Despite the government's pledges of self-reliance, pulse farming in India is continuously declining as imports rise. Has the market changed its rules regarding pulse prices, or are the slogans and presentations from the Ministry of Agriculture and the Niti Aayog sufficient for India to become self-reliant in pulses, or is there another way?

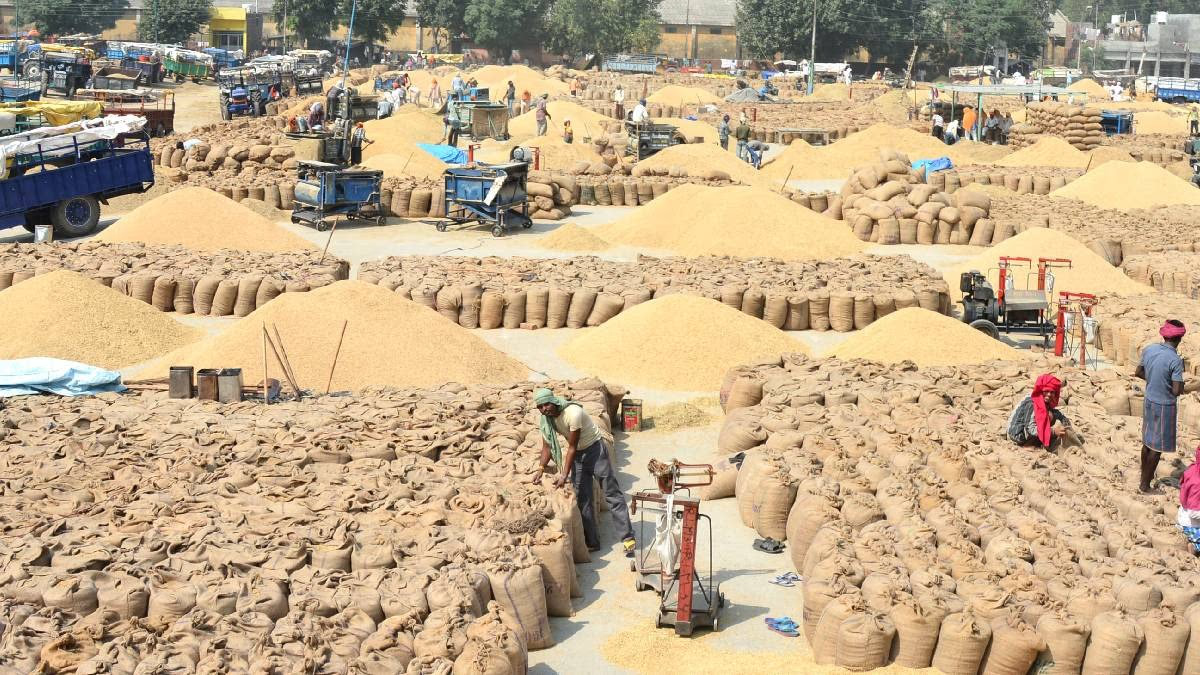

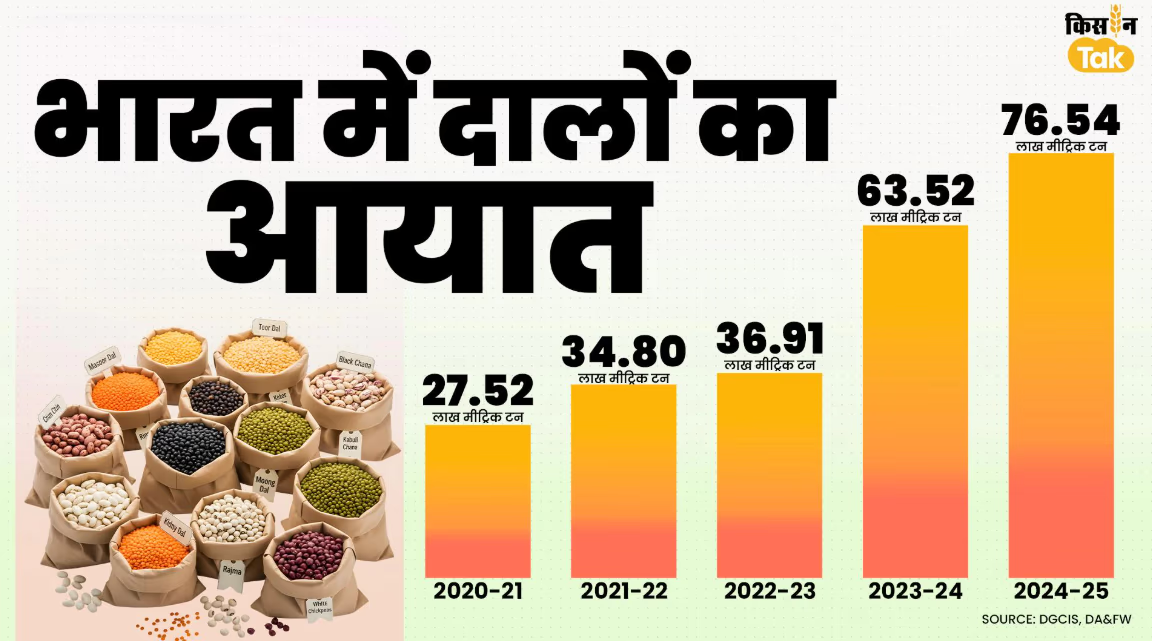

While claims of self-reliance are being made, India is setting new records in pulse imports every year, reaching nearly 7.7 million metric tons. It is ironic that despite the soaring import bill, the cultivation of pulse crops is not increasing but rather decreasing.

In the past four years alone, the area under pulse crops has dwindled by around 3.1 million hectares. Why is this happening? Despite talks of a self-reliant India, why is the area under pulse cultivation not expanding? Officials and political leaders may not provide answers, but it is clear: until farmers receive prices at or above the Minimum Support Price (MSP) level, no mission will succeed.

Source: aajtak

Source: aajtak

Source: aajtak

Source: aajtak

Source: aajtak

The central cabinet recently approved the Pulse Mission to make India self-reliant in pulses. The government aims to expand pulse crop areas to 31 million hectares by 2030-31. Currently, pulse crops are cultivated on 27.5 million hectares, aiming to add an additional 3.5 million hectares.

The mission also targets a production increase to 35 million tons and productivity of 1130 kg per hectare across 416 districts, with an expenditure of Rs 11,440 crores planned. But will this plan succeed?

Source: aajtak

How Can It Work Without Fair Prices?

India encompasses 35.87% of the global area under pulse crops, contributing 27.4% of global production, making it the largest producer. Yet, due to the gap between demand and production, India is the biggest importer too. Thus, efforts to become self-reliant through the Pulse Mission are underway.

While the mission seems comprehensive, it lacks the critical guarantee of stable prices for farmers. Without assured prices, the mission’s success is questionable. Without ensuring farmers' prosperity through competitive pricing, no measures will truly work. Farmers respond to profit opportunities, not just policy presentations or ambitious slogans.

Source: aajtak

It's worth noting, as farming economist Devinder Sharma points out, that the central government’s import policies have devastated pulse and oilseed farming. Farmers who grow these crops ought to be rewarded, as they contribute to reducing import bills. Instead, they are being punished with lower prices.

Why haven't the Ministry of Agriculture and the Niti Aayog investigated why farmers are reducing pulse cultivation? Such analysis is lacking, and consequently, the mission does not promise guaranteed market prices for pulses. Without this assurance, no mission or plan will lure farmers back to pulse farming.

