Finance Minister Nirmala Sitharaman presented the first annual budget of the Modi government's third term in Parliament on Tuesday. This was her seventh consecutive budget presentation. There was curiosity among both the common and special classes regarding the budget from the beginning. Let's dive into the significant highlights of this budget.

Nirmala Sitharaman began her budget speech by stating that people have faith in our policies. India's economy is strong. The inflation rate in the country is under control, hovering around 4%. The global economy is going through tough times, but India’s economy is shining.

Here are the major points of the Modi 3.0 government’s budget:

Announcing a budget of ₹1000 crores to increase the space economy by five times in 10 years.

- Major announcements for Bihar and Andhra Pradesh. Approval for two expressways: Patna-Purnia Expressway and Bodh Gaya-Vaishali Expressway.

- ₹11,500 crores aid to flood-stricken Bihar.

- ₹26,000 crores for highways in Bihar.

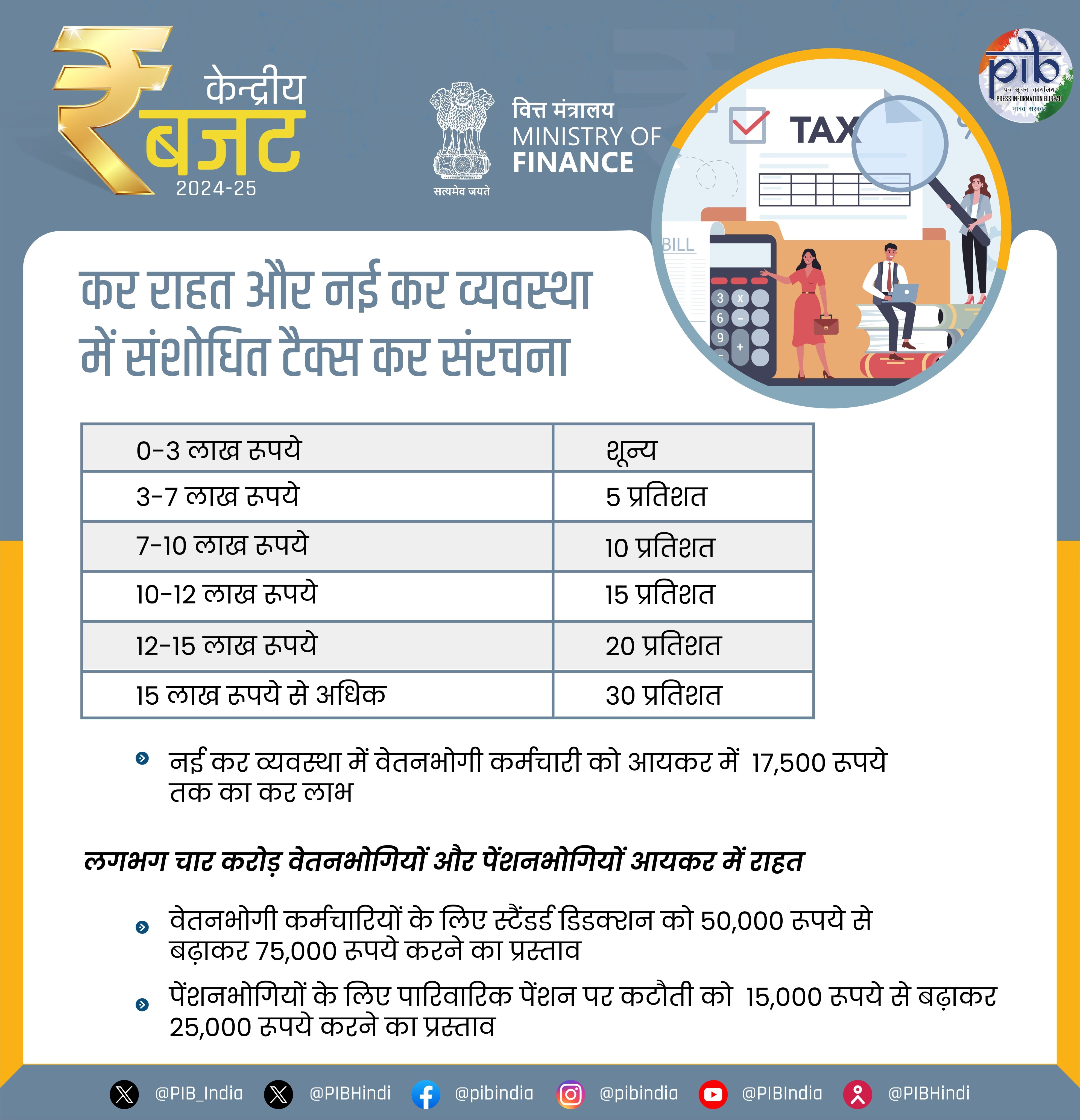

- Savings of ₹17,500 in the new tax regime. The new tax slab includes 5% tax for income between ₹3-7 lakhs, 10% for ₹7-10 lakhs, 15% for ₹10-12 lakhs, 20% for ₹12-15 lakhs, and 30% for over ₹15 lakhs.

