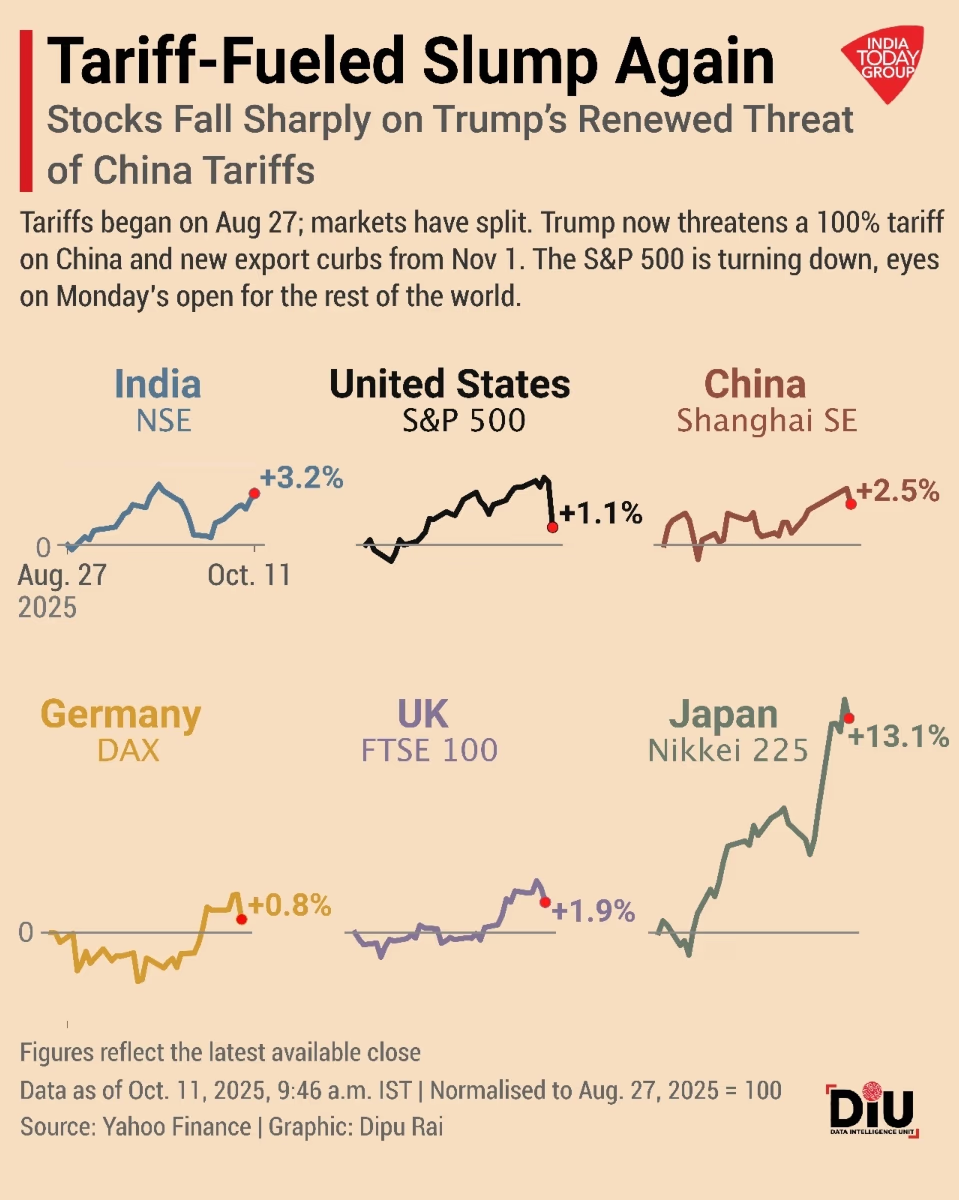

Donald Trump has threatened to impose a 100% tariff on Chinese imports, effective from November 1, 2025. This announcement has caused significant turmoil in both the US and Chinese stock markets. Indian investors are now anxious, trying to predict what will happen when the Indian market opens on Monday.

The 100% tariff decision by Trump has exacerbated trade war tensions between China and the US. Analysts fear that China may retaliate. Should this happen, it could ignite a trade war between the two largest global economies, which isn’t beneficial worldwide. Consequently, there’s apprehension of a sharp decline in stock markets worldwide, including India, come Monday.

Destruction in the US Stock Market

Wall Street witnessed remarkable declines on Friday. The S&P 500 and Nasdaq experienced their most significant one-day drops since April 10. The Dow Jones Industrial Average fell 1.90% to 45,479.60, the S&P500 slid 2.71% to 6,552.51, and the Nasdaq Composite plunged 3.56% to 22,204.43.

Trump's announcement of an additional 100% tariff on Chinese imports and introducing new export controls on critical US software caused substantial drops in the stocks of major tech companies like NVIDIA, Tesla, and Amazon, each declining over 2%.

Source: aajtak

Indications of a Gap-Down in Indian Market

Observations show Nifty trading at a 0.78% decline, at 25,205, hinting at a potential gap-down opening. This occurs despite strong performances last week, where both Sensex and Nifty recorded gains of approximately 1.5%.

According to a Business Today report, Ponmudi R., the CEO of Enrich Money and a SEBI-registered expert, stated that the market's direction in the coming week will depend on a combination of domestic factors, global macroeconomic trends, and corporate earnings.

What Experts Say?

Ponmudi indicated that the rekindling of the US-China tariff war is likely to impact global risk perception. This trade tension may affect the dollar's standing, thereby increasing pressure on emerging market stocks and currencies. Ponmudi emphasized that attention on the corporate front will be on the IT sector, with giant companies like Infosys, HCL Tech, and Tech Mahindra set to announce their second-quarter results.

Ponmudi mentioned that Nifty continues to show resilience, maintaining a high-low pattern above the critical sectors of 25,000-24,850. He stated that 'trendline support and strong put writing have helped the index withstand volatility and maintain its upward trend. On the upside, the significant call open interest between 25,300-25,400 has created a short-term barrier with the long-term decline resistance line. A decisive close above 25,500 could reignite bullish momentum, confirming a higher-high pattern and paving the way towards 25,700-25,900.'