Source: aajtak

The Dilemma of Low Prices

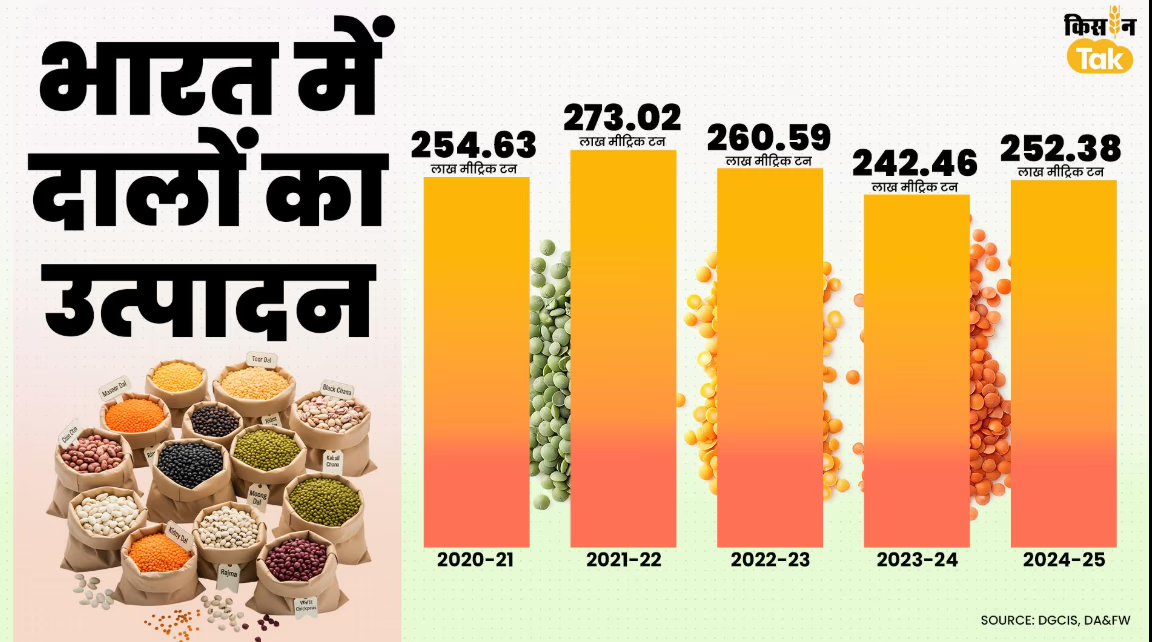

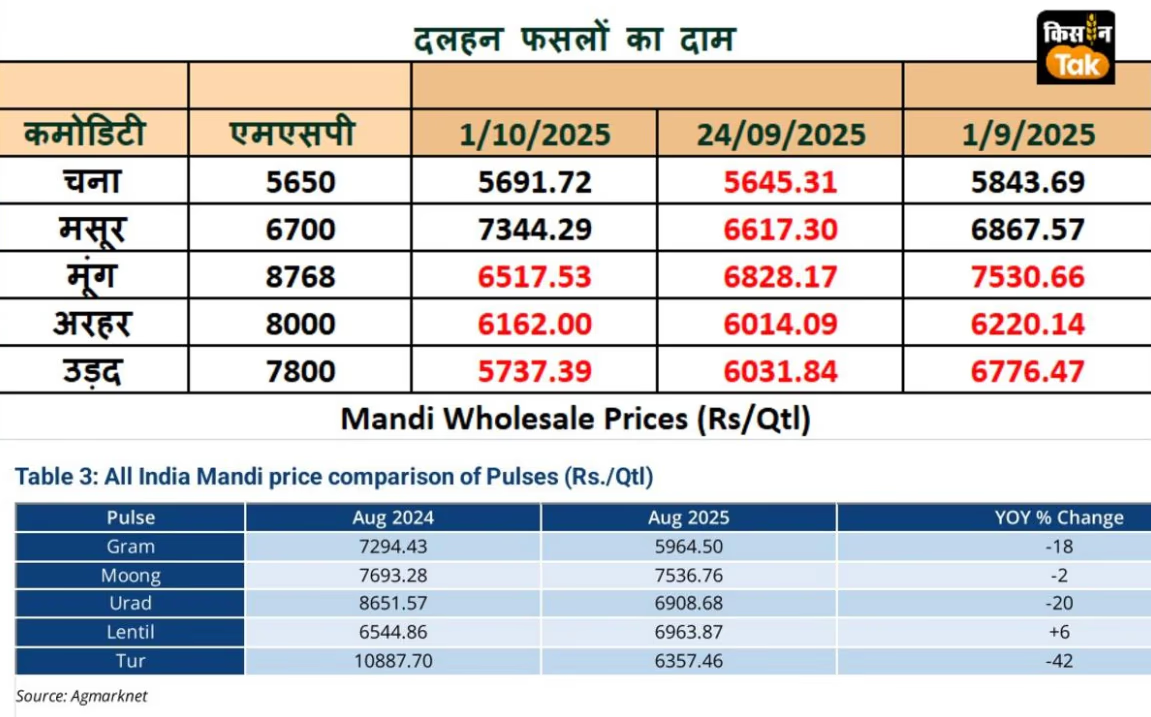

Research by the Ministry of Agriculture highlights a drop in pulse prices. From August 2024 to August 2025, pigeon pea prices fell by 42%, black gram by 20%, and chickpea by 18%. On October 1st, MSP for pigeon pea was Rs 1838 below, Rs 2250 for green gram, and Rs 2063 for black gram.

India's self-reliance mission in pulses sees paradoxes in the market—demand high, prices low. Without assured prices, farmers lack incentive to expand pulse cultivation. The reality is that farmers won’t continue with a losing venture.

Source: aajtak

The Impact of Excessive Imports

According to Niti Aayog, current domestic consumption of pulses is 29 million tons, while production lags at 25.238 million metric tons, creating a shortfall of 3.762 million tons. However, India imported 7.654 million metric tons causing a price slump due to surplus. The big question is why the excess import of 3.892 million tons?

The reality or policy inadequacy needs addressing. Mismanagement risks jeopardizing India's agriculture sector and its farmers, leaving them grappling with declining returns.

As alarming as the situation is, Union Home and Cooperation Minister Amit Shah has rashly assured that by December 2027, India will be self-reliant in pulse production, negating the need for imports. Time will tell, whether this promise pans out.