: aajtak

Subhash Chandra said that without increasing income in agriculture and the micro sector, we cannot become a developed nation. Announcements might be made to improve GST collection.

Experts mentioned that frequent changes in income tax are not good. There might be changes in capital gains tax. To become a developed nation, we need to grow at 8 to 9 percent. It's essential to increase farmers' income. Focus may be on boosting the merchandise economy. The indirect tax-GST ratio still isn't as before.

How to Reduce Fiscal Deficit?

To reduce the fiscal deficit, three things are very important. First, investment. By focusing on ease of doing business, it will work. Attention is needed on skill development and education. The government should also focus on capital expenditure. Both physical and digital infrastructure need attention. This will not only increase employment but also improve the economy.

Relief for the Common Man

An expert said that the Prime Minister and Finance Minister need to focus on all sections of society. Out of the 9 crore people who pay direct taxes, most are salaried. Therefore, tax exemptions should be given. Additionally, pocket income should be increased. This time, the government is positive about it and needs to increase it even more.