Finance Minister Nirmala Sitharaman made no changes to the income tax slabs in the Union Budget of 2026. Yet, salaried taxpayers can still reduce their tax bills in the fiscal year 2026-27 under the new tax regime. Remarkably, it is possible to earn over 1.4 million rupees and still pay zero tax.

Due to increased exemptions under Section 87A of the Income Tax law, no tax is required on incomes up to 1.2 million rupees. However, by carefully structuring salaries, this limit can be extended significantly. According to Parag Jain, the Tax Head at One Finance and a Chartered Accountant, salaried employees can save taxes on up to 1.46-1.47 million rupees through employer contributions to retirement plans like EPF and the National Pension System (NPS). Let’s delve into the details...

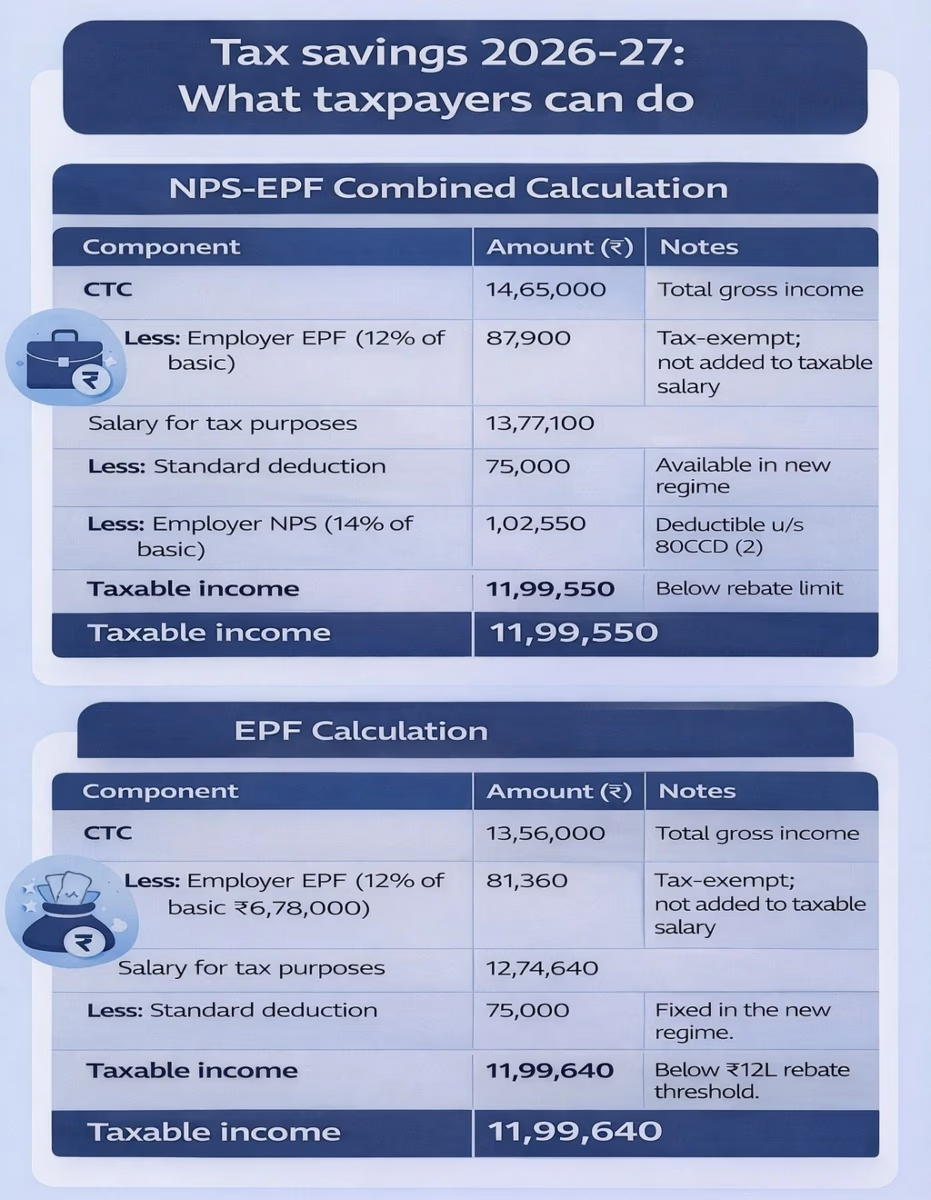

Tax Saving Calculation

Under the new tax regime effective from fiscal year 2026-27, salaried taxpayers benefit from a standard deduction of 75,000 rupees.

Additionally, contributions made by employers within the stipulated limits to EPF and NPS are excluded from taxable salary or allowed as deductions.

If these measures are correctly applied, taxable income can be reduced to 1.2 million rupees or less, meaning no income tax is payable.

Jain emphasized that the upper limit of tax-free salary is attainable only when both EPF and NPS are part of the salary structure. He noted that if an employee opts for both EPF and NPS under the new tax regime, and the basic salary is about 50% of the CTC, almost 1.46 million rupees of total salary can be tax-free.

How can 1.46 million rupees be tax-free?

Suppose with a basic salary of 732,000 rupees, the employer’s 12% EPF contribution amounts to approximately 87,900 rupees, which is not added to taxable income. From the remaining salary, a standard deduction of 75,000 rupees applies. Furthermore, the employer's NPS contribution, up to 14% of basic salary or roughly 102,000 rupees, is deductible under Section 80CCD(2). This results in a taxable income close to 1.2 million rupees, which becomes tax-free under the Section 87A exemption.

Source: aajtak

The unique aspect of this calculation is that the total annual limit of 750,000 rupees for employer contributions to EPF, NPS, and pension funds is not exceeded, as the total employer contribution remains within permissible limits.