- No changes in the old tax slab.

Standard deduction for salaried employees increased from ₹50,000 to ₹75,000 in the new tax regime.

- No tax on income up to ₹3 lakhs in the new tax regime.

Source: aajtak

Abolition of Angel Tax to promote startups.

Corporate tax rate for foreign companies reduced from 40% to 35%.

Significant relief in TDS for e-commerce operators, reduced from 1% to 0.1%.

- Proposal to increase the deduction for family pension for pensioners from ₹15,000 to ₹25,000.

Reduction in customs duty on gold and silver to 6%.

- Imported gold and silver to become cheaper.

- Customs duty reduction on leather and shoes.

- Reduction in customs duty on telecom equipment.

- Customs duty on mobile phones and chargers reduced.

- Income Tax Act 1961 to be reviewed in six months.

- Reduction in customs duty on platinum to 6.4%.

- Exemption in customs duty on three cancer drugs, equipment for cancer to also become cheaper.

Attempt to resolve tax disputes within six months.

- Launch of NPS Vatsalya scheme, allowing parents to invest in this scheme.

- FDI laws to be made more flexible.

- Loan limit for states increased.

- Vishnupad Temple and Mahabodhi Temple to be developed along the lines of Kashi Vishwanath.

- Multiple new announcements to promote global tourism in India.

- Nalanda to be developed as a tourist hub.

- New airports and medical colleges to be built in Bihar.

- A 24,000 MW project to be established in Pirpainti, Bihar.

- Flood management and related projects in Assam.

- Announcement of a bridge over the Ganga River in Bihar.

- Odisha's tourist spots to be developed to world-class standards.

- Initiation of the National Research Fund.

- Announcement of economic policy framework.

- Focus on the upliftment of four castes: poor, youth, Antyodaya, and women.

- Presentation of five schemes worth ₹2 lakh crores to tackle youth employment.

- Initiation of three employment schemes. Firstly, a new registration in EPFO for those with salaries less than ₹1 lakh will receive ₹15,000 aid. This will benefit 2.10 crore youths. For employers, a hiring incentive will be provided. The government will contribute ₹3,000 per month to the EPFO for employees with a salary below ₹1 lakh.

- Revision of the Model Skill Loan Scheme to provide a loan of up to ₹7.5 lakhs. An educational loan of up to ₹10 lakhs will be provided across the country for higher education. The government will bear 3% interest on these loans. E-vouchers will be provided to one lakh students annually.

- ₹1.52 lakh crore allocation for agriculture.

- Announcement of educational loans up to ₹10 lakhs for higher education in the country.

- Construction of 3 crore houses under PM Awas Yojana in urban and rural India.

- Allocation of ₹2.66 crores for rural development this year.

- Special economic package of ₹15,000 crores for Andhra Pradesh.

- Allocation of three lakh crores for women.

- Increase in Mudra loan limit from ₹10 lakhs to ₹20 lakhs.

- Three crore new houses under PM Awas Yojana.

- Announcement of financial package for MSME.

- Allocation of ₹1.52 lakh crores for agriculture and related sectors.

- Work on sewage treatment in 100 major cities.

- One crore households to benefit from the PM Surya Ghar free electricity scheme.

- Approval of 12 new industrial hubs.

- Establishment of a debt recovery tribunal system.

- Construction of two new expressways in Bihar. Bodh Gaya-Vaishali Expressway to be built.

- Announcement of an internship scheme for one crore youths. Top 500 companies have to provide internships.

While presenting the budget, Finance Minister Sitharaman stated that our goal is to pave the roadmap for a developed India. Emphasis is on increasing production in the agricultural sector and focusing on employment and skill development. Focus on reformist policies remains strong.

Click here to read the complete budget speech in Hindi.

Finance Minister presented a nine-point plan

She stated that our first priority for a developed India is

productivity in agriculture

. The second priority is

jobs and skills

. The third priority is

inclusive human resource development and social justice

. The fourth priority is

manufacturing and services

, and the fifth priority is

urban development

. The sixth priority is

energy security

. The seventh priority is

infrastructure

and the eighth priority is

innovation, research, and development

. The ninth priority is

next-generation reforms

. Future budgets will be prepared based on these priorities.

What was in the interim budget?

Earlier in February, Finance Minister Nirmala Sitharaman presented an interim budget worth more than ₹47.65 lakh crores. She mentioned that revenue over ₹30 lakh crores would come from taxes and other sources, with the remaining expenses financed through loans.

Moraji Desai presented the budget ten times

Former Prime Minister Morarji Desai holds the record for presenting the budget the most, having done so ten times between 1962 and 1969 as the finance minister. Following him, P. Chidambaram presented the budget nine times, and Pranab Mukherjee eight times.

Nirmala Sitharaman has broken this record by presenting the budget seven consecutive times, making her the first finance minister to achieve this feat.