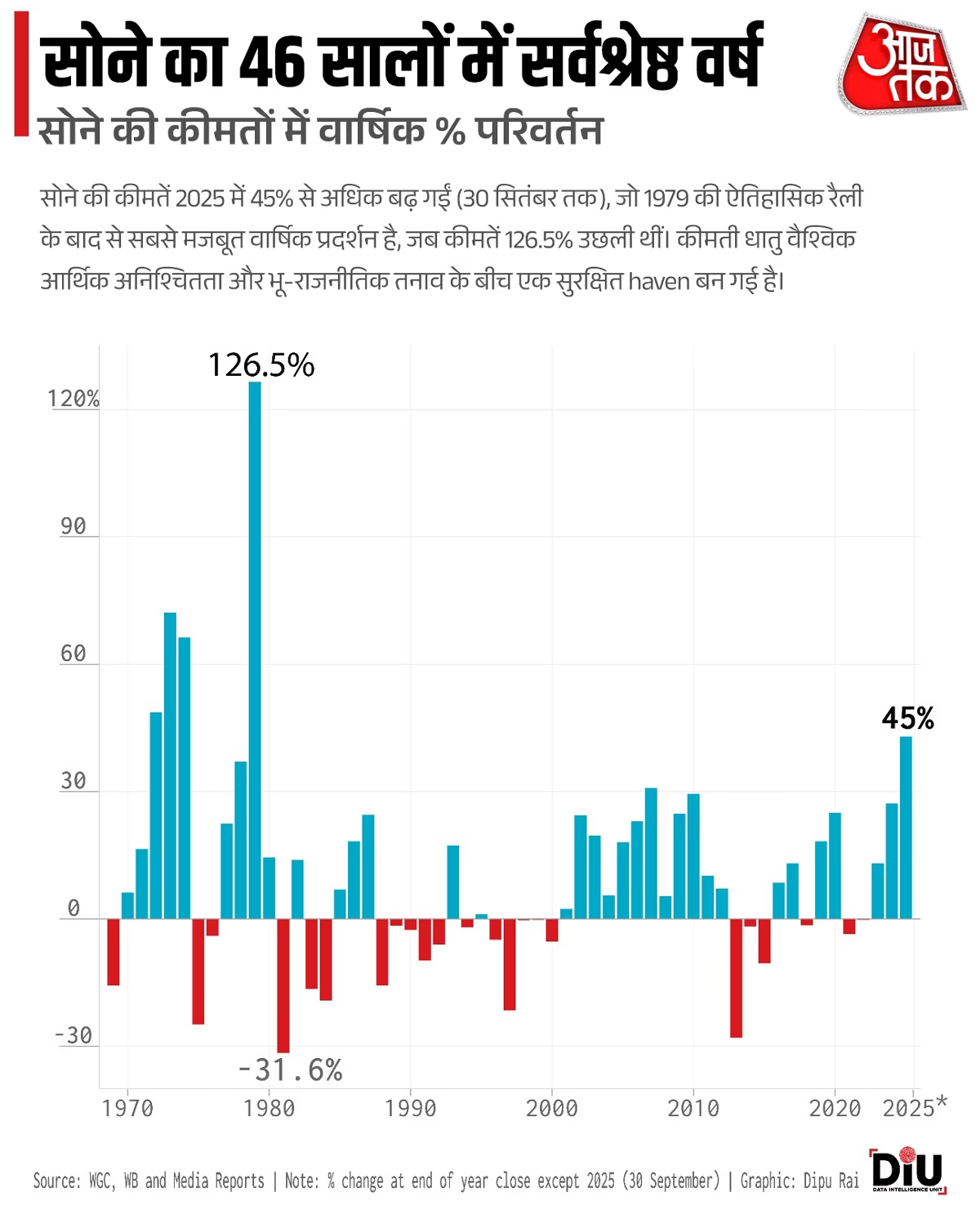

Gold has surged over 45% this year, marking the largest annual rise since 1979. The sparkling performance of gold this year has been unprecedented in decades. In 2025, its prices are consistently reaching new heights. Let's delve into the factors behind this rise in bullion.

Why Is It Important?

Gold's resurgence clarifies deep investor concerns about the global financial system and American politics, coupled with growing fears about the dollar's future.

By the Numbers

$3,848/ounce: Record high gold price as of Monday+45%: Rise in gold prices since January 1, 20251979: The last time gold prices spiked so rapidly, soaring by 126% during the Iranian revolution and oil crisis.

The Gold Story

Gold prices are soaring as investors are wary of potential US government shutdowns, rising trade tensions, and political disputes over Federal Reserve policies. President Donald Trump's attacks on the Federal Reserve, new tariffs, and major spending policies have heightened uncertainty, prompting a move to the safe haven of gold.

Source: aajtak

This boom is reminiscent of the turmoil in the 1970s. At that time, inflation, oil crises, and political instability drove gold prices sky-high. In 1971, Richard Nixon ended the convertibility of the dollar to gold, dismantling the Bretton Woods system. Economist Yanis Varoufakis calls it a magic trick that allowed the US to finance deficits globally through debt, a scenario he dubbed the Global Minotaur.

