With rising inflation, people's needs are expanding too. A salary up to one lakh rupees might not fulfill all your dreams. However, investing wisely can turn your dreams into reality. We're introducing a plan that helps you accumulate crores (Crorepati Scheme) and provides a monthly income source.

This plan is a Systematic Withdrawal Plan (SWP) under Mutual Funds. It allows you to deposit a lump sum and enjoy regular income for life. Your funds not only remain intact but could grow with potential returns. SWP is deemed more robust than SIP.

The Power of SWP Revealed

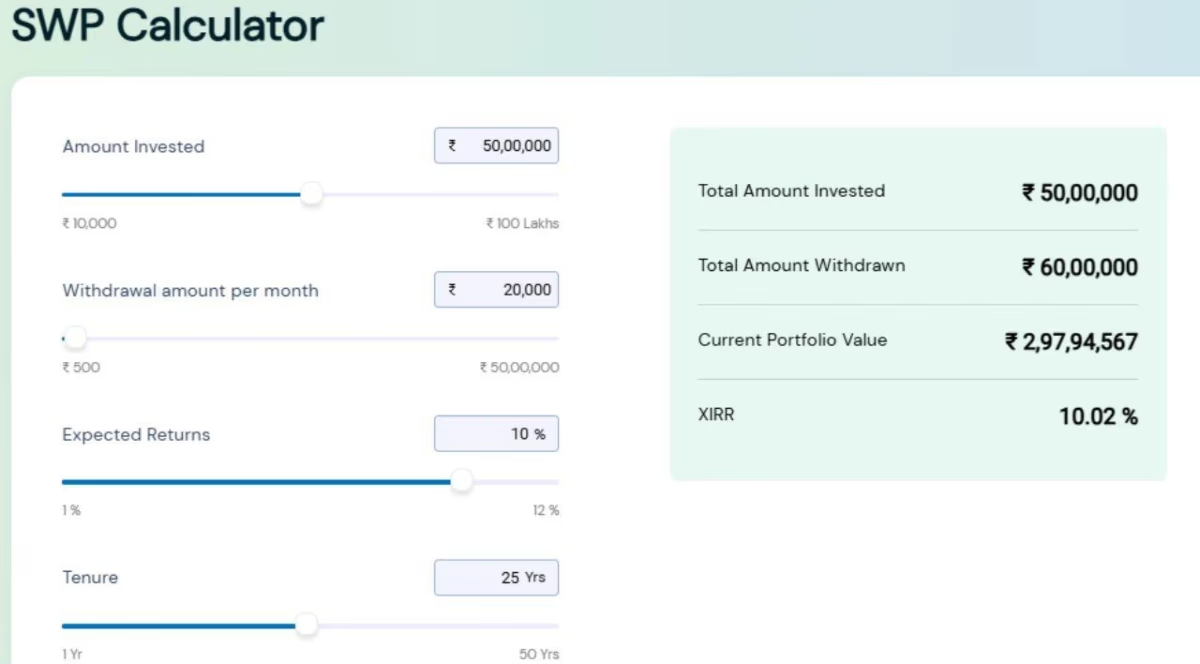

Imagine having a corpus of 50 lakh rupees. By withdrawing 20,000 rupees monthly over 25 years, you could still maintain a hefty corpus of about 3 crores. Often, SIP doesn’t match SWP’s prowess.

How to Achieve 3 Crores and Monthly Income?

In SWP, the leftover amount after withdrawals continues to earn returns. Typically, long-term mutual funds yield annual returns between 12% to 15%, but here, we calculated with a 10% return.

Suppose you've accumulated a corpus of 50 lakh rupees through SIP or the stock market and want to halt further investments, yet still draw monthly withdrawals without depleting your funds. SWP serves this purpose best. Using the SWP Calculator, we gauged how much investment is needed and how much you’ll receive.

If your corpus is 50 lakh rupees and you withdraw 20,000 rupees monthly for the next 25 years, you will withdraw a total of 60,00,000 rupees. Remarkably, your initial investment would still accumulate to 2,97,94,567 rupees or around 3 crores. That's because even after taking monthly withdrawals, the remaining amount in your portfolio continues to earn interest, enhancing its value over time.

Source: aajtak