On Tuesday, Finance Minister Nirmala Sitharaman presented the 2024-25 budget, marking the first budget of Modi’s third term.

The budget outlines where the government plans to generate revenue and where the expenditure will go. Sitharaman revealed that the government will spend more than 48.20 trillion rupees in 2024-25. This number is just an estimate, and usually, the actual expenditure exceeds the projection.

The government expects to generate 31.29 trillion rupees from taxes, but to cover the remaining expenses, it will borrow 16.13 trillion rupees in 2024-25. A significant portion of the government’s budget is allocated for paying interest on its debts.

Where Will the Government Earn and Spend?

- Sources of Revenue:

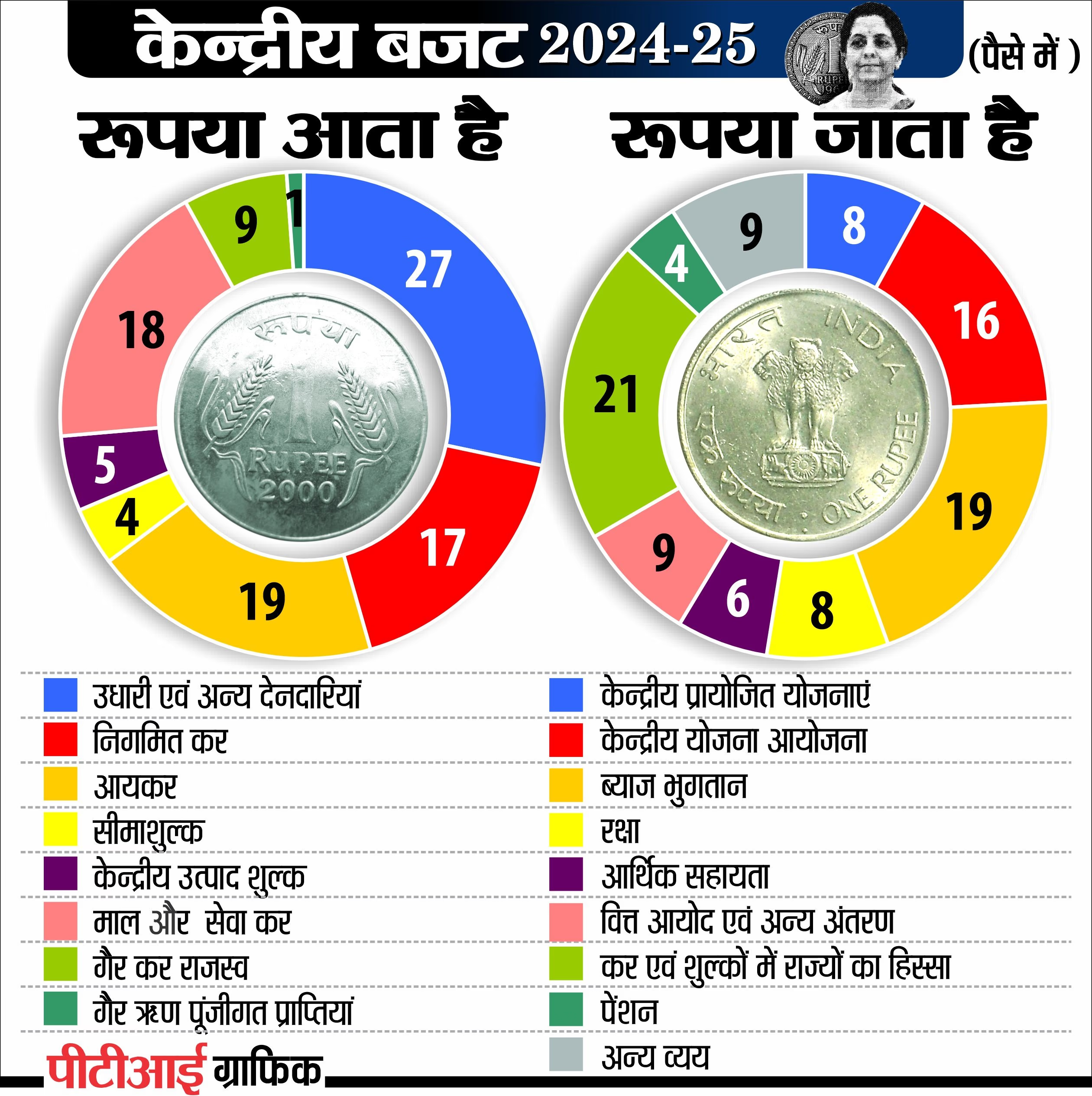

Out of every rupee the government earns, 27 paise will come from borrowing. Additionally, 19 paise from income tax, 18 paise from GST, and 17 paise from corporation tax will be collected. Other sources include 9 paise from non-tax revenue, 5 paise from excise duty, 4 paise from customs duty, and 1 paise from non-debt receipts.

- Expenditure Plan:

For every rupee spent, 19 paise will go towards interest payments. 21 paise will be transferred to the states as a share of tax and duties. 16 paise will be allocated to central sectors, and 8 paise to centrally sponsored schemes. Another 8 paise will go towards defense, 6 paise towards subsidies, and 4 paise towards pensions. The remaining 18 paise will cover various other expenses.

Source: aajtak

Read more:

Where Does the Government Borrow From?

It might seem surprising that a government needs to borrow money, but there are several avenues available for this.

One source is domestic borrowing (internal debt). Here, the government takes loans from insurance companies, corporate entities, the RBI, and other banks. Another method involves public debt, where funds are raised through treasury bills, gold bonds, and small savings schemes.

Additionally, the government secures loans from international institutions like the IMF, the World Bank, and other foreign banks, known as external debt. In critical situations, the government might even pawn gold, as occurred in 1990.

How Much Debt Does the Government Have?

According to the Ministry of Finance, as of March 31, 2024, the central government’s debt will exceed 168.72 trillion rupees. Of this, 163.35 trillion will be internal debt, while 5.37 trillion rupees will be external debt.