At the end of the 1970s, gold prices experienced a phenomenal surge (peaking in 1979) and a subsequent drop in 1980. Today's soaring gold prices reflect this paradox once more. When confidence in the dollar wanes, gold prices climb, but during times of fear, investors often flock back to the dollar. There's a delicate balance, where the strength of one often signals the return of the other.

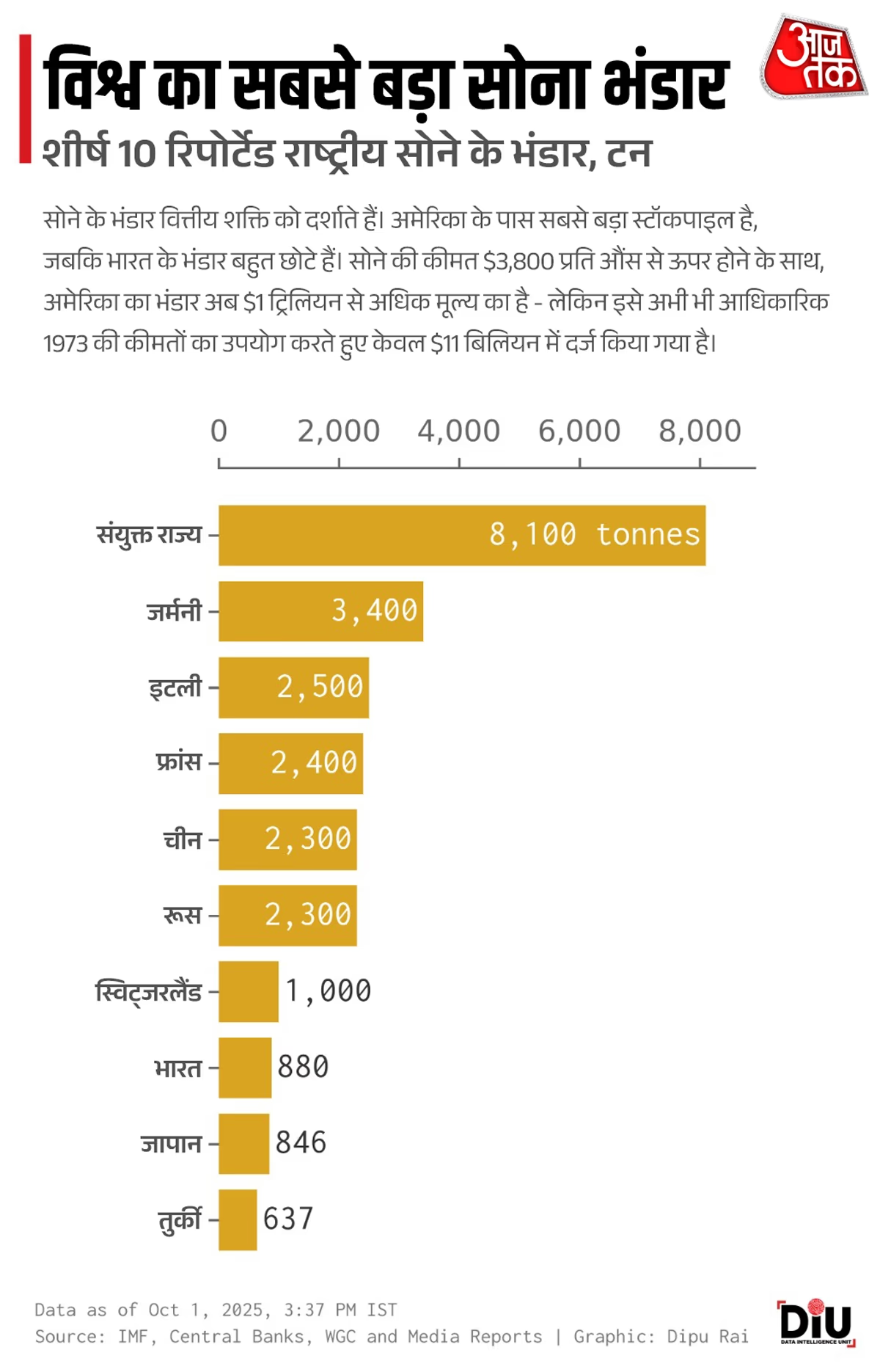

Geopolitics also plays a role in this narrative. China and Russia are stockpiling gold, with 90% of their transactions conducted in local currencies. Presidents Trump and Biden have mirrored Nixon's approach to protect key industries. Currently, the dollar reigns supreme as the dominant currency, but the rising gold prices subtly question whether this dominance can be maintained in the future.

Source: aajtak

The Big Picture

Gold isn't just a commodity; it's a barometer of trust or mistrust in the value of money. Its unique status stems from its rarity, durability, and limited supply. When political actions weaken confidence in the dollar, investors turn to gold. The question remains: will gold continue to be merely a hedge, or will it assume a larger role in a new financial system?