The Adani Group is set to acquire most of Sahara Group’s properties. According to two legal sources requesting anonymity, the Sahara Group submitted a term sheet to the Supreme Court on September 6, 2025. This document outlined that the Adani Group is to acquire Aamby Valley, the Sahara Star Hotel in Mumbai, and various properties across the nation. Supreme Court approval is awaited for this transaction.

Due to the sensitivity of the deal, financial details are kept confidential and will only be presented to the Supreme Court in a sealed envelope. Documents reviewed by India Today reveal that the Adani Group must deposit the agreed amount into the SEBI-Sahara refund account or any account directed by the court.

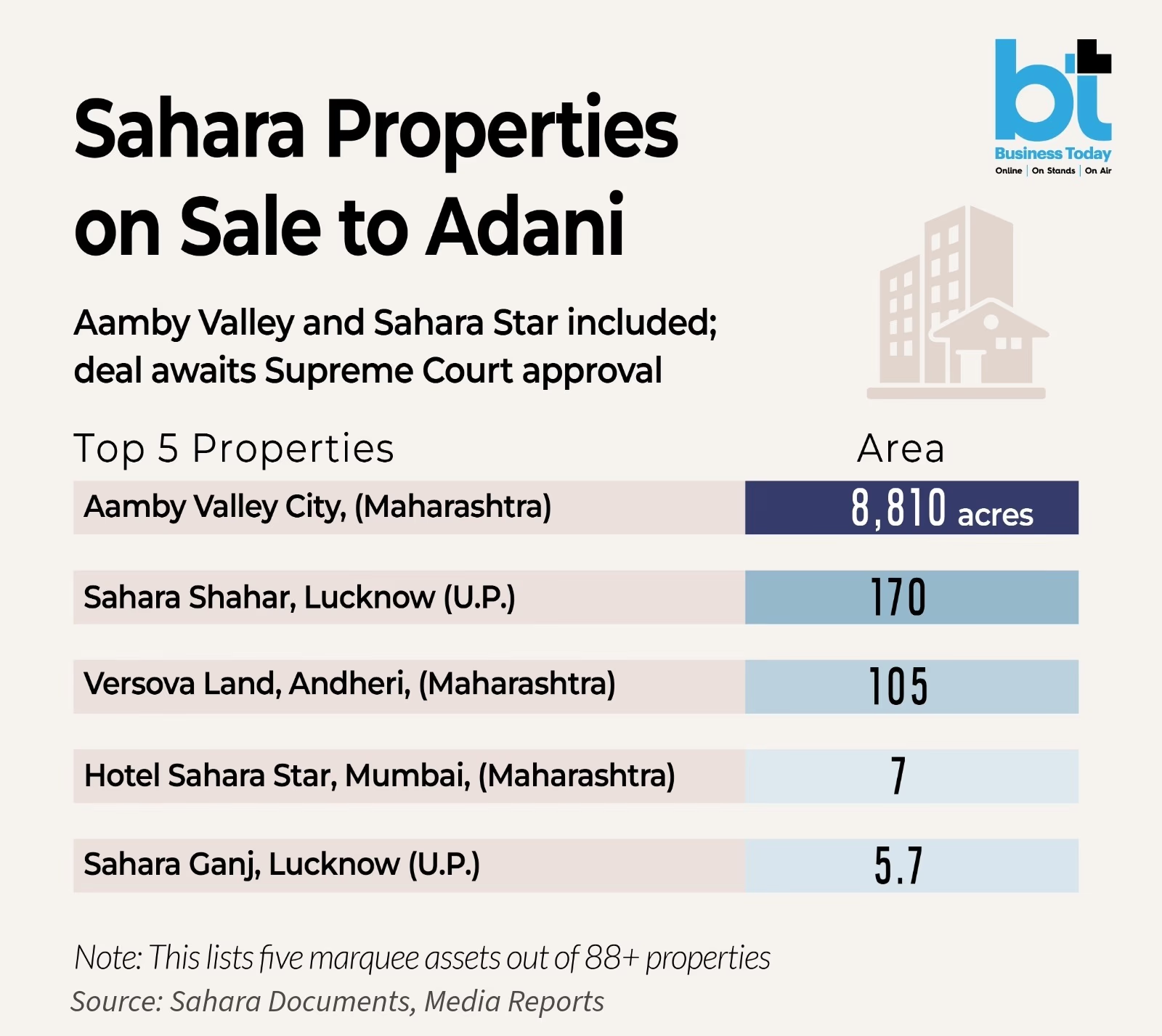

According to court-submitted documents, Adani Properties will see the transfer of over 88 properties, including Aamby Valley Township and the Sahara Star Hotel, in a lump sum, single block deal.

An expedited resolution of this issue, which has been stalled for years under the court's supervision, can enable faster refunds to legitimate claimants through the SEBI-Sahara refund account. This also ensures that the properties transfer to a single buyer rather than fragmented sales. If approved, this verdict could set a benchmark for court-overseen complex asset sales. This case will be before the Supreme Court's next hearing on October 14, and per the court's instructions, the proceeds might be transferred to the SEBI-Sahara refund account.

Which Sahara Properties Are on the Block?

The deal includes Aamby Valley City, sprawling over 8,810 acres in Maharashtra. Additionally, properties near Mumbai's airport—the Sahara Star Hotel, and assets in Maharashtra, Uttar Pradesh, Haryana, Rajasthan, Gujarat, West Bengal, Jharkhand, Madhya Pradesh, Karnataka, and Uttarakhand are part of the deal. Currently, no receiver is appointed by the court. Sahara India Commercial Corporation Limited (SICCL) submitted an application on behalf of Sahara entities to the Supreme Court. Sahara's management is negotiating the sale.

An application by the Sahara Group in the Supreme Court seeks extensive protection under Article 142 'Complete Justice', seeking relief from the court's powers.

The Sahara Group has requested the Supreme Court to exempt the acquired properties from all regulatory or criminal inquiries, investigations, and actions. They also asked that all claims or liabilities related to the properties be referred only to the Supreme Court and not to other courts, tribunals, or governmental bodies. They have requested the immediate withdrawal of all encumbrance orders and restrictions on these properties issued by various authorities.