Earlier this May, Finance Minister Nirmala Sitharaman noted on X that, by 2022, India’s debt stood at 81% of its GDP. In comparison, Japan's debt was 260%, Italy’s 140.5%, the USA's 121.3%, France’s 111.8%, and the UK's 101.9%.

Sitharaman emphasized that, compared to lower-middle-income countries, India is in a relatively better position. She also mentioned that short-term debt constitutes only 18.7% of India’s external debt, a figure much lower than that of China, Thailand, Turkey, Vietnam, South Africa, and Bangladesh.

Currently, India's debt is 81% of its GDP, including both central and state government debts. The debt surged to 89% during the 2020-21 COVID pandemic.

What Difference Does It Make?

Lower revenue necessitates borrowing to meet expenses, a practice not limited to India but adopted by governments worldwide.

Post the COVID pandemic, borrowing increased further. During Manmohan’s administration, 27 to 29 paise out of every rupee came from borrowing. Under Modi's administration, this reduced to 20 paise. However, during the pandemic, borrowing rose to 36 paise out of every rupee in 2021-22. Thankfully, this trend is now on the decline.

As for the impact of borrowing, it results in an increased fiscal deficit. In 2022-23, the deficit was 6.4% of GDP. For 2024-25, the projected deficit is 4.9%. The government aims to reduce the fiscal deficit to below 4.5% by 2025-26.

Read more:

Is There a Solution?

Governments worldwide, including developed nations like the USA and China, rely on borrowing to run their economies. However, while such countries borrow from their central banks, India borrows more from international institutions and corporate entities, making debt repayment slightly more challenging.

Former RBI Governor D. Subbarao wrote, 'Be it a company or a government, any debt repayment should ideally come from future revenue generated.'

Two years ago, an RBI report highlighted Sri Lanka as an example, suggesting governments should aim for debt sustainability. The RBI advises avoiding unnecessary expenses and striving for debt stability.

The RBI recommends governments increase capital expenditure, especially in infrastructure, as future revenue can be generated from such investments. The 2024-25 budget allocates 11.11 trillion rupees for infrastructure development.