Once considered a dream for India's middle-class families, compact or hatchback cars are rapidly vanishing from the roads. The primary culprit is a steep decline in sales. In recent years, the demand for Sport Utility Vehicles (SUVs) has surged, outpacing the reach of small cars. Entry-level vehicles priced under 5 lakh rupees, which once boasted sales of over 10 lakh units in fiscal year 2016, have now dwindled to just 25,402 units in fiscal year 2025. Let’s delve into the challenges facing small cars:

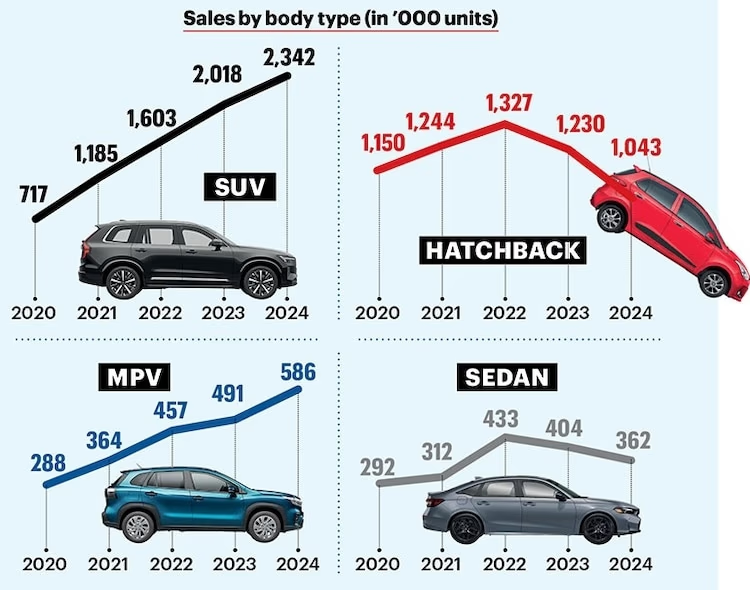

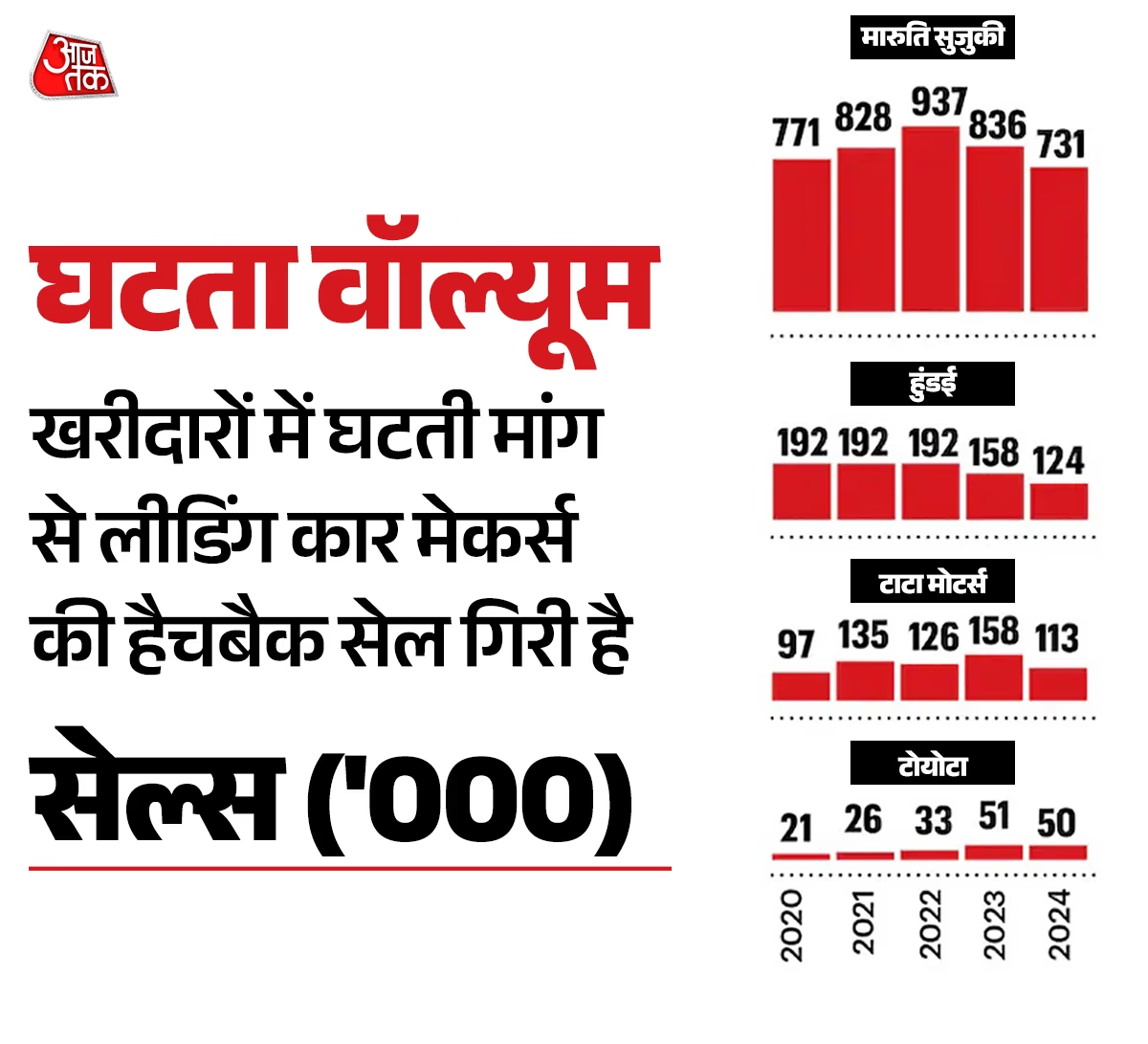

The share of hatchback cars in total car sales has halved, plummeting from 47 percent in 2020 to 24 percent in 2024. Maruti Suzuki, India's leading car manufacturer, saw its hatchback sales drop from 771,478 units in 2020 to 730,766 units in 2024. The decline continues, with May seeing a year-on-year drop of 31.5 percent in the mini segment (Alto and S-Presso), from 9,902 units to 6,776 sold.

Source: aajtak

Hyundai Motor India, considered an alternative to Maruti Suzuki and the country's second-largest car manufacturer, also witnessed a drop in hatchback sales. In 2020, Hyundai sold 192,080 small cars, but by 2024 that number had fallen to 124,082 units.

The waning demand for small cars is a concern for automakers. Maruti Suzuki's Senior Executive Officer (Marketing and Sales), Partho Banerjee, mentioned on June 2, "If the government wishes to support the auto industry, it needs to identify problem areas and strategize to stabilize and boost small car sales. Incentives are crucial to enable two-wheeler owners to transition to four-wheelers."

Maruti Suzuki's Chairman, R.C. Bhargav, shared with India Today, "Small car sales were robust until 2018. However, the market hasn't grown since. Growth in the auto sector requires all segments to thrive." He expressed concern that unless addressed, the decline in small car sales will continue, ultimately impacting car manufacturers significantly.