Source: aajtak

Proposal for a High-Level Committee

Sahara proposed forming a high-level committee headed by a former Supreme Court judge to oversee the fund management, monitor the sale process, settle objections or competing proposals, and identify, resolve, and settle Sahara's remaining liabilities.

Documents reviewed by India Today indicate that past attempts to sell properties failed due to poor market conditions, lack of credible buyers, and numerous ongoing litigations, eroding buyers’ confidence. Moreover, despite efforts and the appointment of advisors, SEBI failed to sell or liquidate any Sahara assets.

Decision to Sell All Properties to a Single Entity

Sahara stated that complicating matters further, several investigative agencies initiated independent probes against Sahara and its executives, directly impacting the group's ability to sell its properties. Faced with these ongoing challenges, management concluded that selling each property individually would take years. To address the situation and maximize value in the shortest timeline, they decided to sell nearly all their remaining properties to a single unit (Adani Group) in one block or lot. However, no response has been received from the Adani Group in this matter.

The Complete Sahara Saga

The longstanding Sahara controversy centers on funds raised from millions of small investors that remain unrefunded. In 2012, India's capital market regulator SEBI ruled that two of Sahara's companies sold optionally fully convertible debentures without proper approvals and ordered a refund with interest, which led to the Supreme Court case upholding that decision.

This led to founder Subrata Roy being jailed in 2014 for non-compliance, later being paroled due to delayed asset sales and repayments. Court and agency actions led to several Sahara assets being seized, with a SEBI-Sahara refund account set up to repay claimants. Sahara Group remains under scrutiny amid ongoing litigation and other proceedings.

It's worth mentioning that Sahara once owned an airline, sports teams, hotels in London and New York, financial services, mutual fund and life insurance businesses, Aamby Valley Township, and a land bank of approximately 36,000 acres. Most of these properties have been seized or sold.