Source: aajtak

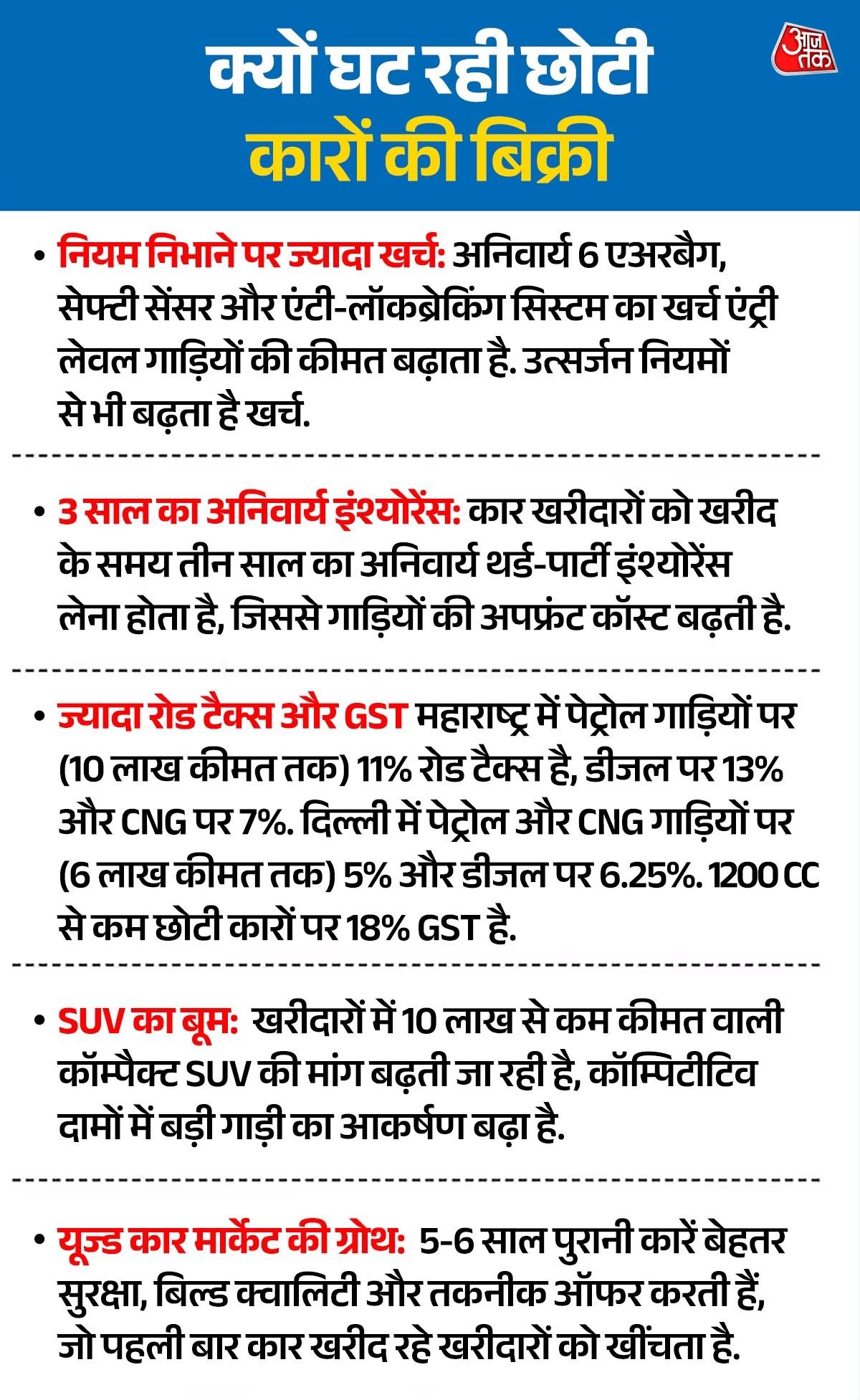

There are several key reasons behind the decline in small car sales. Here are some focused insights:

R.C. Bhargav notes, "Recent changes in needs and regulations have significantly impacted the manufacturing costs of small cars. Some small car prices had to be increased this year due to the addition of airbags, resulting in weaker retail sales." The Ministry of Road Transport and Highways mandated six airbags in small cars to enhance safety. Consequently, the industry anticipates vehicle costs could rise by approximately 60,000 rupees due to airbags and necessary modifications.

Though safety features and new additions affect vehicle prices across the board, the hatchback and small car segment is most impacted. Buyers with budgets under 5 lakh rupees are particularly burdened by these additional costs. In essence, budget car buyers may find rising prices discouraging due to budget constraints.

Source: aajtak

New car buyers are now required to purchase a three-year vehicle insurance policy, increasing initial purchase costs. The industry contends that this insurance mandate should be optional. Buyers should have the option to purchase a one-year policy and renew it before expiration, reducing initial costs.

Car manufacturers are now urging central and state governments to reduce tax burdens and make small cars more affordable. Bhargav suggests: "First, the GST needs to be reviewed and potentially lowered. Secondly, road taxes should be made annual. An annualized road tax structure could reduce the initial purchase price by about 10 percent.

Source: aajtak

In Maharashtra, petrol vehicles under 10 lakh rupees attract an 11% GST, diesel vehicles 13%, and CNG vehicles 7%. Meanwhile, in Delhi, vehicles under 6 lakh rupees attract a GST of 5% on petrol and CNG vehicles and 6.25% on diesel. Small cars with engines under 1200cc attract an 18% GST.

The Indian market is witnessing a vast expansion of Sport Utility Vehicles (SUVs). Our market boasts a robust range of SUVs, including micro, mini, compact, mid-size, and full-size segments. The mini and compact SUV segments are experiencing the quickest growth. Factors like sporty appearance, cost-effectiveness, and superior mileage are appealing to customers.

In recent years, the burgeoning demand for SUV cars has nearly sidelined small cars. Customers are predominantly opting for SUV cars priced under 10 lakh rupees. This is driving every automaker to enter the market with entry-level and compact SUV models at competitive prices.

Models like the Tata Nexon, Maruti Suzuki Brezza, and Hyundai Venue are seeing a surge in demand. Not only because they are priced under 10 lakh rupees, but also because buyers now prefer larger-sized vehicles.

When observing sales data, SUV sales jumped from 716,976 units in 2020 to 2.34 million units in 2024. Meanwhile, MPV car sales rose from 287,663 in 2020 to 586,467 in 2024. Last year, SUV cars represented 54% of the market share, up from just 29% four years ago.

Source: aajtak

Ravi Bhatia, President and Director of JATO Dynamics, states, "As incomes rise and loans become more accessible, car buyers increasingly choose upmarket options. Customers want more features, greater comfort, and enhanced brand appeal. Car manufacturers find profitability easier with a well-featured mid-size SUV than with a basic hatchback."

Car buyers are also gravitating towards pre-owned cars. Ravi Bhatia mentions, "Today’s five- or six-year-old car is safer, better built, and technologically-featured, making it an excellent choice for first-time buyers. Better cars at lower costs are available in the used car market, impacting sales of new entry-level models.

Experts suggest that, instead of spending more on a new car, customers are opting for well-maintained second-hand cars available at a lower price. They are finding that the cost of a new hatchback could buy them a more appealing compact SUV in the pre-owned market, impacting small car sales.